Pros

- Affordable rates, even for people with minor moving violations

- Highly customizable policies with a wide range of add-ons and perks

- Offers SR-22 coverage and policies to high-risk drivers

Cons

- Limited self-service options

- Limited features on the mobile app and website

- Available in only 12 states

Bottom Line

Erie is a great option if you live within the company’s service area, especially if you need complex or specialty coverage. But if a highly functional mobile app is at the top of your list of desirable features, you’ll need to consider other options.Erie Auto Insurance: At a Glance

Founded: April 20, 1925

Available in: 12 states

Ownership: Publicly traded as Erie Indemnity Company (NASDAQ: ERIE)

Average premium: $153/month

Mobile app: iOS and Google Play

Customer service: 1 (800) 458-0811

Claims: 1 (800) 367-3743

Primary competitors: Allstate, Mercury, State Farm, NJM, and Nationwide

Erie Insurance Group was founded in 1925 in Erie, Pennsylvania. The company started as a local auto insurer but expanded to offer a wide range of insurance products, including home, life, and business. Today, Erie Insurance operates in 12 states and has around 6,000 employees.

By all accounts, the majority of those employees enjoy their job. Employees give the company 3.9 out of 5 stars on Indeed, and 93% of employees told Great Place to Work that they love working for Erie.

Perhaps that is why the company is so well known for its strong commitment to customer service. They consistently receive high ratings for customer satisfaction from organizations, including J.D. Power.

Is Erie a Good Choice for Car Insurance?

| Category | Score |

|---|---|

| Cost | 4.7/5 |

| Customer satisfaction | 5/5 |

| Ease of use | 4/5 |

| Availability | 3.7/5 |

| Industry reputation | 4.7/5 |

| Overall Score* | 4.75/5 |

| *Company ratings for each category are determined using our proprietary, objective rating formula. You can find more information on our unique scoring methodology at the bottom of this article. | |

Yes, Erie is a solid choice for car insurance. The company offers low rates, plenty of customizable coverage options, and tons of bonus features, both paid and free. Customer satisfaction is high, and there are many reasons why.

Customer service and agents tend to be very easy to get in contact with. And many customers stay with the company long-term, which speaks to both the customer service and satisfaction with pricing.

But there are some flaws, including a less-than-ideal mobile app that lacks functions — such as claims reporting — that are now considered standard. Even so, we think there’s a lot to love at Erie.

Erie Customer Reviews

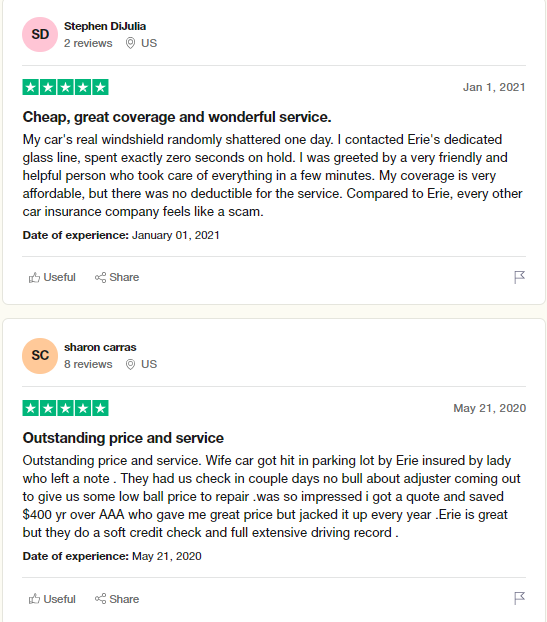

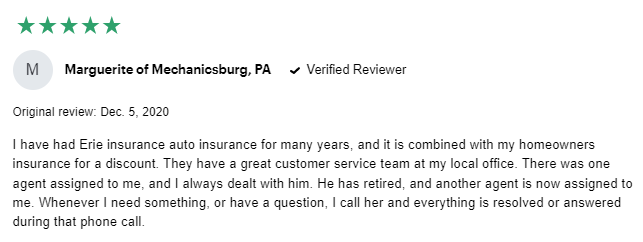

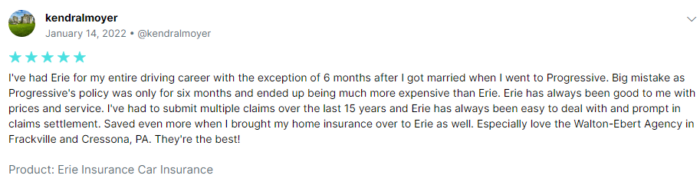

Overall, customer reviews for Erie are mixed, which is somewhat expected with car insurance companies. Many of the positive reviews mention getting good prices and customer care.

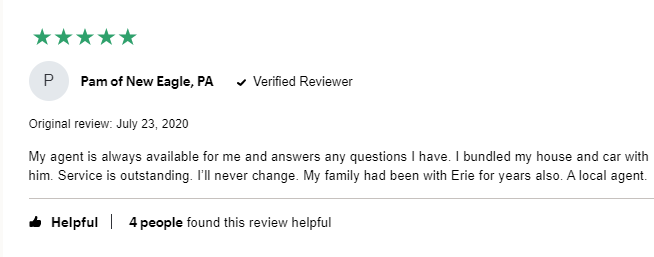

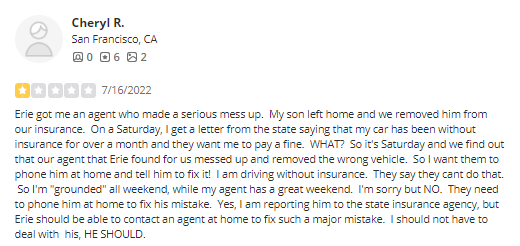

And many positive reviews mention good relationships with their local agents, like this one:

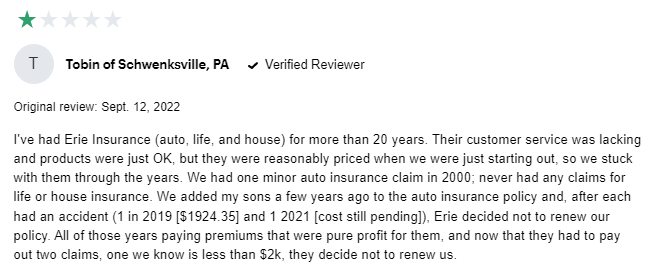

Of course, no company can please everyone all the time. That’s especially true when it comes to claims. I found this review from a long-time customer who received a notice of nonrenewal after two teen drivers on the policy each caused an at-fault claim.

As we’ll see, Erie’s quickness to drop even long-term customers after claims stands out among negative reviews.

Erie customer complaints

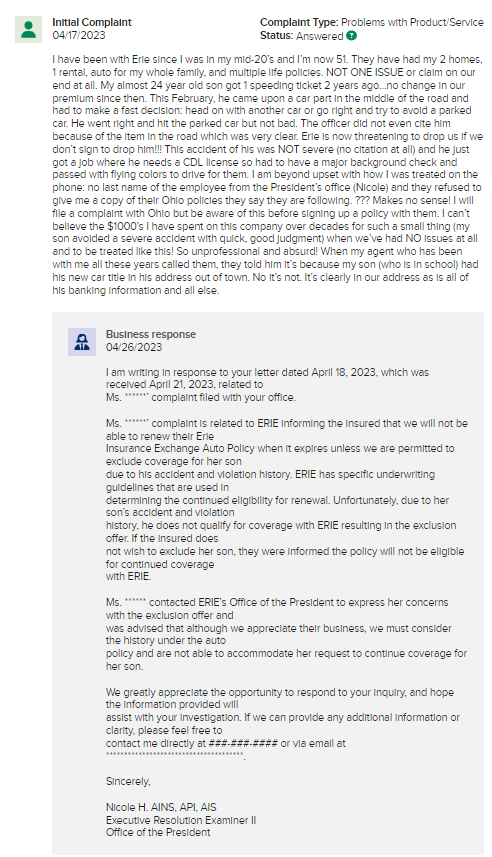

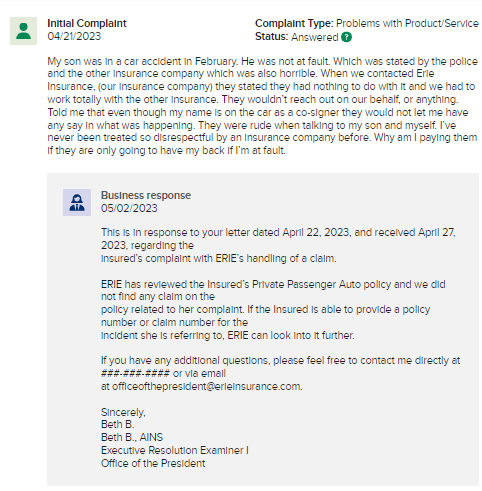

I wanted to look through official complaints recently filed with the Better Business Bureau to get a good idea of Erie customers’ common pain points. This recent complaint echoes the negative review above, as this customer also received a nonrenewal after their son was in an accident.

And, in this case, we get to see Erie’s official point of view on the topic, which is apologetic but firm.

A complaint filed just two days earlier seems to echo the issue here. The claimant says that the company offered them no help in getting a resolution when they weren’t at fault in a car accident.

There’s no resolution yet, but Erie did offer a reply that no claim had been filed with the company in relation to the event.

All in all, I have to say Erie seems to be on the up and up. The company reaches out to customers after complaints — and not just when people formally complain. Erie representatives reply to negative (and positive) reviews on social media and elsewhere.

Where is Erie Insurance available?

Erie is available in 12 states plus the District of Columbia. Those states are:

- Illinois

- Indiana

- Kentucky

- Maryland

- New York

- North Carolina

- Ohio

- Pennsylvania

- Tennessee

- Virginia

- West Virginia

- Wisconsin

Coverage options and terms of service, as with all insurance companies, vary depending on your state.

How Much Is Erie Car Insurance?

Erie car insurance is known for affordable rates, and our research bears this out. The company’s average rates tend to be lower than competitors’ rates (though not always).

Additionally, Erie’s policies come with standard features that rarely come standard with other companies, such as free accident protection after three years. So if you’re comparing an Erie policy to competitors, be sure to account for any differences between coverage options and limits.

Erie’s national average rates

Erie performs well overall compared to national averages. The company typically doesn’t offer the absolute lowest price, but it’s also not offering the highest. A lot depends on the driver’s risk factors — Erie seems to quote higher-than-average rates for high-risk drivers.

| Liability Only | Full Coverage |

|---|---|

| $91/month | $215/month |

While these rates aren’t rock-bottom, I’d like to point out that comparing national average policy prices is kind of like comparing apples and oranges. Prices for two policies can be similar, but the value of the policies — their coverage options, limits, and policy perks — can be quite different.

Erie rates for teens and young drivers

When it comes to drivers 25 and younger, Erie is middle-of-the-road compared to others. But we’ve given the company high marks here because it offers robust policy options and perks for the same price as a so-so policy elsewhere. Additionally, young drivers who stay on their parents’ policy can get significant savings with Erie.

| Age | Liability Only | Full Coverage |

|---|---|---|

| 18-year-old drivers | $188 | $443 |

| 25-year-old drivers | $85 | $200 |

Erie rates for adult drivers

As drivers get older and gain more experience on the road, they generally pose a lower risk of at-fault claims. And as drivers reach their 30s and 40s, Erie’s prices begin to level out. While rates for 25-year-olds are above average, rates for 40-year-olds are about average. But again, what’s found in an Erie policy may make it more valuable depending on your needs and preferences.

| Age | Liability Only | Full Coverage |

|---|---|---|

| 25-year-old drivers | $85 | $200 |

| 40-year-old drivers | $71 | $167 |

Erie rates for seniors

Seniors generally pay lower auto insurance rates, all else being equal. And as we’ve seen, Erie does a great job beating out competitors when it comes to rates for low-risk drivers. So it didn’t surprise us when we found the company offering lower-than-average rates to seniors.

| Age | Liability Only | Full Coverage |

|---|---|---|

| 65-year-old drivers | $70 | $164 |

Erie rates after an accident

Erie’s rates for drivers with an at-fault accident are about average. But I’d also like to highlight the accident forgiveness opportunities here — free and paid — which can save you if you get into another accident.

| Driving History | Liability Only | Full Coverage |

|---|---|---|

| Clean Record | $71 | $169 |

| With At-Fault Accident | $95 | $221 |

Erie rates after a speeding ticket

A single speeding ticket can increase rates significantly, and even a small monthly bump adds up. Compared to average prices, Erie’s policies are average or slightly higher. But when I got my quote, I did receive a lower-than-average rate for a full-coverage policy. So it’s still worth it to get a quote from Erie, even if you have a speeding ticket (or two) on your record.

| Driving History | Liability Only | Full Coverage |

|---|---|---|

| Clean Record | $71 | $169 |

| With Ticket | $81 | $194 |

Erie rates after a DUI

Erie saves drivers with a DUI around $20 a month ($240 annually) on a full-coverage policy compared to the industry average.

| Driving History | Liability Only | Full Coverage |

|---|---|---|

| Clean Record | $71 | $169 |

| With DUI | $119 | $277 |

Other factors can affect your car insurance rate, so always get a customized quote from several insurers before deciding on your policy.

Find Your Best Rate in Minutes

Erie rates for drivers with bad credit

Your credit score can have a major impact on your car insurance rates, and Erie certainly illustrates that here. Policies for people with excellent and good credit are priced below average, and fair credit will get you rates that are nearly average. But prices for Erie policyholders with poor credit are significantly higher than average rates.

| Credit Score | Liability Only | Full Coverage |

|---|---|---|

| Excellent | $55 | $129 |

| Good | $65 | $158 |

| Fair | $90 | $212 |

| Poor | $155 | $362 |

Your credit score is just one factor that influences your policy costs, and each company will give your score a different weight when determining your rate. It’s still possible to find a great insurance policy with bad credit; you just may need to look elsewhere.

Erie rates by state

Erie operates in 12 states and offers lower-than-average rates in each of them. Keep in mind that discounts and coverage options vary by state due to several factors, including state car insurance laws and other regulations.

| State | Statewide Average | Erie’s Average Rate |

|---|---|---|

| Illinois | $229 | $122 |

| Maryland | $281 | $191 |

| New York | $502 | $398 |

| North Carolina | $154 | $113 |

| Ohio | $128 | $92 |

| Pennsylvania | $245 | $165 |

| Tennessee | $172 | $145 |

| Virginia | $185 | $108 |

| Washington, D.C. | $185 | $139 |

| West Virginia | $184 | $104 |

| Wisconsin | $172 | $99 |

Erie’s rates compared to top competitors

Compared to competitors, Erie offers highly affordable rates for liability-only policies. And though a full-coverage policy may not be the cheapest option, you get great value for the money, given “built-in extras” like free accident forgiveness.

| Company | Liability Only | Full Coverage |

|---|---|---|

| Erie | $91 | $215 |

| American Family | $97 | $185 |

| Farmers | $126 | $281 |

| GEICO | $101 | $270 |

| State Farm | $99 | $217 |

| Travelers | $109 | $225 |

Erie Car Insurance Discounts

Erie only has about six true car insurance discounts, but we’ve given them solid marks here. That’s because, in addition to discounts, their overall rates are already quite low.

Discounts and their benefits vary by state. Some Erie discounts include:

- Multi-policy discounts (a.k.a. bundling)

- Vehicle storage

- Safety savings (for car safety features, a standard in the industry)

- Preferred payment discounts for paying in full

- Youthful driver for unmarried drivers under 21 who live with their parents

- College student (similar to the student-away-at-school discount)

Erie has several additional free and paid perks that can lead to more savings in the long run. These include accident forgiveness and a diminishing deductible, which we’ll go over in the coverages section.

Erie Rate Lock

Erie Rate Lock — called ERIE RateProtect in New York — keeps your rate the same even after a claim. So long as you haven’t changed your address, vehicles, or drivers, your rate will remain stable for as long as you carry the policy.

The website doesn’t go into the nitty-gritty, except to say that some exclusions apply and that you should speak directly with an agent about the program.

Several customers talked about the Rate Lock program, including this one from a 20-year customer on Reddit:

Purchasing an Erie Car Insurance Policy

Purchasing a policy from Erie is pretty simple, but it’s not the easiest experience out there. The main drawback is that you have to work with an agent to purchase the policy and receive your paperwork. For people looking to check “getting a policy” off their to-do list with no phone calls or extra emails involved, this isn’t ideal.

But there are some advantages here. Working with an agent means specialized care, and you know exactly who to contact when you have questions. And you’ll have ample opportunity to ask questions about your policy and the coverages you’re purchasing.

In the hundreds of car insurance reviews I’ve read at Erie and elsewhere, misunderstandings about how car insurance works are a very common issue.

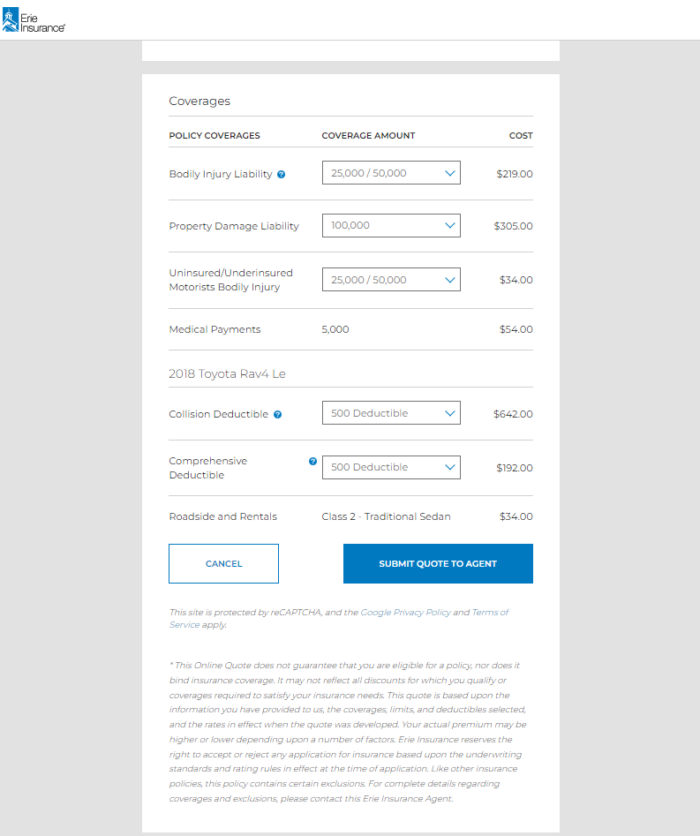

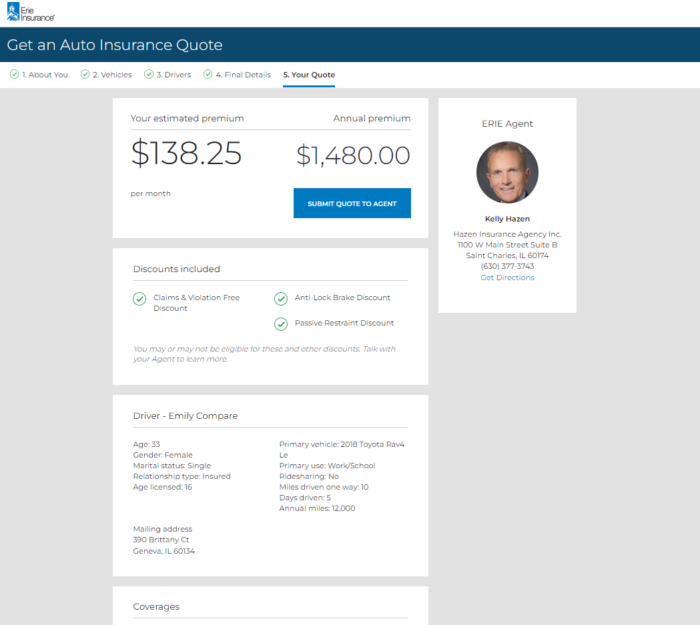

How easy is it to get an Erie quote?

Getting an initial quote was easy on the Erie website. The home page has a field where I entered my ZIP code and started the quote questionnaire.

I filled out some basic contact information and hit continue.

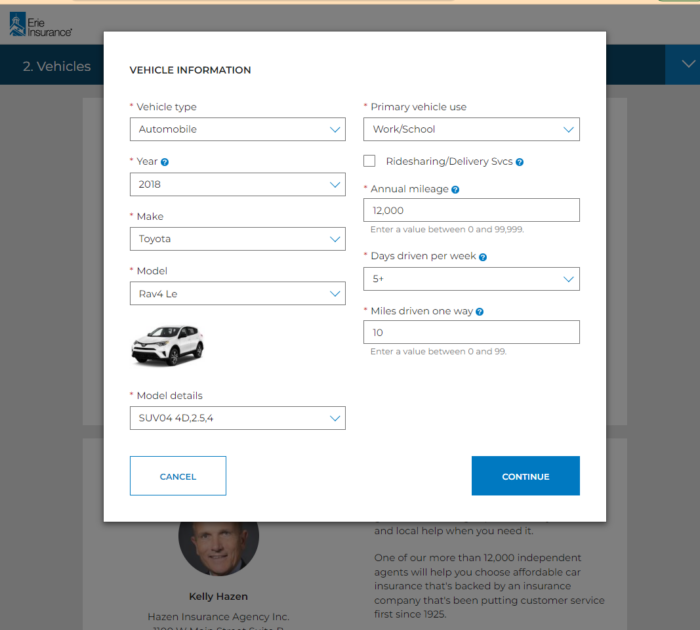

I was asked for information about my vehicle, though not about whether I had a lease or loan.

I hit continue prematurely on this page — I realized I hadn’t correctly entered my model number. And I discovered that your information does not save if you hit the back button, which is fairly standard across larger and midsized insurers. Because of this, I was forced to enter my information twice on this page.

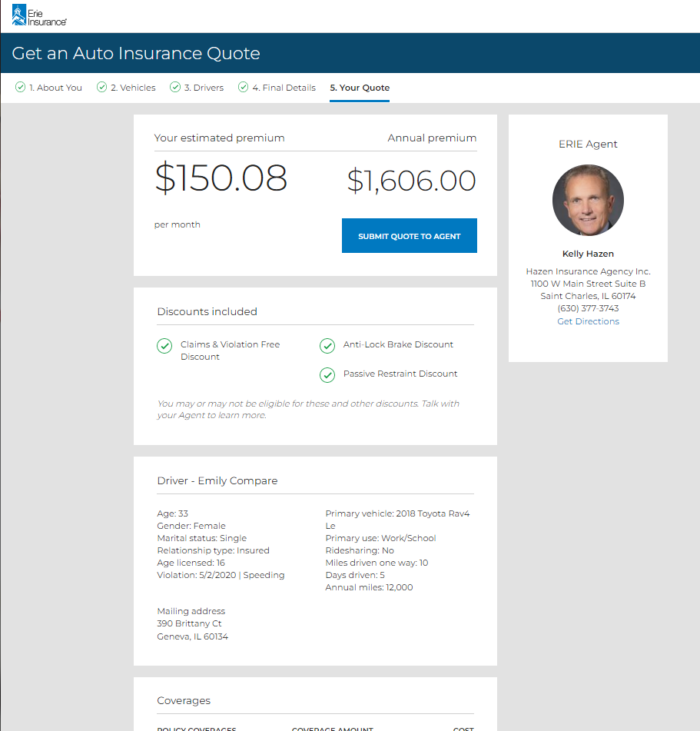

Next, I had to enter my recent driving history, including moving violations (I had a speeding ticket a few years ago). Then, I hit continue and was taken to my quoting page.

The initial quote offered was not for minimum coverage but was set for a 100/300/100 policy. Those aren’t the maximum liability limits offered at Erie, but it’s worth noting that the first quote won’t be your cheapest option.

The initial quote also defaulted to $500 deductibles on both my collision and comprehensive coverage options.

I was able to run the quote for minimum coverage (with collision and comprehensive included because I have a car loan) and was quoted $12 per month less. It was good to see that effectively doubling my liability limits was affordable.

Though, as you can see, there were no options available for special add-ons, like rental car reimbursement.

From here, I submitted the quote and was instructed that I could finalize my quote and purchase my policy over the phone with an agent.

Can you purchase an Erie policy 100% online?

No, you can’t purchase an Erie policy entirely online. At the end of the quoting process, I was directed to submit my quote to an agent.

You’ll need to speak with an agent to purchase an Erie car insurance policy. And, if reviews are any indication, you’ll need to speak with your agent to make changes to an existing policy as well.

What types of coverage does Erie offer?

Erie offers a fairly wide range of coverage options, especially for a regional insurer. Erie offers all these standard coverage options:

- Bodily injury liability

- Property damage liability

- Personal injury protection (PIP)

- Uninsured and underinsured motorist protection

- Comprehensive coverage

- Collision coverage

And they have quite a few additional coverages and benefits you can add to your policy (each with its own fee).

I didn’t see any customizable options beyond changing basic coverage amounts and deductibles. The website tells customers to speak to an agent about additional coverage options (which I’ll review next), but I didn’t find any information about the cost of the add-ons.

“Built-in extras”

Erie says it offers these perks with any auto insurance policy, including first accident forgiveness, which waives the charge for a first accident after insuring with Erie for at least three claim-free years.

They also cover windshield repair, though not replacement, with any policy. And you get pet injury coverage, which covers vet bills after an accident up to $500 per pet and $1,000 per accident.

Erie pays for meals, lodging, and other travel expenses related to a covered claim. And every policy also includes coverage for:

- Borrowed or rented cars

- Relatives who borrow your car

- Waived deductibles for special circumstances

- Locksmith services

- On-site road service in the event of an accident with “reasonable” towing and labor

I didn’t find any specific information about rules or limitations for these extras, except for a footnote stating that sublimits may apply. In other words, Erie will cover these costs up to a certain limit, which will likely be outlined in your policy documents.

What other types of insurance does Erie offer?

Erie has been around for nearly a century, so it’s definitely learned how to insure more than vehicles. The company offers (well-reviewed) policies for:

- Motorcycles

- RVs

- Boats

- Collector and classic cars

- ATVs, snowmobiles, and golf carts

- Homeowners

- Renters

- Condos

- Mobile homes

- Life insurance

- Long-term care coverage

- Businesses

- Commercial auto

For a regional insurer, Erie certainly doesn’t skimp on its offerings.

Does Erie offer auto and home insurance bundling?

Yes, and several reviewers expressed satisfaction with both the insurance products and the savings. I should also note that reviews seemed to be higher for home insurance across the several online review platforms I researched for this article.

Other Erie Products, Services, and Perks

Erie has a few riders — a.k.a. additional coverage options — you can add for a fee. Let’s take a look at the most popular ones.

New-car replacement

For an additional amount each month, you can get coverage for a few bonus benefits. First, you’ll get actual replacement value coverage for your vehicle in case of a total loss. So if your car is totaled, the reimbursement covers the actual cost to replace your car, not the value of it at the time of the incident.

You can also choose better-car replacement, though I didn’t find any specifics about limitations here.

Auto Security

Auto Security is Erie’s version of gap coverage. It’s useful if you’ve recently bought a new car, as it covers the difference between the value of your vehicle and the balance left on your loan in the case of a total loss.

Rental car coverage

Erie’s rental car coverage option is pretty incredible. There are six “classes” of rental cars to choose from — from compact to luxury cars. You can decide which class you want, and the price is adjusted accordingly. They also have a special option for accessible vehicles.

You can add rental coverage to collision or comprehensive claims, or both. And you can use one of Erie’s partners (which include Enterprise Rent-A-Car) or your preferred rental company.

Roadside and rentals bundle

This expands the automatic roadside assistance, which only covers you after a narrow group of specific events. It includes towing up to 20 miles if your car is disabled and (alone) costs around $5 a month per vehicle on the policy ($60 annually).

There’s no specific cost information when roadside assistance is bundled with rentals, but that’s likely because the option is customized to each policy.

Erie Auto Plus

Auto Plus comes with several valuable coverage options that aren’t available everywhere. This includes:

- Diminishing deductible, which lowers your deductible for every year you go accident-free

- Increased coverage limits for additional benefits like travel costs and personal item protection

- Waived deductible for special situations (unspecified, and I didn’t find anything indicating whether this expands the waived deductible circumstances that are standard.)

- Transportation expenses if your car is totaled

- Death benefit of $10,000

According to the website, you can add Auto Plus for “pennies a day,” but I couldn’t find anything more specific on the price. If you want to sign up for any special coverage options or get a quote, you’ll have to do so in person.

Luckily, the company excels in face-to-face care.

Erie Customer Service

Erie was built with a high value placed on customer service. The company motto, “The ERIE is Above all in SERvIcE,” was coined by co-founder H.O. Hirt and even trademarked in 1985. Back in the day, customers were invited to contact customer service via collect call (where the call’s receiver covers the cost).

But is Erie above all in customer service? The company earns high marks from J.D. Power, taking first place in the Mid-Atlantic and North Central regions and third in the Southeast. Erie also boasts a 90% retention rate on its website.

It may be due to the local agent model. In dozens of reviews, I found customers giving high praise to their agents. The policyholder below has been happy with customer service even after their original agent retired and they were assigned a new one.

And this reviewer, who has made multiple claims in their 15 years with the company, says they love their local agency.

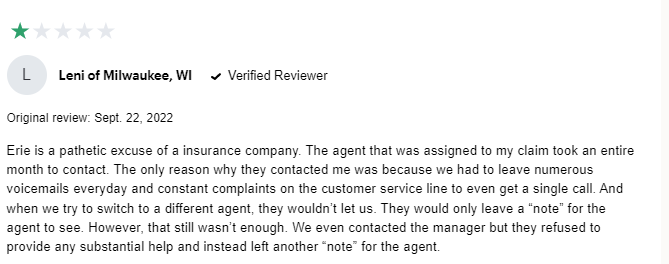

But, as with any insurance company, service can vary by office and agent. The review below made an impression on me because, after the policyholder discovers they’ve been driving without insurance due to their agent’s administrative error, no one on the 24/7 customer service team was able to replace her policy immediately.

Many of Erie’s competitors offer customers the ability to purchase a policy and put it into effect the same day, even on weekends.

Filing a Claim With Erie

Overall, Erie does a good job of managing customer claims, especially in relation to the industry average. The company scores high for claims satisfaction with J.D. Power, and I found several five-star reviews mentioning fast and easy claims processing.

The only reason Erie isn’t getting higher marks here is because the mobile app doesn’t currently allow customers to upload claims photos, which ultimately delays service.

The Erie claims process

You’ll have to file a claim with your local agent or the customer service team (available 24/7) by phone. You can file windshield or auto glass claims online and call for roadside assistance via a web browser or the app. But all other claims require you to work with someone directly.

Once the claim is submitted, you can track it throughout the process online or with the mobile app. But if questions arise, you’ll be directed to reach out to your agent or claims service representative.

While it’s definitely beneficial to have a point person, not being able to file claims directly on the app is a potential drawback, especially if you like being able to do things yourself.

What policyholders have to say about filing a claim with Erie

Let’s start by stating that claims processing, for any insurance product and with any insurance company, is the trickiest part of customer care. For customers, the process is stressful (they’ve just suffered damages after all), and sometimes, customers are surprised to learn they don’t have the level of coverage they thought they had.

For insurers, handling these stressful situations can be hit or miss. And when there’s a disagreement between the two parties, things get messy fast.

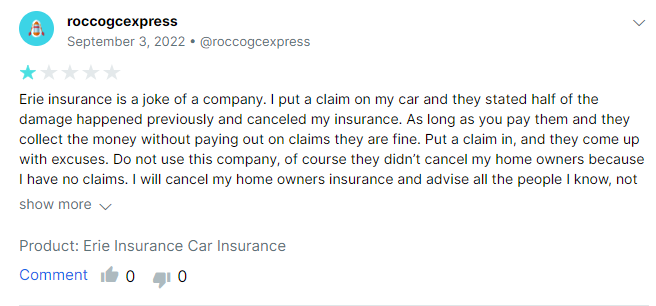

After submitting a claim, this reviewer was not only denied but also dropped from coverage altogether. We can’t say exactly what happened here, but it does illustrate how important it is to keep detailed records of the items you’ve insured. Had this policyholder taken a cell phone video of their vehicle at the start of the policy, it could have been the evidence needed to ensure their claim was paid.

But let’s not pretend all the responsibility is on the customer to ensure claims are handled accurately and fast. In this review, we see Erie’s claims service team struggles to find where exactly the buck stops. Instead of honoring the customer’s request (to switch to a new claims agent), each person the policyholder comes in contact with refers them back to their original agent.

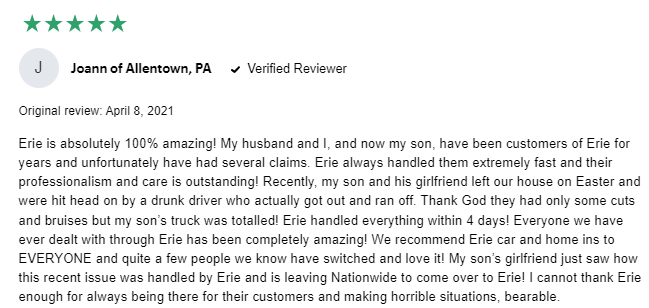

But Erie receives high marks for a reason. Below, we see why. When things work well, everything runs smoothly for the customer. It’s also incredible that the claim was handled in just four days, which speaks volumes about the company’s ability to manage issues quickly.

Erie Insurance Mobile App

Overall, the Erie Insurance Mobile app is doing just fine. The app does well with the functions it offers. But, again, some basic features are surprisingly missing. It’s definitely not all bad, and the company is making improvements, but it’s hard to know exactly what improvements have been made.

Let’s look at a few reviews.

Apple App Store: 2.9 out of 5 stars

In the App Store, reviews are only so-so. It offers the basic functionality one expects, including:

- Access to ID cards and policy documents

- Making payments

- Viewing claim status

- Contacting your agent

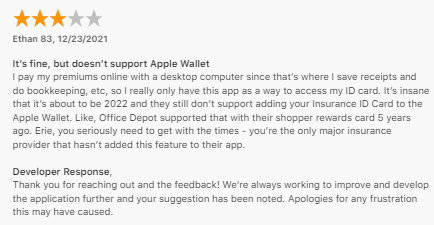

Take the below review. The customer points out a basic flaw: the app doesn’t connect to Apple Wallet, which allows users to automatically upload payment information with the click of a button. But pay attention to what makes it so frustrating: other applications have been able to do this for years.

Apple Wallet was introduced in 2015 when it supplanted its 3-year-old predecessor, Passbook. But even though it’s been around for more than eight years, Erie still hasn’t built the functionality into its own app.

And by the looks of this review, payment processing has functionality issues in general — which we’ll see is also a problem with the Android version.

Even so, the functions the app can perform are performed well. For drivers looking for easy access to information about their policy (and, with the latest update, information about their claims as well), this app does just fine. But expect to have to go online or call your agent when you want to manage your policy.

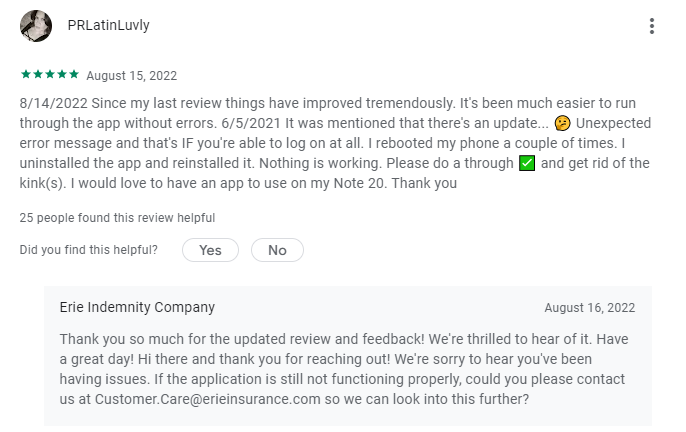

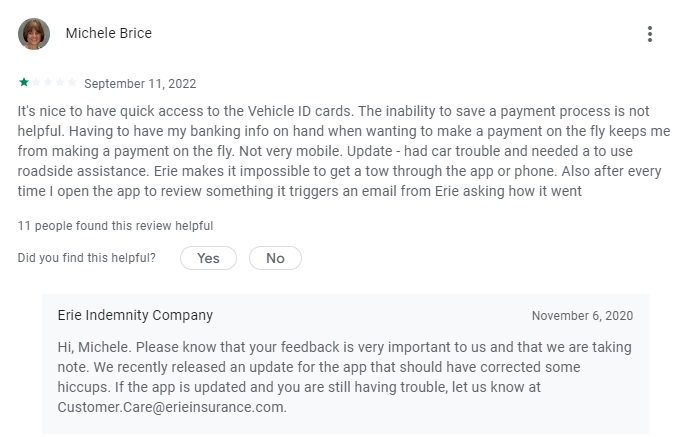

Google Play: 3.4 out of 5 stars

Erie Insurance Mobile gets 3.4 out of 5 stars on the Google Play store. Let’s look at a few reviews to see exactly what it does well and where it falls short.

The app’s decent score indicates it works well enough. And it appears to be updated frequently by the company. But you can see in the following review that glitches — most notably with logging in — are a common pain point.

But they’re also being addressed. The updated portion of the review mentions that there are far fewer errors with the app within two months of the user’s previous negative review.

But this review, made shortly after the one above, reveals more limitations. Here, the customer states that they can’t save their payment information and couldn’t use the app to access roadside assistance (which is promised on the company website). The company did reach out to let the customer know that new updates should have resolved “some hiccups,” though they didn’t specify which ones.

I noticed, too, that the company seems to have a new policy of leaving the customer care email on negative reviews, as the email was only found in responses to recent reviewers.

Bottom Line: Is Erie Car Insurance Right for You?

For the right driver, Erie is an excellent choice. The company offers low rates, customized policies, and rare benefits when drivers join the Auto Plus program. It also boasts a high renewal rate, but can’t please everyone.

While rates are low, Erie may not offer the cheapest rate depending on where you live, your driving record, and other factors. It’s always a great idea to compare your options by price and otherwise when choosing a policy.

Find the Best Company for You in Minutes

Here’s an overview of what we uncovered in our research.

Where Erie stands out

Erie is a great choice for drivers with clean, accident-free driving records and solid credit scores. The company boasts cheaper-than-average rates in each state it operates in and generally gets great marks for customer service and claims handling.

It also has some of the best perks of any auto insurance company, with built-in accident forgiveness (after three years of claims-free driving) and deductible waivers for certain situations.

Where Erie falls short

Erie’s technological prowess isn’t leading the pack. While the website offers several useful features, you can’t buy a policy 100% online. And it’s difficult to change your information once you move to the next page in the quoting process. If you need to move backward through your application, you’ll have to re-enter your information.

The Android and iOS versions of the mobile app have only so-so scores, and several reviewers mention that the apps lack important features. For example, several reviewers request updates to allow them to submit and manage claims with the app — a feature that’s commonly found among many of Erie’s competitors.

Some online reviews indicate that the company is willing to drop customers when their risk changes, which appears to be somewhere around two at-fault claims.

Erie is best for drivers who…

Erie is a great choice for drivers who want personalized service from a local agent. The company’s customer service scores are among the best in its class, and its 90% retention rate reinforces that idea. So if you care about customer service, Erie might be the company for you.

Popular Erie Alternatives

Erie is a unique insurance company, but plenty of alternatives are out there. We’ve listed several strong contenders, including large national brands and regional insurers.

- AAA may offer better rates to drivers in rural areas.

- Allstate has more discount options, but Erie tends to offer lower rates in general and specifically for people with an at-fault accident.

- Encompass tends to offer similar rates to Erie but has a larger range of discount options.

- GEICO tends to offer lower rates to drivers with clean records, but Erie tends to offer lower rates to couples and to drivers with one moving violation.

- Grange often offers lower rates than Erie (but not for drivers with a DUI).

- Mercury may offer better rates to low-mileage drivers.

- Progressive offers more discount options than Erie, though Erie tends to beat Progressive on price in general.

- State Auto may be a better fit for people with two or more moving violations on their driving record.

- State Farm has similar (though slightly higher on average) rates overall and lower rates for drivers with DUIs. Erie offers more customizable coverage options.

Keep in mind that we’re considering the “average” experience, and car insurance, like many things, is highly subjective. Be sure to put your preferences and needs above what is “generally” true or recommended. Our notes are intended to help you find what’s best for you.

Erie Auto Insurance FAQs

Want to learn more about Erie? Here are answers to some of the most commonly asked questions by drivers like you.

Is Erie a reliable insurance company?

Yes, Erie is considered a reliable insurance company due to its long reputation, highly regarded service, and strong financial rating — A+ (Superior) from A.M. Best.

Customers report somewhat higher satisfaction rates with Erie’s home insurance. But car insurance customers also report satisfaction with the prices, products, and customer service at Erie.

Does Erie have the cheapest car insurance?

Erie definitely offers affordable policies in general, and for some drivers, they’ll offer the cheapest car insurance policy. But it’s not for everyone. The best way to know if Erie is the cheapest option for you is to compare quotes for policies from several insurers.

Is Erie good at paying claims?

Erie certainly has the financial rating to cover claims and scores well above the industry average in the J.D. Power 2022 Auto Claims Satisfaction Study.

Some recent reviews do mention delays in claims handling and difficulty getting in touch with their claims agent or adjuster.

Is Erie actually good?

Yes, Erie is a good insurance company. Most customers report high satisfaction with customer service (especially their local agent) and claims handling. Many of Erie’s customers take advantage of the Auto Plus program.

We found many online customer reviews (negative and positive ones) where the reviewer indicates they’ve been with the company for a long time — 5, 10, and even 20 years.

Is Erie difficult to deal with?

For the most part, customers report having an easy time getting in touch with customer service representatives and personal agents at Erie.

However, some customer reviews show that claims dealings are more difficult, especially from non-Erie customers looking for information about a claim involving an Erie driver. The most common complaint was a delay in the claims process.

How long has Erie been in business?

Erie Insurance has been in business since 1925, so 97 years.