Pros

- Compares multiple policies at once

- Sells policies from 40+ companies

- Offers referral bonuses ($25 Amazon gift card)

Cons

- Quotes may differ from actual rates

- Doesn’t work with GEICO, Progressive, and others

- Policy coverage levels sometimes don’t match in quotes

Bottom Line

Some customers report a simplified process and big savings — sometimes more than $1,000 per year. But several customer reviews report inaccurate quoting, where savings are much less after the buying process. Some customers also received rate hikes a few months into their policies and regret switching.Gabi is an online insurance comparison site that works to help you find a better rate on a new policy. The company is best known for car insurance.

Gabi functions as a lead-generation platform for insurance underwriters. This means it acts as an intermediary, matching users with insurers that align with their coverage needs.

Gabi doesn’t generate real-time quotes but uses AI to make accurate quote predictions. This should make it easier to get car insurance coverage, but it doesn’t always work well in practice. If you purchase your policy using Gabi, the company supports you throughout the purchase process.

Gabi: What to Know

Established in 2016 and headquartered in San Francisco, Gabi Insurance is a car insurance comparison website that provides quotes for various insurance products, including auto, homeowners, and renters insurance. It works with more than 40 insurance partners to provide quotes and earns revenue through commissions from the insurers it connects you with. The company offers an iOS mobile app but doesn’t currently offer one for Android users.

Gabi doesn’t underwrite policies directly but functions as a broker. It facilitates the setup and maintenance of your policy with the chosen insurer, similar to a traditional insurance broker. To get quotes, you can fill out a form or upload your current policy’s declarations page. With the latter option, a Gabi agent reviews your information and follows up with quotes in about two days.

In 2022, Experian, a credit reporting agency, acquired Gabi for $326 million. Gabi shares user information with Experian but promises not to sell your personal information (though it will sell demographic information) to any third party.

How to Compare Car Insurance Quotes on Gabi

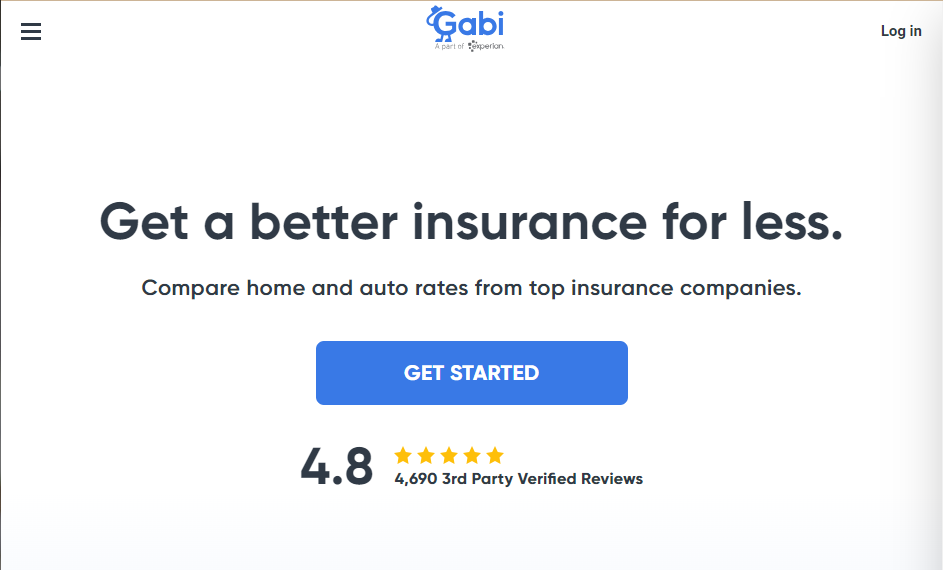

Gabi markets itself as an insurance agent that provides free side-by-side quote comparisons. But does Gabi live up to its promises? Let’s take a look.

I started by going to the home page and hitting “Get Started.”

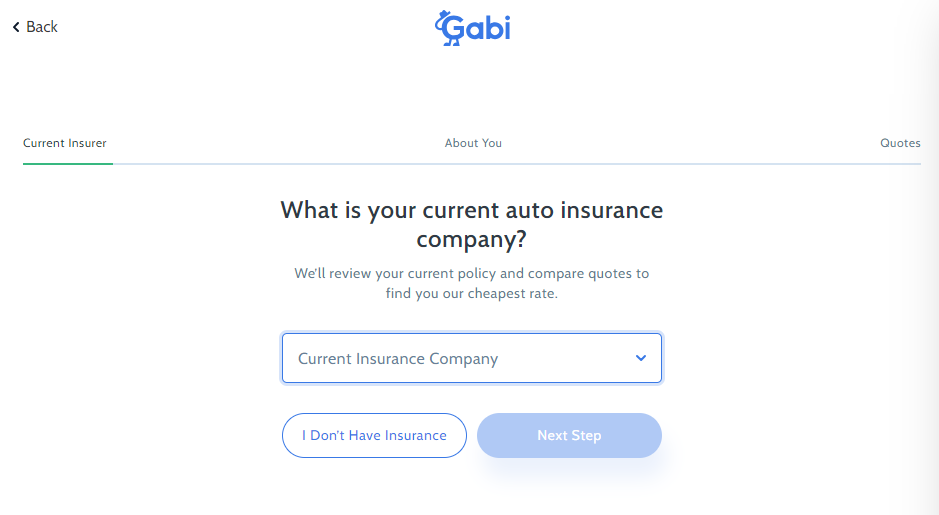

First, I provided information about my current insurance company.

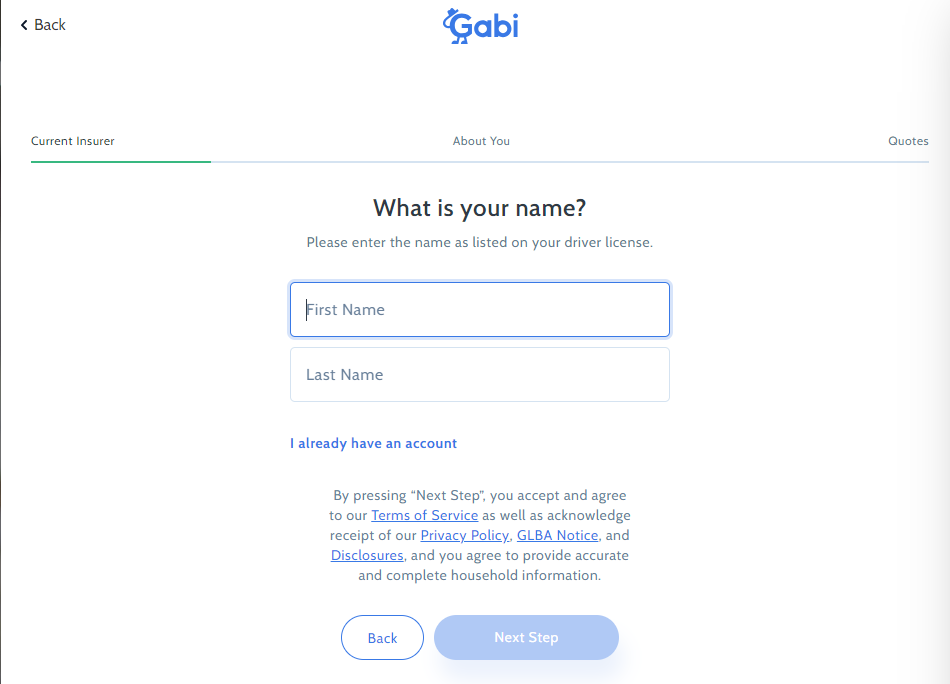

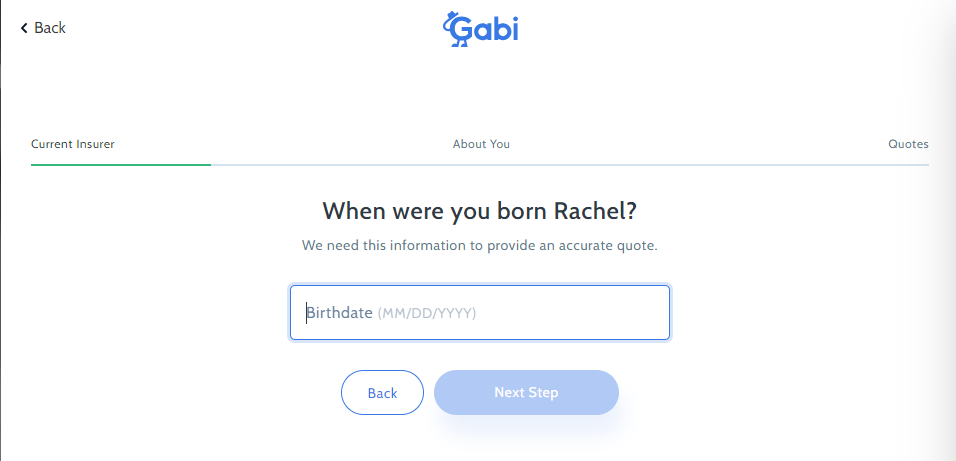

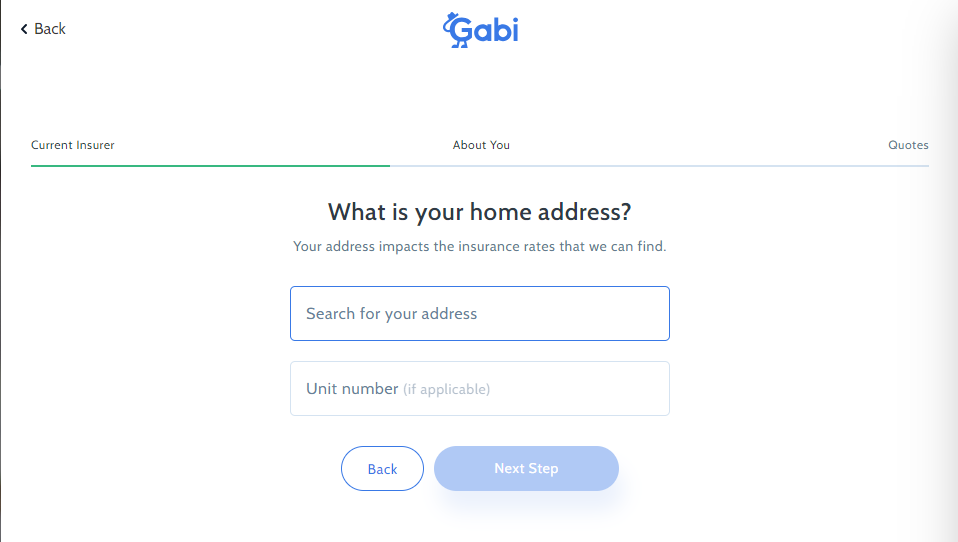

Next was a series of questions about me — name, age, and address.

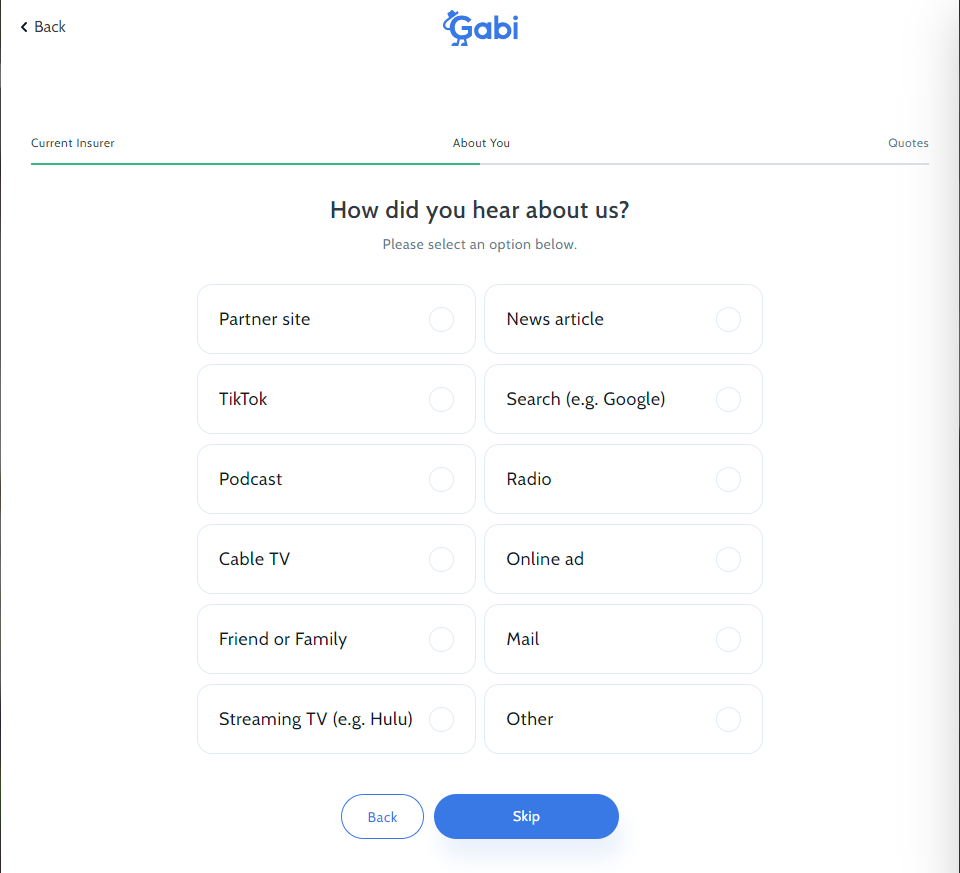

I also shared how I’d heard about Gabi.

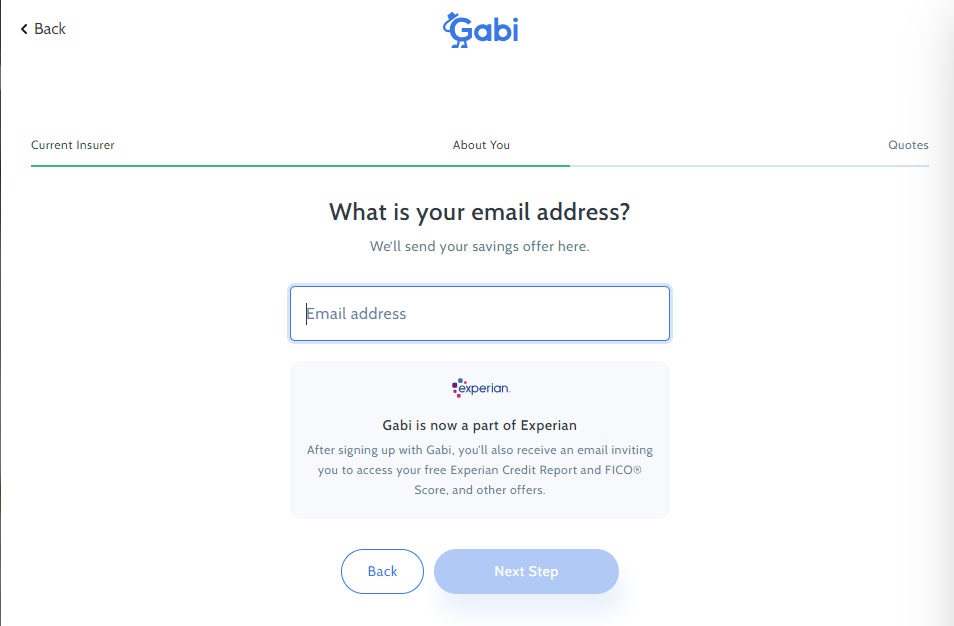

Next, I encountered a question about my contact information, where I saw my information would be shared with Experian. I couldn’t opt out.

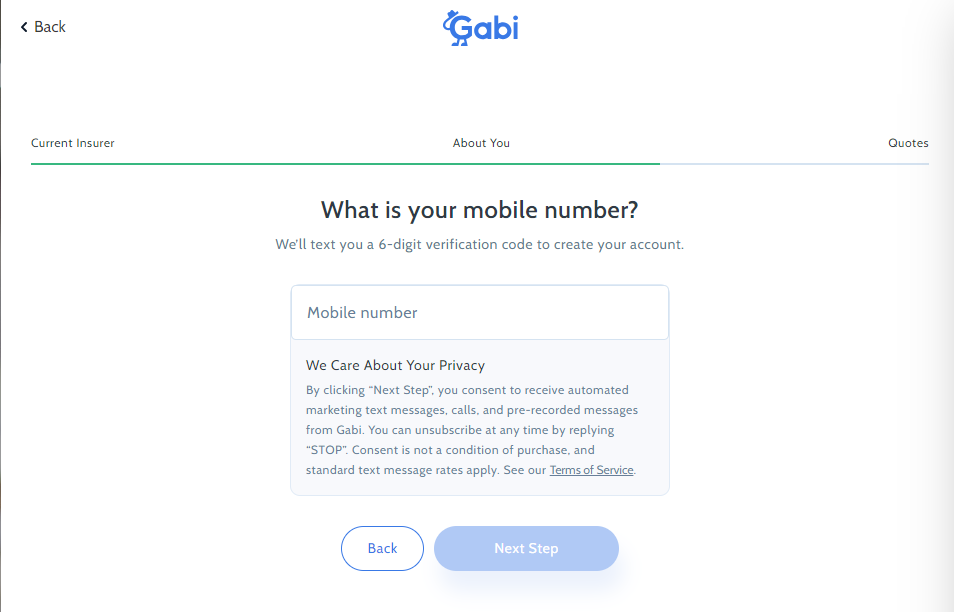

Next, I entered my cell phone number. I couldn’t find a way to continue without verifying my number.

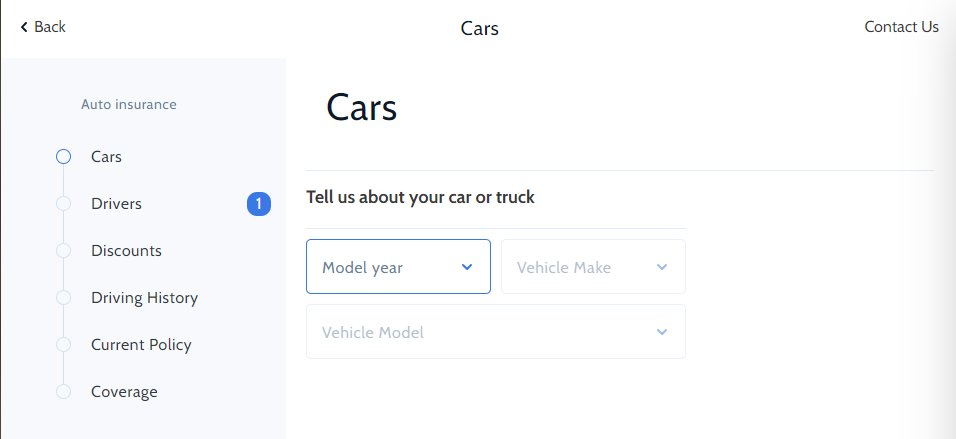

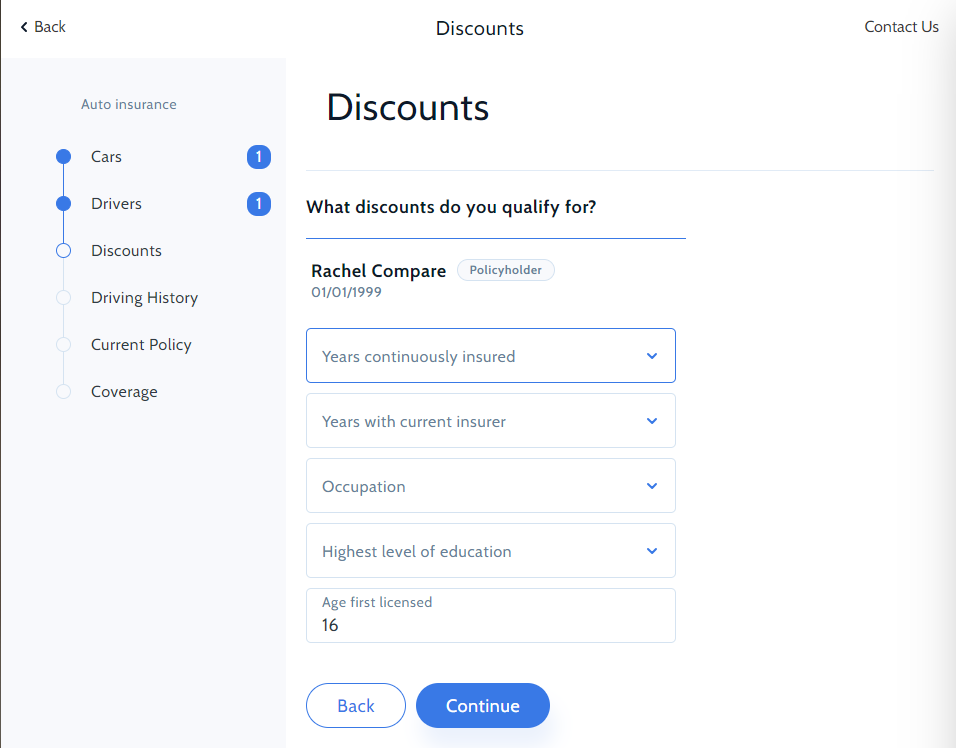

Next, there were a few questions regarding vehicle information, as well as my insurance history, occupation, education, and more.

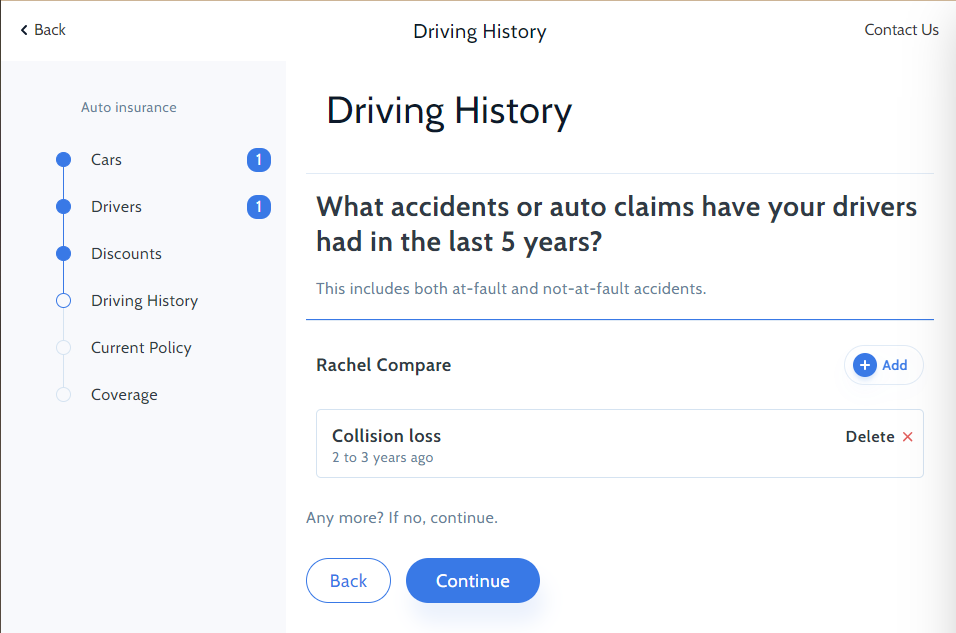

I also provided my driving history and gave information about a recent collision.

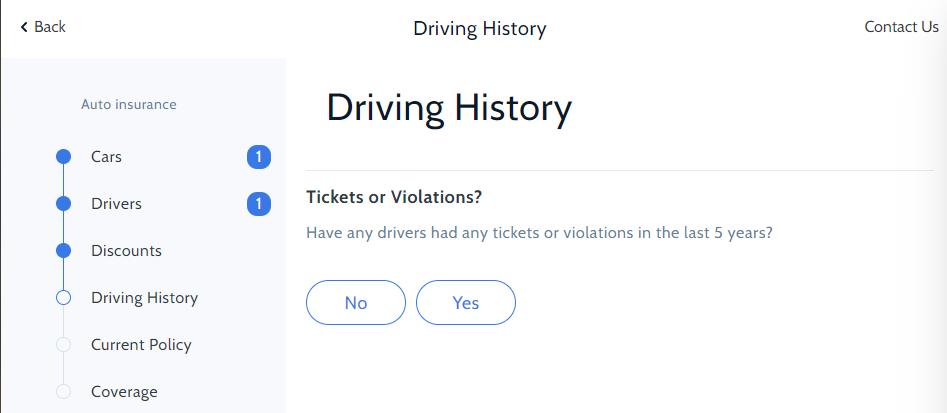

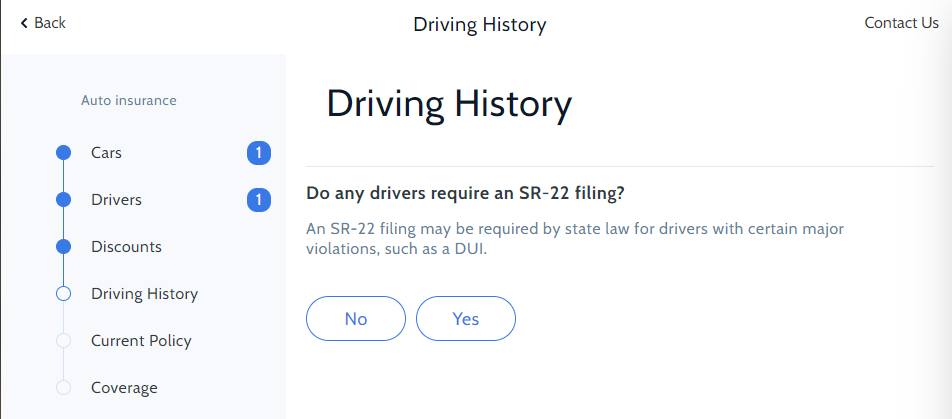

I then answered a few questions about tickets and saw a question about a possible SR-22 form.

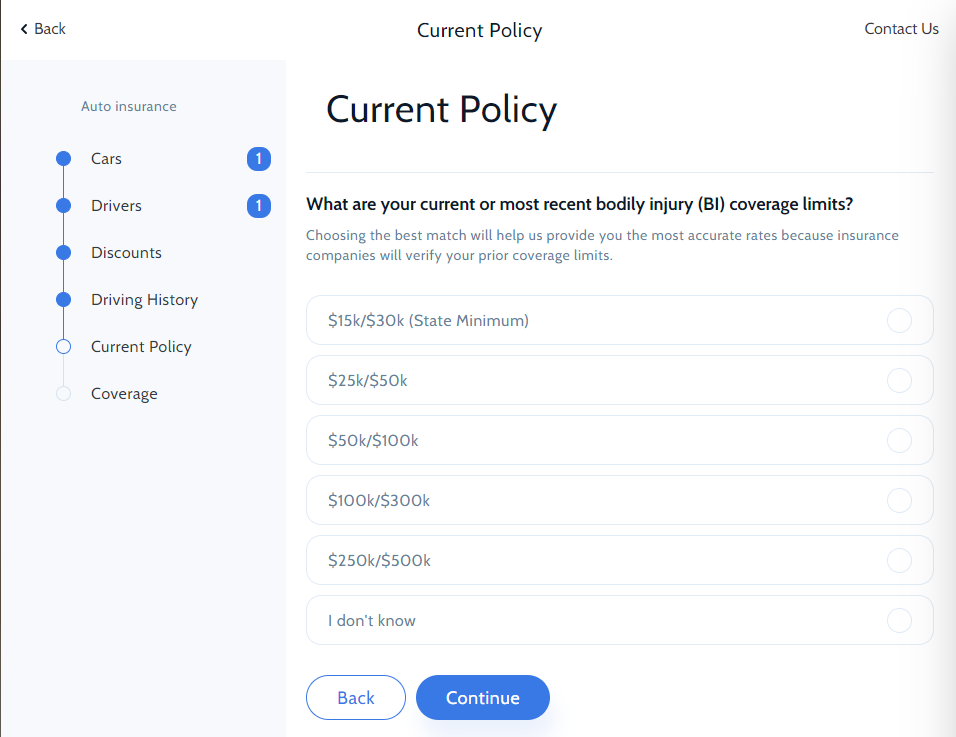

Then, I answered a few questions about my current insurance policy, like how often I pay and how much coverage I need.

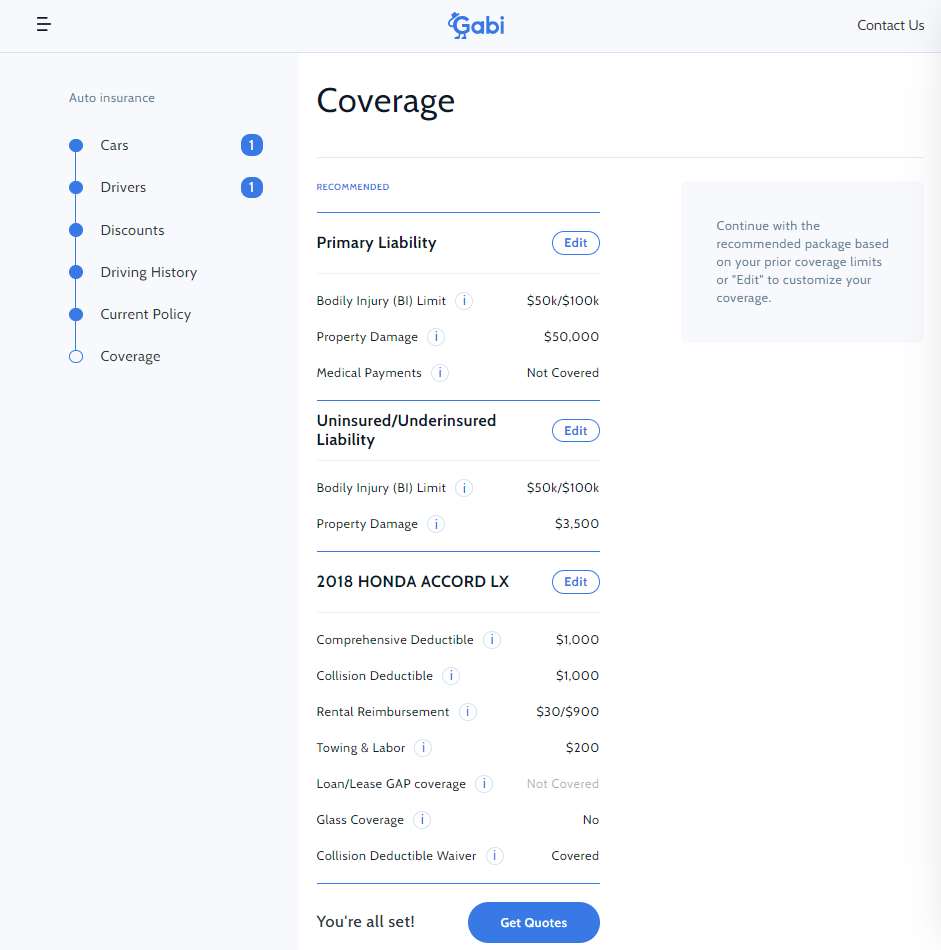

I also gave a few finer policy details (rental reimbursement, comprehensive and collision limits, and deductibles). Then I hit “Get Quotes.”

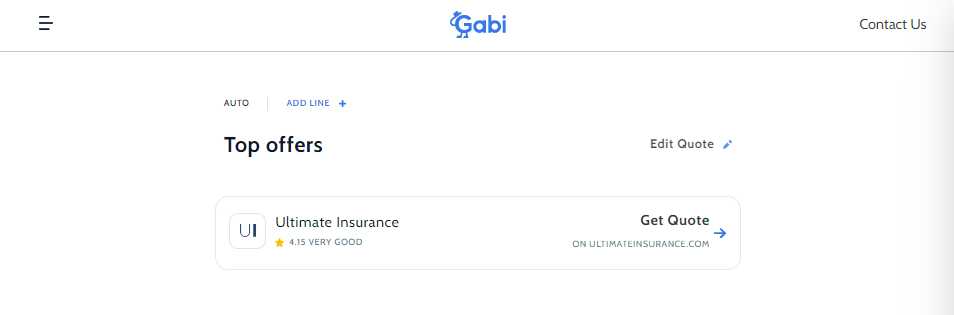

Unfortunately, I didn’t get any quotes. The only “offer” I received was from a company called “Ultimate Insurance.” I checked it out.

The company is another quote-comparison website where my ZIP code was automatically entered.

But I realized I’d have to fill out the form all over again.

Overall, I was pretty dissatisfied with my results. It felt like I had wasted my time not only to receive no quotes but also to be transferred to another website where I’d have to walk through the same steps again to receive quotes — hopefully.

Gabi Reviews: What Real Customers Are Saying

Like many companies in the industry, Gabi has mixed reviews online. Trustpilot users give the company 3.5 out of 5 stars (with no written reviews), while Yelp users award 3.2 out of 5. The Better Business Bureau (BBB) gives the company an A+, but users give the company a 1.36 out of 5 stars — though all 10 complaints have warm responses from the company.

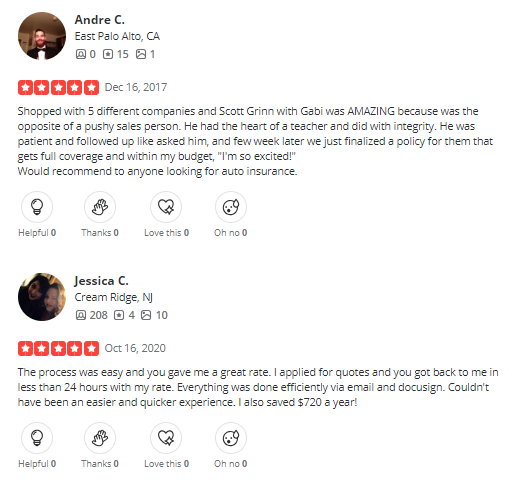

Among positive reviews, Gabi is noted for being easy to use, offering great insurance agents, and saving people money — as in these two Yelp reviews below.

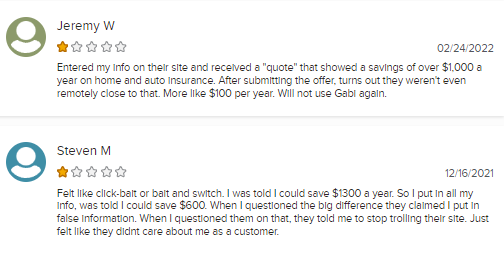

On the negative side, reviews focus on inaccurate quoting. Several people felt they were lured in with big savings only to get lackluster results. The BBB reviews below highlight that issue.

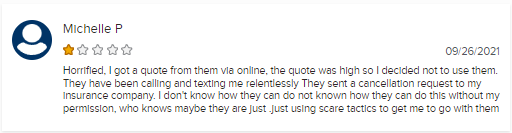

And a less common issue was feeling hounded after getting a quote. The reviewer below says they received too many follow-up calls and texts — and their current insurer even received a cancellation request.

Gabi vs. Compare.com

Gabi and Compare.com look similar on the surface. Both sites are capable of generating multiple quotes from insurers and allowing customers to compare their car insurance options side by side. Each makes it easy to fill out one simple form to receive quotes. Neither company sells your personal data (name, address, phone number) to third parties.

But a crucial difference between the two is quoting accuracy. Where Gabi uses AI to predict your costs with its partners, Compare.com gets you real quotes (as accurate as the information you provide).

Another difference is with insurance products. Gabi can provide quoting information about home, condo, and renters insurance from the same form as your car insurance quote. You just click “Add Line+” from the quote page and fill out additional information.

Compare.com works with partners to get similar product quotes, but you’ll need to go to the partner websites to get them.

| Feature | Gabi | Compare.com |

|---|---|---|

| Shopper Approved ratings | Not Rated | 4.7 out of 5 |

| Clearsurance ratings | Not Rated | 4 out of 5 |

| Trustpilot ratings | 3.5 out of 5 | 2.5 out of 5 |

| BBB rating | A+ | A+ |

| Number of real-time quotes* | 0 | 8 |

*The number of real-time quotes generated is for a 30-year-old female living in Austin, Texas, driving a 2018 Toyota RAV4, with an at-fault accident in the last three years. The number of quotes you receive from each platform may vary based on your driver profile.

Gabi vs. NerdWallet

Neither Gabi nor NerdWallet sells your personal information to third parties, but both share your information with third parties that are affiliated with the product you’re quoting on the site. While Gabi provides estimated quotes to users, NerdWallet doesn’t. Instead, you’ll get links to partner websites to get quotes there.

While NerdWallet’s privacy policy indicates that information isn’t shared, I found several reviews claiming they were spammed after using the service. This wasn’t a dominant theme I found with Gabi. On the other hand, NerdWallet offers a wider variety of insurance and financial products through its partners, including credit monitoring, personal loans, mortgages, and more.

Because of NerdWallet’s wide range of products, it’s a little more difficult to uncover more information about its car insurance offerings, like a list of its partner companies.

Gabi vs. The Zebra

Neither Gabi nor The Zebra sells your information, which customer reviews appear to support. The Zebra has been around longer than Gabi, and it has a (much) longer list of partners to show for it — 80 partners, according to the list provided on the website.

And, although Gabi can only provide estimates, The Zebra provides real-time quotes from its partners. It also doesn’t require your phone number to get quotes.

Both services are simple to use and make their quotes easy to understand. Gabi can help you purchase your policy with one of its agents, while The Zebra does a better job of transferring your information to one of its partners and allowing you to finish the buying process online.

Both companies can offer quotes for additional products like home insurance, but only The Zebra offers life and pet insurance quotes.

Is Gabi a Spammy Site?

No. Gabi isn’t a spammy website. The company makes its privacy policy prominent and easy to understand. In it, the company explains that it doesn’t sell any personally identifiable information. That means your name, address, email, address, and phone number shouldn’t be attached to any of your demographic information.

But it can sell your demographic information (e.g., your age and gender) to third parties — especially Gabi partners. Once you get a quote from the website, you should expect to see some follow-up emails. You can unsubscribe from these emails easily to stop receiving them.

You can also expect to see targeted ads on other websites, as the company participates in third-party tracking to produce interest-based advertising. A good way to avoid this is by using an incognito window or an ad blocker.

Gabi FAQs

Want to learn more about Gabi? Below are some quick answers to the most common questions asked about the company.

Is Gabi easy to use?

Yes, Gabi is easy to use. The site makes it simple to fill out the quote form. The quoting list is fairly clear and easy to understand. But when using the site, you might get inaccurate quotes or no quotes at all. Instead, you may have the option to go to another website to get quotes.

Is Gabi a trustworthy site?

Yes, Gabi is a trustworthy site. The company is committed to not selling your information, according to its privacy policy. But it may sell your personal information in an anonymized form — i.e., without your identifying information attached to it.

But do keep in mind the site doesn’t provide real-time quoting, so real costs may differ from what appears on the website, which may appear misleading.

Does it cost money to use Gabi?

No, it doesn’t cost money to use Gabi. You aren’t obligated to buy an insurance policy through Gabi, nor does the company charge additional fees if you purchase your policy with the site. The company makes money as an insurance broker, meaning car insurance companies pay Gabi for bringing customers to the company.

Who are Gabi’s competitors?

Gabi’s competitors include The Zebra, Insurify, Compare.com, ValuePenguin, Jerry, QuoteWizard, Policygenius, and more. Essentially, any site that advertises car insurance quote comparison. But keep in mind that only a handful of competitors — including Compare.com — offer real-time quoting. Some car insurance companies that act as agencies offer additional quotes when you generate a quote directly on their site.

Methodology

Data scientists at Compare.com analyzed more than 50 million real-time auto insurance rates from more than 75 partner insurance providers in order to compile the quotes and statistics seen in this article. Compare.com’s auto insurance data includes coverage analysis and details on drivers’ vehicles, driving records, insurance histories, and demographic information.

All the quotes listed in this article have been gathered from a combination of real Compare.com quotes and external insurance rate data gathered in collaboration with Quadrant Information Services. Compare.com uses these observations to provide drivers with insight into how auto insurance companies determine their premiums.

Sources

- Coverager, “Experian acquires Gabi for $320 million,” Accessed January 13, 2024.

- Yelp, “Gabi Personal Insurance Agency,” Accessed January 14, 2024.

- Trustpilot, “Gabi ,” Accessed January 14, 2024.

- BBB, “Customer Reviews for Gabi.com,” Accessed January 14, 2024.

- Trustpilot, “NerdWallet: ‘Spam’ Search,” Accessed January 14, 2024.