Pros

- Partners with multiple insurance companies

- Can save time

- Free to use

Cons

- Doesn't show actual rates

- May favor advertising partners

- Sells information to third parties

Bottom Line

While NerdWallet offers valuable educational content, it may not be the best tool for comparing car insurance. You must consent to receive calls and texts from its third-party partners, which could result in a flood of messages.

It’s also unclear which insurance companies these partners are affiliated with, and you aren’t necessarily getting a wide selection of quotes or the most budget-friendly options.

NerdWallet is a popular personal finance company offering educational content and financial products and services through its network of third-party partners. This includes a popular car insurance comparison tool.

To shop for an auto insurance policy through NerdWallet, you’ll enter your personal information into an online form, including your vehicle information, birthdate, address, phone number, and more.

But you won’t see any rates with your NerdWallet quotes. The tool only shows ads from a few of its partner insurance companies, so you may be better off using other insurance comparison sites to purchase your next policy.

We’ll break down everything you need to know about NerdWallet’s insurance shopping tool in the sections below.

NerdWallet: What to Know

NerdWallet is an established personal finance website launched in 2009 by co-founders Tim Chen and Jake Gibson. Since its founding, the site has grown to become a household name in finance, with 24 million monthly unique users during the third quarter of 2023, according to its website.

You can find educational content related to banking, budgets, credit cards, credit scores and credit reports, debt, insurance, investments, lenders, and loans on NerdWallet. The company also provides comparison tools you can use to shop for different financial products and services. Additionally, the company created the NerdWallet app for Android and iOS that’s designed to help users better manage their bills and cash flow.

NerdWallet generates income primarily through an affiliate model, meaning it receives a commission if you purchase a product or service from one of its partners. The company indicates it may sell or share your personal information, though you can request that it doesn’t through an online privacy form on the NerdWallet website.

What services does NerdWallet offer?

NerdWallet is a comprehensive personal finance site offering a wide range of educational information, as well as products and services through affiliated partners. You can improve your financial literacy and get car insurance, credit cards, investment accounts, mortgages, personal loans, budget and spending tools, and more through its site.

For the purposes of this article, we’ll focus on NerdWallet’s car insurance offering, including how to compare quotes via the site and how it stacks up against competitors.

How to Compare Car Insurance Quotes on NerdWallet

The process of comparing car insurance quotes on NerdWallet is fairly straightforward. You start by entering some personal information, including your:

- Driving history, including any recent accidents and speeding tickets

- Current insurer

- Vehicle make, model, and year

- Marital status

- Gender identity

- Birthdate

- Address

- Phone number

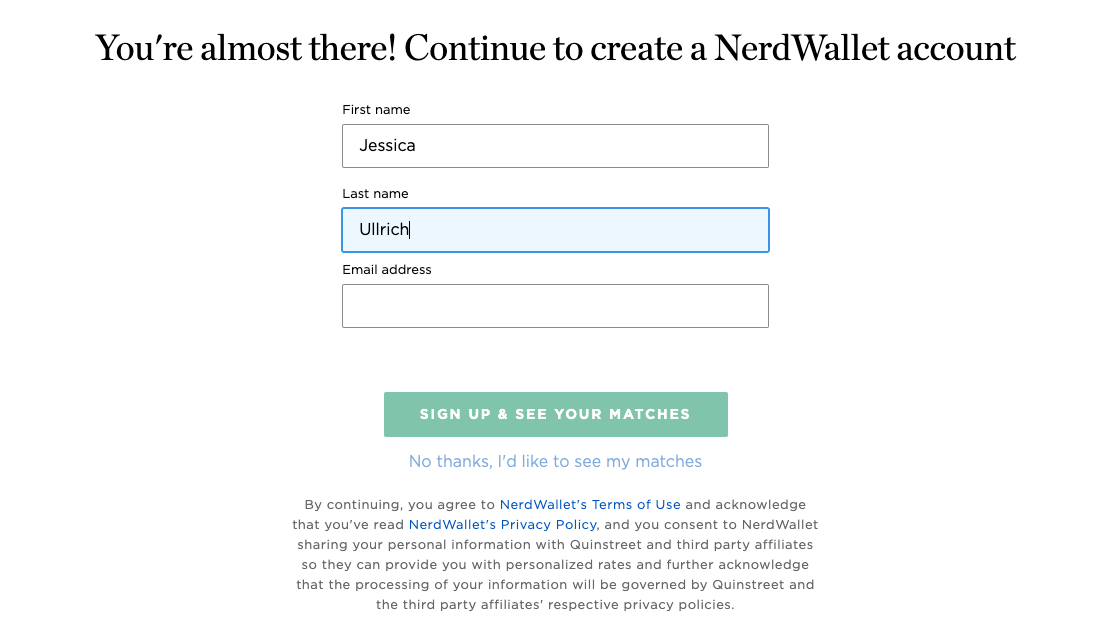

Upon submitting this information, you’ll be prompted to sign up for a free NerdWallet account to see your results.

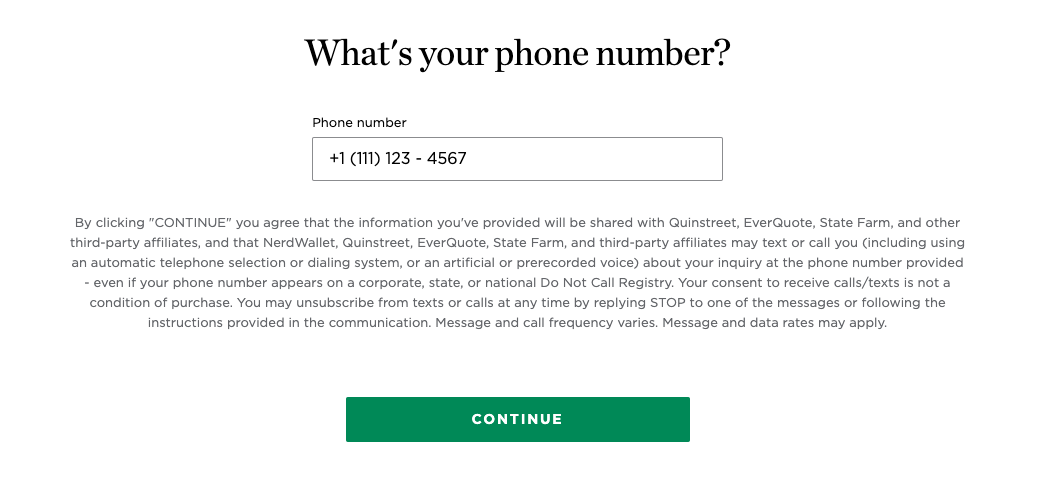

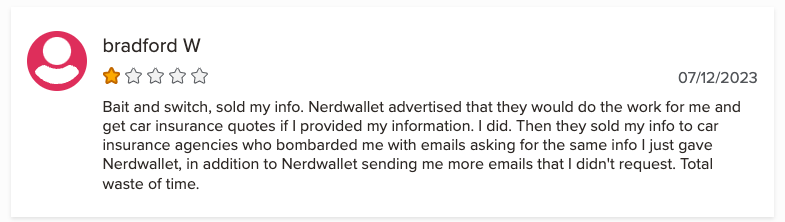

You must also agree to receive calls, texts, and emails from NerdWallet’s affiliates when providing your phone number. This leads to some users complaining about being bombarded by calls and texts from NerdWallet partners. We’ll cover that in more detail in the next section.

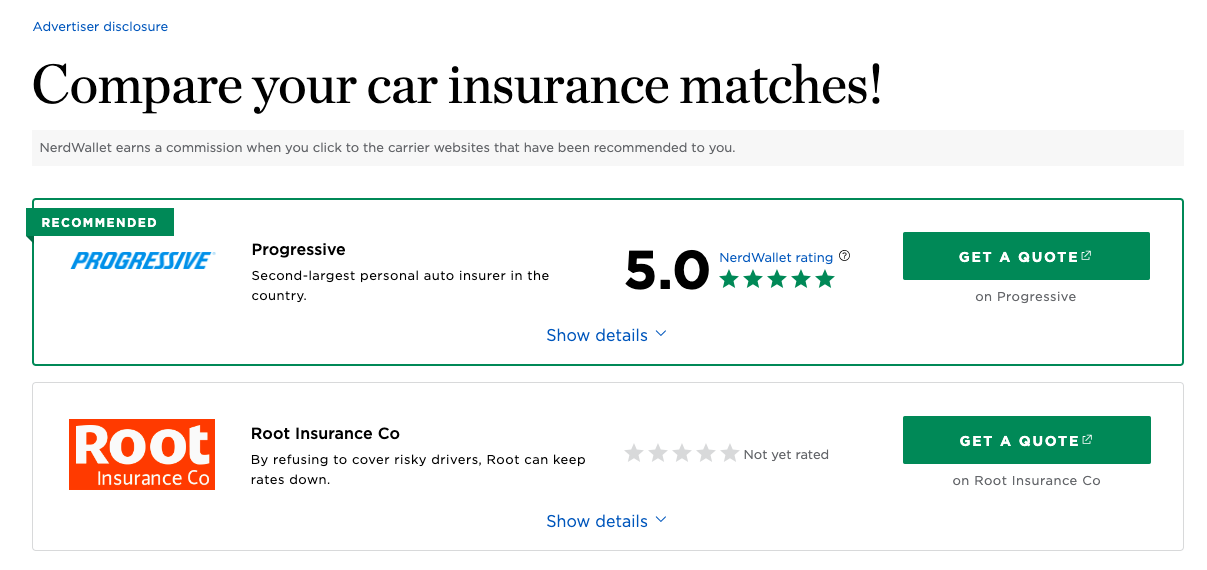

Once you’ve entered your personal information and signed up for a free NerdWallet account, the site offers matches to various car insurance companies. Its advertiser disclosure is clearly displayed at the top of the page, indicating that NerdWallet is compensated when you purchase a policy through one of these links.

You’ll receive quotes when you click the “Get a Quote” button for one of your insurance company matches, but you may have to re-enter some personal information or answer additional questions.

For instance, Progressive provided auto policy quotes ranging from $59.10 to $123.79 per month for a 2019 Honda Accord. Root wouldn’t provide quotes for the same car without a valid vehicle identification number (VIN), so we could only obtain a quote from one of the two insurers NerdWallet suggested, which was a bit disappointing.

NerdWallet Reviews: What Real Customers Are Saying

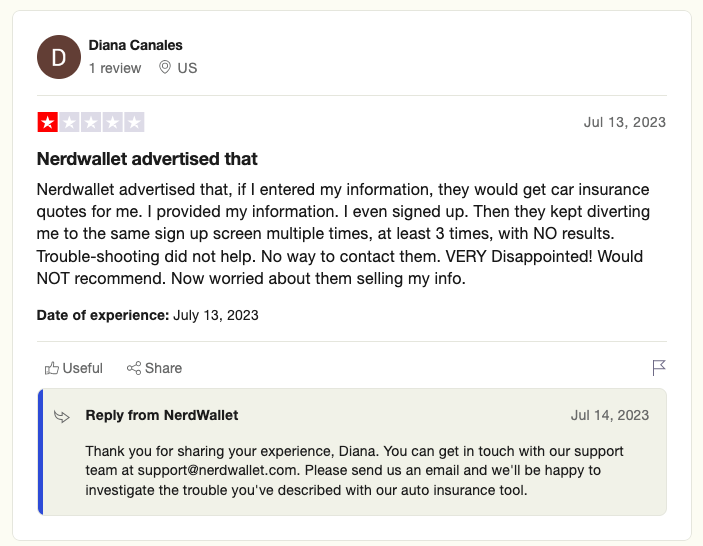

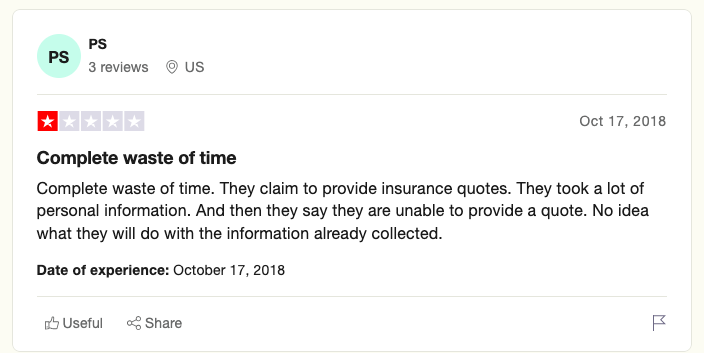

While NerdWallet is an established financial services company offering educational articles to help people make informed financial decisions, its customer reviews are relatively poor. The company receives just 1.8 out of 5 stars across 132 Trustpilot customer reviews, and 1 out of 5 stars across 11 Better Business Bureau (BBB) customer reviews.

Positive reviews are scarce on Trustpilot, with 79% of reviewers giving NerdWallet a one-star rating. The site also fares poorly on the BBB, with 100% of reviewers giving it a single-star rating. Concerned reviewers mention being bombarded with spammy calls and texts after submitting their personal information, problems with the online comparison form, and not receiving any insurance quotes.

Some reviewers also mentioned concerns about how NerdWallet would use their personal information and financial data, with others mentioning that its car insurance quote process was a waste of time. While it’s possible some users had decent experiences using NerdWallet’s car insurance comparison tool, several — like those found in the screenshots above and below — have shared negative feedback.

NerdWallet vs. Compare.com

NerdWallet is primarily an educational personal finance website offering consumers tools to compare car insurance and other financial products. That said, its past customer reviews focused on its car insurance comparison tool are concerning.

If you’re searching for a new auto policy, Compare.com specializes in car insurance comparisons, letting you compare real quotes from up to 75 insurers. To get started, you’ll enter information about your vehicle, driving history, and personal demographics, and the site indicates you’ll receive multiple insurance quotes.

Our search for auto insurance coverage on Compare.com using the demographics outlined below returned five real-time quotes — more than any other insurance comparison site we researched. But the total number of quotes you receive will likely vary depending on your unique insurance profile — including your driving and insurance history, age, gender, location, coverage needs, and more.

Here’s how the two sites stack up:

| NerdWallet | Compare.com | |

|---|---|---|

| Number of real-time quotes | 0 | 5 |

| Cheapest quote | N/A | $141 per month |

| Trustpilot consumer rating | 1.8 out of 5 stars | 2.5 out of 5 stars |

| BBB accreditation | Yes | Yes |

| BBB rating | A+ | A+ |

Note: The number of real-time quotes generated is for a 30-year-old single female living in Austin, Texas, who drives a 2019 Honda Accord and has one speeding ticket in the past three years. The number of quotes received from each site may vary depending on your driving profile.

NerdWallet vs. The Zebra

The Zebra is another NerdWallet alternative for drivers seeking new car insurance coverage. Similar to Compare.com, The Zebra’s primary focus is insurance comparisons, though it also offers educational content.

Similar to competitor sites, The Zebra lets you input your vehicle and personal information to receive auto insurance quotes. Like NerdWallet, The Zebra returned just one real-time quote from Progressive.

NerdWallet vs. Insurify

Similar to NerdWallet, Insurify provides educational content and insurance comparison tools. But as its name suggests, Insurify’s specialty is teaching consumers about insurance and helping them find insurance products that best meet their needs.

Insurify returned five real-time quote options when we used it to search for car insurance quotes. But, again, your unique driver profile may affect the total number of quotes you receive.

Is NerdWallet a Spammy Site?

Complaints on multiple consumer review sites suggest that NerdWallet affiliates may bombard you with calls and texts after sharing your contact information through NerdWallet’s auto insurance comparison tool.

To be fair, the company makes it clear you’ll receive texts and calls from third parties after you share your phone number. But it doesn’t specify which companies will contact you or how many communications you’ll receive. NerdWallet also indicates it may share or sell your personal information, though it provides a request form you can use to opt out.

NerdWallet FAQs

Want to learn more about NerdWallet? We’ve compiled answers to some of the most commonly asked questions below.

Is NerdWallet easy to use?

Yes. NerdWallet’s auto insurance comparison tool is fairly easy to use. You simply input some vehicle information and your driving profile to receive quotes from different auto insurance companies.

The number of quotes you receive may vary depending on personal factors, such as your driving history and demographics. But it’s worth noting that none of your results will include prices.

Is NerdWallet a trustworthy site?

Yes. NerdWallet is a long-standing personal finance site established in 2009. While the site provides a wealth of educational content that helps explain complex concepts like credit utilization and net worth, its auto insurance comparison tool leaves something to be desired.

Past customers also share overwhelmingly negative reviews about both its auto insurance and other comparison tools on the site.

Is there a monthly fee for NerdWallet?

No. It’s free to sign up for a NerdWallet account, and you won’t pay a monthly fee to use the site or its car insurance comparison tool.

What’s better than NerdWallet?

If you’re evaluating car insurance companies, a comparison site specializing in insurance may be a better option than NerdWallet. Sites like Insurify and Compare.com may be better options. Both sites show real quotes (with prices) and partner with a larger number of insurance companies.

Methodology

Data scientists at Compare.com analyzed more than 50 million real-time auto insurance rates from more than 75 partner insurance providers to compile the quotes and statistics seen in this article. Compare.com’s auto insurance data includes coverage analysis and details on drivers’ vehicles, driving records, insurance histories, and demographic information. All the quotes listed in this article have been gathered from a combination of real Compare.com quotes and external insurance rate data gathered in collaboration with Quadrant Information Services. Compare.com uses these observations to provide drivers with insight into how auto insurance companies determine their premiums.

Sources

- Trustpilot, “NerdWallet,” Accessed December 11, 2023.

- Better Business Bureau, “NerdWallet,” Accessed December 11, 2023.