Pros

- Ability to compare multiple quotes at once

- Free to use

- Tech-forward and user-friendly

Cons

- Rates not available from every company

- Some specialized coverages not available

- Not all users may receive quotes

Bottom Line

Insurify is one of the industry’s oldest car insurance comparison sites, providing more than 130 million quotes since 2013, according to its website. It’s one of a select few sites that provide real-time quotes — it partners with more than 100 insurance companies — but some results may contain ads, and not all users may receive a quote.Insurify is a “virtual insurance agent” that lets you easily and quickly compare quotes from various car, home, renters, pet, and life insurance companies in a single place. By providing some personal information and answering a few questions about the various factors that help determine insurance rates, you’ll get personalized quote comparisons in a few minutes.

CEO Snejina Zacharia founded Insurify in 2013 after she was involved in a minor accident and discovered firsthand that insurance shopping is a complex and often stressful process.

Learn more about the company, Insurify reviews, and what to consider in this guide.

Insurify: What to Know

Insurify is a one-stop platform to compare quotes and find the best deals on insurance. As a licensed insurance broker in all 50 states, Insurify lets you compare personalized rate quotes for home, car, renters, life, and pet insurance from more than 100 top insurers. When you’re ready to buy, you can take advantage of discounts and purchase right on the Insurify website — or, if you prefer, from a live agent.

The company grew from founder and CEO Snejina Zacharia’s desire to create an efficient, user-friendly experience for consumers looking to save money on insurance. Since then, Insurify has helped 10.4 million people across the U.S. purchase billions of dollars worth of coverage, according to the company’s website.

You can access the platform from your computer or download its mobile app to your Android or iOS device. Just answer some simple questions, and, within five minutes, you’ll get up to 20 quotes from car insurance companies that want your business.

While Insurify shares your personal information and data with its marketing partners, it claims it won’t sell your information to third parties.

Insurify is accredited by the Better Business Bureau (BBB) with an A+ rating. Customers on sites like Shopper Approved, Trustpilot, and Facebook give Insurify an average rating of 4.8 out of 5.

How to Compare Car Insurance Quotes on Insurify

Insurify makes it easy to compare car insurance quotes from different companies. Here’s how you do it.

Using the company’s website, navigate to Insurify.com and select “Car” from the insurance choices near the top of the screen. Then select the “Compare quotes” button or enter your ZIP code and select “View my quotes” to get started.

From here, you’ll enter Insurify’s auto insurance quote questionnaire. Throughout the process, each question gets its own screen, which makes the process simple and easy to navigate. The first several screens ask about your current insurance and how you heard about Insurify. Then, the questionnaire moves on to questions about your car. Enter your car’s year, make, and model, in addition to its trim and how long you’ve owned it.

Next, you’ll answer questions about how you use your car. In this example, we selected “Commuting or personal use.”

The next few screens ask how many miles you drive each day and whether you own your car outright, make payments on it, or lease it.

Once you’ve entered all your vehicle information, it’s time to select the types of coverage you want your quotes to include: full coverage or basic liability. Full coverage includes collision and comprehensive coverages that protect your vehicle in addition to basic liability coverage.

This page has a link you can select to learn about the different coverages, which is helpful, especially for first-time insurance shoppers.

After you’ve made your selection, you’ll see a summary screen with the information you’ve submitted so far. You can update the details, delete the car and start from scratch, or add another vehicle.

After you’ve made any necessary changes, click on the “Continue to driver info” button.

In addition to basic information about you, you’ll have to provide details about your current insurance, driving record, and credit history. Each question is presented in a user-friendly and self-explanatory way, so the process is simple and moves quickly.

Our test quote received eight immediate quotes plus three “instant offers.” But the number of quotes and the prices you see will largely depend on your unique driver profile, including where you live, your insurance history, your driving record, and more.

Insurify Reviews: What Real Customers Are Saying

Insurify’s online reviews are overwhelmingly positive. Many of the reviews appear on Shopper Approved, where nearly 4,000 verified Insurify customers give the company an overall rating of 4.8 out of 5.

Many of the high ratings boil down to outstanding customer service provided by the company’s in-house agents. One customer on Shopper Approved, for example, said, “He made it so easy and fast to get my son insurance when other companies made it so difficult.”

Another Shopper Approved reviewer needed a new policy and had this to say about her Insurify agent: “The representative clearly outlined my options and gave valuable insights and education regarding the automobile insurance policy and roadside assistance programs. Many thanks for the assistance, the representative was very efficient, articulate, and truly wonderful.”

More than 2,500 additional reviews appear on Trustpilot, Facebook, and the BBB website, where the company also has an A+ rating.

Like Shopper Approved, Insurify’s Trustpilot rating sits at an “excellent” 4.8 stars as of this writing. Several reviewers raved about how “easy and painless” the process of getting new insurance was with Insurify.

Insurify’s average customer rating on the BBB site is 4.62 out of 5. Most of those reviewers say they received great service, and many also rave about getting a great price. “One of the best car insurance purchasing experiences I have had in a long time. Happy with what I’m paying per month,” one customer wrote.

Of course, no company gets it right 100% of the time, and these review sites still have some negative comments. Most are from customers who received fewer quotes than expected.

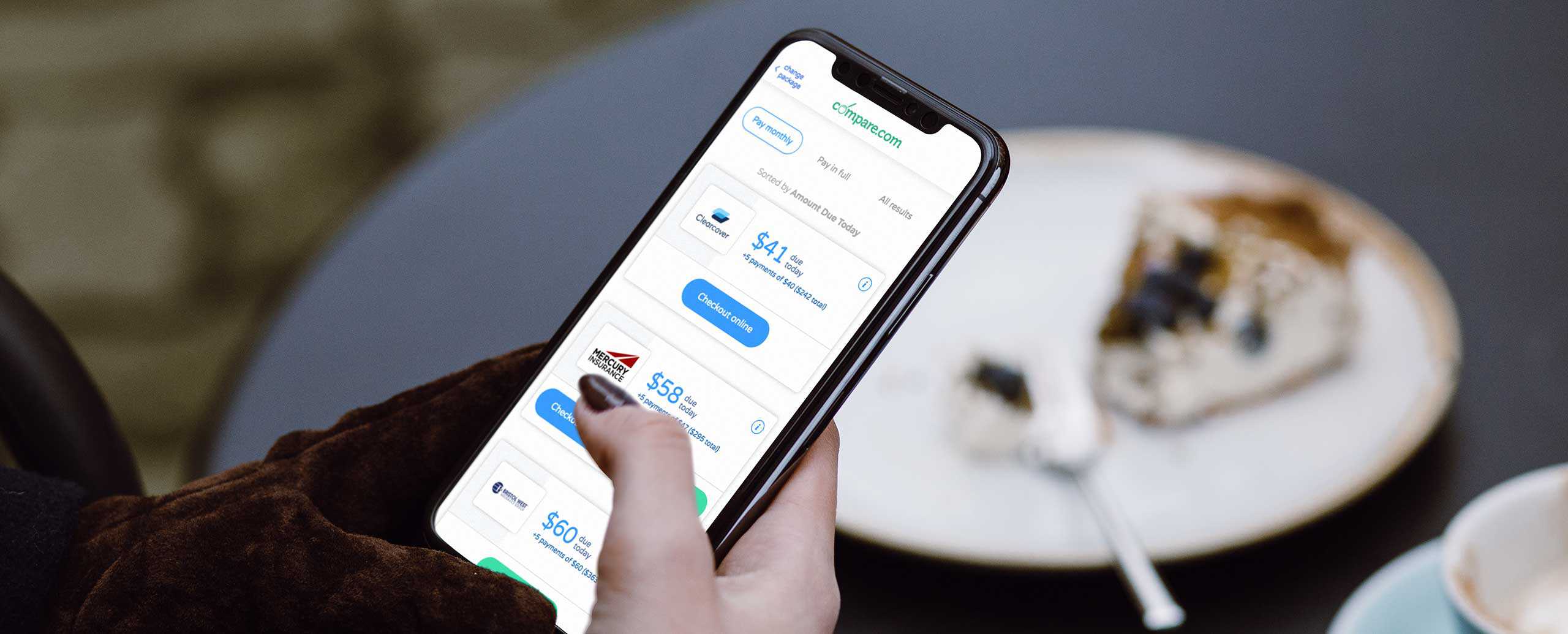

Insurify vs. Compare.com

Insurify and Compare.com are similar sites that both provide the ability to compare auto insurance quotes from top insurers. In fact, Insurify acquired Compare.com in Mar. 2023, and Compare.com currently operates as a subsidiary of Insurify.

At first glance, Compare.com’s platform appears nearly identical to Insurify’s, but, after the first couple of screens, Compare.com’s questionnaire becomes more detailed. That could be a good thing if an extra moment or two on the platform saves you from having to provide additional information to several companies individually.

Here’s how the two sites stack up:

| Feature | Insurify | Compare.com |

|---|---|---|

| Shopper Approved ratings | 4.8 out of 5 | 4.7 out of 5 |

| Trustpilot ratings | 4.8 out of 5 | 4.4 out of 5 |

| BBB rating | A+ | A+ |

| Number of real-time quotes | 8 | 8 |

Insurify vs. NerdWallet

NerdWallet is a comprehensive financial platform that offers several products and services, including a range of insurance products. Its platform does essentially the same thing as Insurify’s but with a softer sell. On the main auto insurance rates page, for example, you’ll find information about rates as well as insurance company reviews, but you’ll have to click through to that content to find a link to request rate quotes.

If you want car insurance quotes through NerdWallet, expect a more time-consuming and frustrating process. After all, NerdWallet partners with an outside agency to produce quotes, and the results you receive are just ads, not actual quotes.

The sheer volume of information makes NerdWallet a great place to learn about insurance and any other product you might be interested in. But Insurify provides a better experience for anyone who wants to get on the platform, get real quotes, and be done.

Insurify vs. The Zebra

The Zebra is an insurance-only comparison site like Insurify, and its auto insurance platform is relatively similar from a user’s standpoint. Just answer a series of questions, and, in about five minutes, you’ll have personalized rate quotes from several insurance companies.

The Zebra, like Insurify, has more than 100 insurance companies on its platform. And, like Insurify, The Zebra gives you access to live insurance agents.

Still, The Zebra tends to produce fewer quotes for most users, and many of its results are ads for other companies.

Is Insurify a Spammy Site?

Insurify isn’t technically a spammy site because it doesn’t sell your information without your consent. Instead, it requires you to give permission for it to share your information with its marketing partners before it shows you quotes.

As a result, you could receive unwanted calls and/or texts, just like you might after using a platform that sells your information. But these calls tend to only be from quotes you interact with on the results page.

Insurify FAQs

Insurance plays a major role in protecting your finances, so it’s a good idea to gather as much information as you can before you buy a policy. We’ve answered some of the most commonly asked questions about Insurify below.

Is Insurify easy to use?

Yes. The Insurify platform is very easy to use. It walks you through an interview-style series of questions to gather information and then displays your customized quotes in one place. The whole process only takes about five minutes, and you can contact a live agent at any point during the process.

Is Insurify a trustworthy site?

Yes. Insurify is a trustworthy site. It has a BBB accreditation and an A+ rating. Its average customer rating is an impressive 4.8 out of 5 across multiple platforms.

Since its founding, Insurify has sold more than $200 billion in insurance coverage and provided over 130 million quotes, according to its website. While its information-sharing policies might be a sticking point for some, the company is transparent in disclosing how your information is used.

Does it cost money to use Insurify?

No. You’ll never pay a fee to use Insurify. The company makes money through commissions when you purchase insurance using its website.

You request quotes free of charge and pay only if you decide to purchase a policy. And then you only pay for your actual insurance premiums.

Who is Insurify owned by?

Insurify is currently privately owned. Snejina Zacharia is the company’s co-founder and CEO. She started the company after a frustrating experience with her own search for a reasonably priced policy following a rate increase due to a car accident.

Methodology

Data scientists at Compare.com analyzed more than 50 million real-time auto insurance rates from more than 75 partner insurance providers in order to compile the quotes and statistics seen in this article. Compare.com’s auto insurance data includes coverage analysis and details on drivers’ vehicles, driving records, insurance histories, and demographic information. All the quotes listed in this article have been gathered from a combination of real Compare.com quotes and external insurance rate data gathered in collaboration with Quadrant Information Services. Compare.com uses these observations to provide drivers with insight into how auto insurance companies determine their premiums.

Sources