Pros

- High customer satisfaction ratings

- Cheap premiums for spotty driving records

- Many discount opportunities

Cons

- Customer service dependent on local agent

- Less functional website and mobile apps

- More expensive coverage than competitors

Bottom Line

American Family is a full-service insurance company headquartered in Madison, Wisconsin. It offers many insurance products to help you protect your car, home, business, and more. But the company lags behind competitors in terms of financial strength.There’s a lot to like with American Family Mutual Insurance Company — usually shortened to AmFam — so long as you live in one of the 19 states the company does business in.

Policyholders can get a broad range of coverage and coverage limits. Most policyholders qualify for several discounts, which makes the company’s already low rates even more affordable.

But there are issues, including inconsistent customer service and less-than-ideal technological features. Even so, the company is certainly worth your consideration, especially if you need unique coverages or higher limits.

Is American Family a Good Choice for Car Insurance?

| Category | Score |

|---|---|

| Cost | 4.7/5 |

| Customer satisfaction | 4.7/5 |

| Ease of use | 5/5 |

| Availability | 4/5 |

| Industry reputation | 4/5 |

| Overall Score* | 4.98/5 |

| *Company ratings for each category are determined using our proprietary, objective rating formula. You can find more information on our unique scoring methodology at the bottom of this article. | |

AmFam can be a great choice for car insurance coverage as long as the company meets your needs and budget. Nearly all AmFam policyholders can find the coverage they need at a discount, so it’s definitely worth getting a quote.

Where American Family stands out

AmFam is well known for offering cheap car insurance coverage no matter the driver’s age or driving history. The company also scores well for claims handling and customer satisfaction in most of the regions it operates.

Where American Family falls short

Besides its limited coverage area, AmFam struggles with its website and mobile app — specifically a lack of features and design quality compared to competitors. Similarly, its usage-based insurance product (which relies on the mobile app) lags behind competitors in terms of customer satisfaction.

Compare Rates from America’s Top Companies

American Family Insurance Customer Reviews

As with all car insurance companies, reviews for AmFam are mixed. After all, car insurance is a notoriously difficult industry to operate in. Despite that, I found several examples of positive reviews from both new and longtime customers — especially ones that directly call out their excellent agent or local office, like the reviews below.

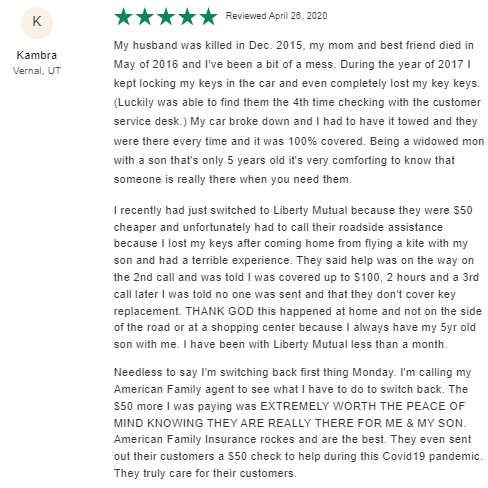

Beyond this, I found several reviews where the company clearly shows empathy for customers during their time of greatest need. Take the reviewer below, who struggled with locking her keys in the car after losing her husband, best friend, and mother within the span of a year. The customer service team had her back every step of the way.

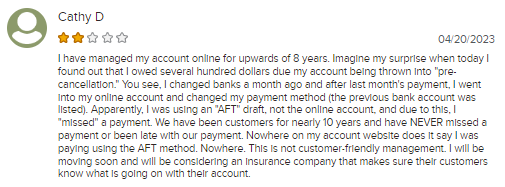

But not every review is sparkling. Several reviewers talk about negative experiences with their local agents (see the customer service section for more detail) and issues with sudden, unexplainable rate increases — a trend we see happening with companies these days. Another trend I want to highlight is issues customers have self-managing their policies.

The reviewer below wanted to change their payment method — which should be easy to do. But the switch results in a missed payment, which snowballs into something called a “pre-cancellation.”

I should note that this isn’t uniform across the industry. Several insurers — including GEICO and Progressive — offer grace periods to allow customers the chance to get their balance current before initiating a cancellation.

Finally, AmFam has a steady practice of responding to both formal complaints and reviews across the web, so the company is listening to what its customers have to say.

What You Can Expect to Pay With American Family Insurance

The table below represents the average costs for liability and full-coverage policies from American Family.

| Liability Only | Full Coverage |

|---|---|

| $63 | $125 |

While the national average may help you understand a company’s costs, it doesn’t paint the whole picture. Many other factors — including your age, driving record, and location — influence your costs. For example, drivers in Maine can expect lower rates than drivers in Michigan, and young drivers typically pay a lot more than older ones.

We’ll cover how rates change depending on these factors later in this article.

American Family vs. The Competition

Does AmFam offer lower rates than its closest competitors? Here’s how average auto premiums stack up.

| Company | Liability Only | Full Coverage |

|---|---|---|

| American Family | $63 | $125 |

| GEICO | $42 | $97 |

| Nationwide | $87 | $158 |

| Progressive | $72 | $146 |

| State Farm | $60 | $112 |

As you can see, while AmFam has low prices, GEICO offers much better rates. State Farm offers somewhat lower rates, too. But keep in mind that these two insurers are generally your cheapest options, on average, nationwide.

Additionally, State Farm and GEICO only offer limited coverage options. For example, neither can provide you with gap protection, which covers the difference between your car’s value and your loan value if your car is totaled.

What Types of Coverage Does American Family Insurance Offer?

You can purchase a wide variety of coverage options from American Family, including all of the following:

- Bodily injury liability coverage: Pays for medical and legal expenses if you injure someone in a car accident.

- Collision coverage: Covers repair costs to your own vehicle after a collision, regardless of fault.

- Comprehensive coverage: Covers damage to your car caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Property damage liability coverage: Pays for damage you cause to someone else’s property, such as their car or a building.

- Medical expense coverage: Pays your and your passengers’ medical expenses from a car accident, regardless of fault.

- Personal injury protection coverage: Also known as PIP, this covers medical expenses, lost wages, and other costs for you and your passengers, regardless of fault.

- Rental reimbursement coverage: Reimburses you for the cost of renting a vehicle while your car is repaired after an accident.

- Uninsured motorist protection: Covers your medical expenses and damages if you’re in an accident caused by a driver who doesn’t have insurance.

- Emergency road service coverage: Provides assistance like towing, fuel delivery, and tire changes if your car breaks down while you’re driving.

- Accidental death and dismemberment coverage: Pays a benefit if you die or suffer specific injuries in a car accident.

American Family Car Insurance Discounts

American Family offers a wide range of discounts you can take advantage of. Most drivers can access at least a few of the following.

- Multi-vehicle: Save money by insuring more than one vehicle with American Family.

- Loyalty: Get rewarded by staying continuously insured with AmFam.

- Early bird: Get a quote at least seven days before your current policy expires to earn extra savings.

- Multi-product: Purchase more than one insurance product through AmFam and receive an average savings of 23%.

- Steer Into Savings: Earn a discount on your auto premium when you switch from a competitor.

- Auto safety equipment: This discount is automatically applied if you have safety equipment, such as airbags, in your vehicle.

- Defensive driver: Customers age 55 and older who complete an approved defensive driving course can earn this discount.

- Good driving: Drivers with a clean record — no accidents, claims, or violations within the last five years — can qualify.

- Low mileage: Drivers must drive less than 7,500 miles per year to qualify.

- Pay-how-you-drive safe driving program: Save 10% for signing up and up to 20% off future premiums when you enroll in AmFam’s telematics program, download the KnowYourDrive app, and begin monitoring your driving.

- Good student: Students who earn good grades qualify.

- TeenSafeDriver: Auto policyholders qualify for this discount if a teen on their policy completes an approved defensive driver program.

- Away at school: Get this discount if your child is younger than age 25, attends college at least 100 miles away, and leaves their car at home.

- Young volunteer: Drivers younger than 25 who volunteer for at least 40 hours a year qualify.

- Generational: Policyholders whose parents are current AmFam policyholders qualify for this discount.

- Auto pay: Customers who sign up for auto pay qualify.

- Customer full pay: Customers who pay their entire policy up front at the time of purchase qualify.

- Paperless: Customers who sign up to get their bills and policy documents by email qualify for this discount.

Don’t forget to request a review with your agent to get all the discounts you’re entitled to.

American Family Car Insurance Rates by Age Group

Your age is one of the biggest influences on your car insurance rates. Here’s the average cost for AmFam drivers based on their age.

| Age | Liability Only | Full Coverage |

|---|---|---|

| Teens (18 years old) | $187 | $334 |

| Young adults (25 years old) | $69 | $142 |

| Adults (40 years old) | $64 | $127 |

| Retirees (65 years old) | $60 | $117 |

You’ll typically pay your highest rates for car insurance when you’re a teen and young adult. By the time you reach middle age, your costs should level off and remain more or less the same — as long as you don’t change anything about your policy and keep your driving record clean. Retirees tend to pay the least overall, though rates will start to creep back up sometime in your 70s.

Teens and young drivers

While average teen premiums at AmFam may seem high — $187 per month for liability and $334 for full coverage — they’re actually much lower than the national averages of $297 and $676, respectively.

The same goes for 25-year-old drivers, with average rates as much as 47% cheaper than the national average. American Family also appears to lower rates more quickly as teens age compared to other insurers.

AmFam has several discounts for young drivers, including its good student, away at school, young volunteers, and generational discounts. You can also complete the free TeenSafeDriver program to potentially earn additional savings.

Seniors and retirees

At American Family, 40-year-old drivers spend an average of $64 per month on liability and $127 on full-coverage policies — both much less than the national averages.

Retirees can also find a good deal at AmFam, with monthly rates averaging $60 for liability and $117 for full coverage (compared to the national average of $97 and $221).

American Family also offers a defensive driving discount for drivers older than 55 — though this discount is only available in select states. Seniors can also take advantage of other discount programs, such as the low-mileage discount for retirees.

American Family Car Insurance Rates by Driving Record

Your driving record is another factor that greatly influences your rates because your insurance company looks at your past driving behavior to determine your level of risk. Here’s how AmFam rates change depending on your driving record.

| Driving History | Liability Only | Full Coverage |

|---|---|---|

| Clean record | $63 | $125 |

| With a speeding ticket | $79 | $156 |

| With an at-fault accident | $97 | $172 |

| With a DUI | $96 | $172 |

Your insurer will raise your risk level when you’re caught doing something risky — and the higher your risk level, the higher your premiums.

This is why at-fault accidents and DUIs usually raise rates much more than a single speeding ticket. Similarly, speeding less than 10 mph over the limit affects premiums less than a ticket between 10 mph and 20 mph over the limit.

After an accident

At-fault accidents often result in substantial premium increases — typically between 42% and 45%, according to our research. Elevated rates typically remain in effect for three to five years, depending on your state.

American Family offers considerably more affordable premiums — $97 per month for liability and $172 for full coverage, on average — than the national average.

But even with a good deal, you can still save even more money on your policy if you’re a driver with an accident on record. Here are our favorite methods available at AmFam:

- Sign up for its usage-based program, drive less, and follow safe driving practices to earn as much as 20% off your premiums.

- Raise your deductibles (the amount you pay out of pocket when you file a claim).

- Take a defensive driving course if you’re age 55 or older.

After a speeding ticket

A single speeding ticket typically increases rates by 37% and usually keeps costs high for around three years, according to Compare.com data. Luckily, American Family appears to penalize drivers with tickets less harshly than the average insurer.

AmFam’s liability premiums cost an average of $79 per month compared to the national average of $113, while its full-coverage policies are $156 per month compared to the national average of $268.

If you get a speeding ticket, ask how you can reduce your penalty (by asking for fewer points on your license, for example). This may result in a smaller increase in premiums.

Be sure to obey all traffic laws from now on — especially speed limits — because multiple tickets can lead to even higher rates and make it less likely for you to get leniency on subsequent tickets.

After a DUI

DUIs can easily double your car insurance premiums, but drivers with DUIs can find potential savings with AmFam. Its liability policies come in at $83 less per month than the national average of $179. AmFam also offers full-coverage policies at a rate of $241 lower per month than the $413 national average.

However, it’s important to note that these rates are still higher than those for drivers with clean records. To mitigate rate increases after a DUI, consider exploring AmFam’s usage-based programs and taking advantage of defensive driving discounts. You can also raise your deductibles for more savings.

American Family Car Insurance Rates by Credit Score

In most states, car insurance companies can use your credit history to determine your rate. For the most part, insurers tend to see people with poor credit scores as higher risk than people with good or excellent credit scores.

Below are AmFam’s average rates for policies based on the driver’s credit score.

| Credit Score | Liability Only | Full Coverage |

|---|---|---|

| Excellent | $55 | $108 |

| Good | $64 | $127 |

| Average | $70 | $139 |

| Poor | $109 | $211 |

AmFam follows the trend of most insurance companies — rates are far cheaper for people with good credit compared to people with poor credit. But the good news here is that, compared to the national average rates for all companies, American Family penalizes drivers with bad credit less. In fact, rates for drivers who have poor credit are $73 cheaper than the national average for liability and $183 cheaper for full-coverage policies, according to Compare.com data.

So, if you’re in the process of rebuilding your credit, consider getting a quote with AmFam.

Get Your Best Rates in Minutes

How to Purchase a Car Insurance Policy from American Family

You can purchase a car insurance policy from American Family entirely online, and it only takes 10 minutes — as long as you don’t need a highly customized policy. The online process starts by asking for basic information about you, your location, and your vehicle.

Once you get the quote, you’ll have three options to choose from. If at least one of those options meets your needs, you can proceed to the final steps of the binding process.

At that point, you’ll need to offer more information — including your driver’s license number — to verify your driving record. Bear in mind that the quoting process doesn’t initially ask for your driving record, so, if you have a few marks, you may not get an accurate quote.

Overall, the process is easy but not customizable. People with unique needs must call or chat with an agent to complete the purchase.

Getting a quote from American Family Insurance

To get my quote from AmFam, I started by going to the company’s car insurance home page.

From there, I could choose which insurance products I wanted a quote for.

Once in the quote questionnaire, I was asked for my address. I liked that the sidebar showed me the steps I’d need to take to get to my quote, and I appreciated being able to track my progress throughout.

Next, I provided some basic information about myself.

Then, the site asked questions about my car that I don’t typically find in other companies’ quote processes. I think this was to determine if I needed specialty coverage for a collector’s vehicle or similar.

I entered my vehicle information next. Then, I verified where I park my car, plus some information about my vehicle’s safety features.

Then, I added a little more information about me (marital status, gender, etc.).

The final section was about my current car insurance coverage. I assume this was to verify that I’ve continuously had insurance and to estimate the level of coverage I’d want.

Next, I added more contact information and I was prompted to choose between a standard policy and usage-based insurance.

And, with that, I got a range of quotes covering three tiers: basic, traditional, and premier. I could flip through each option to see the differences between them.

I liked that the site made these differences clear, but I prefer being able to fully customize each choice — coverage types, coverage levels, and deductibles. Now, I could do this by hitting the chat button on the screen’s lower right corner throughout the process, but this adds quite a bit of time.

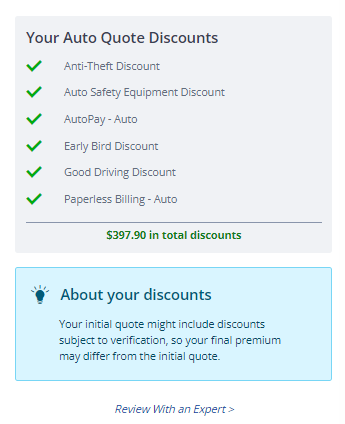

Once I selected which option I wanted, I noticed another box popped up on my screen. This outlined all of my discounts and their corresponding benefits.

The “review with an expert” link gave me another opportunity to customize my policy with assistance by chat or a phone call. This is a nice feature, but, again, it would be better if I could customize it on my own.

Overall, the process was simple and fast, but I wish it was easier to customize my policy after I got to the quote page. The price transparency (how much each coverage option contributed to the bottom line) could also be better.

American Family Customer Service

Overall, AmFam’s customer service is a mixed bag. The company scores higher than average in several areas, including the Central, Southwest, and California regions (where American Family operates under the CONNECT name). But the company falls well below average in the Southeast.

It also scores low for usage-based insurance (policies priced based on your mileage and driving habits).

I made a few calls to the AmFam customer service line to see how easy it was to get in touch with a representative. I called on a Sunday morning (8:02 a.m. EST) and Wednesday afternoon (1:23 p.m. EST). On both occasions, I got in touch with a representative in less than three minutes — and I found both reps were kind and knowledgeable, even when I asked more technical questions.

I found many customer reviews praising their local agent especially — and just as many explaining how easy it is to work with customer service at AmFam. Take the reviewer below who has had such a positive experience that they feel like family.

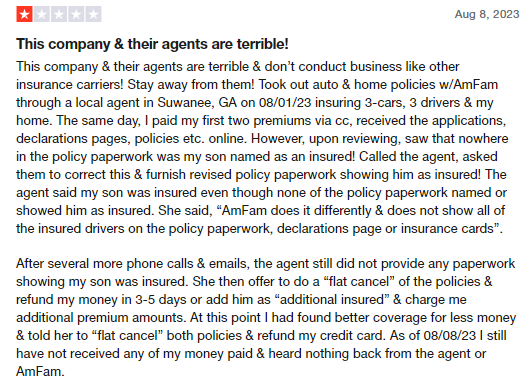

But the quality of your agent makes a big difference. I found several reviews explaining less-than-ideal interactions with theirs. The next reviewer possibly wins the award for worst experience: They can’t get in touch with their agent to cancel their policy, and, when they reach out to the corporate office, their agent finally returns their calls — to allegedly berate them.

The takeaway: Read reviews for your local office and look for an agent with a strong reputation.

Filing a Claim with American Family

You can file a car insurance claim with AmFam in several ways. You can go to your agent directly or call the 1-800-MYAMFAM customer service line. But the easiest and fastest way to file a claim is to do so online.

You’ll need to log into your account via the MyAmFam app (you can also do this online, but the app makes it even easier to upload photos). You’ll be asked to provide the following information:

- Date and time of the accident

- Brief description of the accident

- Photos of the damage to your property

- Contact information for other parties involved

You’ll also need to provide a copy of the police report when one becomes available. From there, your claims agent will begin processing your claim. You can also find a repair shop and car rental through your account to get you back on the road quickly.

The company also says it’ll process your claim within 24 to 48 hours, which you can follow up with through your account or by contacting the claims agent directly.

J.D. Power rated AmFam as slightly higher than average for claims handling in 2022. But what do customers think? As with many insurers, the reviews are mixed.

The primary issue I found repeatedly in recent reviews is the length of time to process the claim. Many customers wait weeks — even months (as in the review below) — to get reimbursed.

But there were plenty of reviewers who had a positive experience with the claims process. I found this review to be especially compelling, as the reviewer felt cared for by the claims team — not just a problem to be dealt with.

More About American Family Insurance

| Founded | 1927 |

| Available in | 19 states |

| Owned by | Policyholders (mutual insurance company) |

| National average premium | $94/month |

| Mobile app | Android, iOS |

| Customer service | 1 (800) 692-6326 |

| Claims | 1 (800) 692-6326 |

| Primary competitors | Auto-Owners, GEICO, Nationwide, Travelers |

American Family’s other insurance products

You can insure a lot more than your car at American Family. The company offers a wide selection of insurance products to help you cover (almost) everything in your life.

- Motorcycle insurance

- Boat, RV, and camper insurance

- ATV and snowmobile insurance

- Home insurance

- Condo insurance

- Renters insurance

- Manufactured home insurance

- Life insurance

- Umbrella insurance

- Business insurance

- Landlord insurance

- Farm and ranch insurance

You can also qualify for a bundling discount when you purchase two or more insurance policies with AmFam, though the company doesn’t advertise the extent of the discount.

Bottom Line: Is American Family Insurance Right for You?

AmFam may be a great option for you — especially if you need robust coverage options and want to bundle your insurance products. But if you place emphasis on a highly functional mobile app, you may want to look elsewhere.

You should also look at reviews from your local office and seek a recommendation for your insurance agent — many of the positive reviews I read included a shoutout to their local branch.

If AmFam sounds like it might fit your needs, then we recommend getting a quote. Just be sure to compare policies with competitors, and don’t forget about the smaller insurance companies in your area.

Find Your Best Rate in Minutes

American Family Insurance Auto Insurance FAQs

Here are the answers to some of the most common questions people ask about American Family.

Is American Family Insurance legit?

Yes. American Family Insurance is a legitimate and well-established company with a history of serving policyholders across the United States.

Does American Family have the cheapest car insurance?

While American Family’s car insurance rates are competitive, the cheapest option depends on your specific circumstances, such as where you live, your driving history, and your coverage needs.

Does American Family offer auto and home insurance bundling?

Yes. American Family Insurance offers auto and home insurance bundling. Bundling your policies often results in cost savings and streamlined coverage.

Can you purchase a policy from American Family 100% online?

Yes. You can purchase an American Family insurance policy entirely online, and often in less than 30 minutes.

Is American Family good at paying claims?

Yes. American Family has a strong track record of reliability when it comes to paying claims, consistently earning positive feedback from policyholders for their prompt and fair claims handling.

Data Methodology:

Data scientists at Compare.com analyzed more than 50 million real-time auto insurance quotes from more than 75 partner insurers in order to compile the rates and statistics seen in this article. Compare.com’s auto insurance data includes coverage analysis and details on drivers’ vehicles, driving records, insurance histories, and demographic information.

All the rates listed in this article have been collected from a combination of real Compare.com quotes and external insurance rate data gathered in collaboration with Quadrant Information Services. Compare.com uses these observations to provide readers with insights into how auto insurance companies determine their premiums.

Rating Methodology:

Compare.com’s mission is to help our readers make more informed decisions about their personal finances. Our editorial staff has crafted a proprietary, objective rating formula — the Compare.com Rating — to make it easier for our readers to analyze and compare many of the industry’s most well-known insurers. The score you see referenced in this article is based on several factors, including:

- Cost: How the insurer’s average rates compare to its direct competitors and the industry as a whole. This includes available savings opportunities, such as discounts and other factors.

- Customer satisfaction: How satisfied existing customers are with the service they receive. This includes the insurer’s scores among various third-party studies, such as the J.D. Power U.S. Insurance Shopping and Claims Satisfaction studies, and the National Association of Insurance Commissioners (NAIC) Complaint Index, among others.

- Ease of use: How easy it is for policyholders to utilize their policies. This includes mobile app availability, customer service availability, payment flexibility, and other related factors.

- Availability: The overall scope of the company’s insurance offerings. This includes available coverage types, national footprint, and other related factors.

- Industry reputation: A measure of the insurer’s overall standing within the industry. This includes its AM Best financial strength rating, BBB accreditation, and other related factors.

Sources

- J.D. Power, “2023 U.S. Auto Insurance Study,” Accessed September 6, 2023

- J.D. Power, “Usage-Based Auto Insurance Takes Center Stage as Satisfaction Flatlines,” Accessed September 6, 2023

- Trustpilot, “American Family Insurance,” Accessed September 7, 2023

- ConsumerAffairs, “American Family Insurance Auto,” Accessed September 7, 2023

- BBB, “American Family Insurance,” Accessed September 7, 2023