Pros

- Lots of discount opportunities

- Strong financial standing

- Offers rideshare insurance

Cons

- Higher-than-average rates

- Only available in 11 states

- Customer reviews could be better

Bottom Line

Mercury tends to offer higher rates, but it can still be an affordable option for certain driver types. The company provides fairly extensive coverage as well (plus discount options that can lower overall costs), so don’t be afraid to get a quote from Mercury.Mercury Auto Insurance: At a Glance

| Founded | April 1, 1962 |

| Available in | Arizona, California, Florida, Georgia, Illinois, Nevada, New Jersey, New York, Oklahoma, Texas, Virginia |

| Owned by | Publicly traded, NYSE: MCY |

| National average premium | $312 |

| Mobile app | Android, iOS |

| Customer service | 1 (800) 503-3724 |

| Claims | 1 (800) 503-3724 |

| Primary competitors | Allstate, American Family, GEICO, Metromile, Progressive |

Mercury Insurance is small but mighty. Founded in 1962, the company started writing auto insurance policies in the 1970s. Mercury provides plenty of coverage options and additional insurance products that make it a competitive choice. The company also uses a local agent model, which can add a personal touch for many policyholders.

However, Mercury’s average prices are fairly high. And I uncovered some issues with its customer service. Keep reading to learn more about Mercury, including everything you need to know about its average rates, coverage options, claims processing, customer reviews, and more.

Is Mercury a Good Choice for Car Insurance?

Mercury General Corporation — better known as Mercury Insurance — specializes in California car insurance policies, so residents of the Golden State will find policies tailored to meet local needs and regulations.

With a wide range of insurance coverages, including additional products like homeowners and umbrella insurance (at a discount), Mercury can meet a wide range of customer needs. And its long-established reputation and financial stability mean Mercury can handle any claims you might have.

Though the company doesn’t typically provide the lowest prices, it can still be a good choice for car insurance — so long as it meets your individual needs, preferences, and budget. Mercury also appears to be especially suited to California drivers.

Where Mercury stands out

Mercury packs a lot of bells and whistles into its policies, especially for a small insurance company (more than its mega-sized competitor, State Farm, for example). And its many discount opportunities can help you lower your rates.

Where Mercury falls short

Mercury’s prices are high compared to its competition. In fact, the company offered higher rates on average for all driver profiles compared to its closest competitors. Be sure to review discount options with Mercury and shop around to make sure you’re getting the best quotes.

Find the Best Car Insurance Policy for You in Minutes

Mercury Customer Reviews

Forbes once listed Mercury as one of the top 100 most trusted companies in the U.S. — but that was 11 years ago. Does service still hold up?

As with most things in car insurance, it depends. Let’s look at what customers are saying online.

First, it’s worth noting that Mercury’s review scores were generally low across the board.

- WalletHub:1 out of 5 stars

- Trustpilot:0 out of 5 stars

- ConsumerAffairs:0 out of 5 stars

- Better Business Bureau:14 out of 5 stars

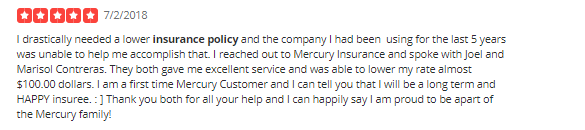

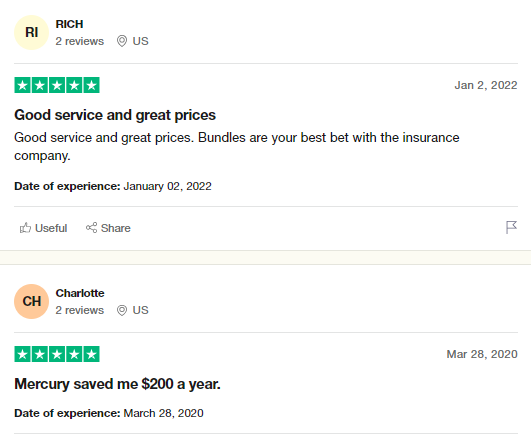

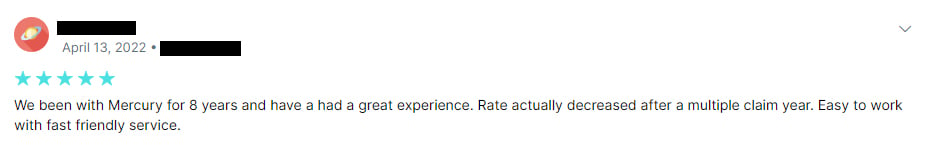

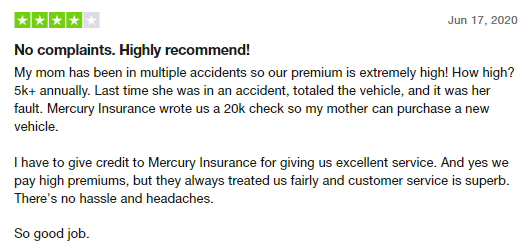

But there were plenty of instances where customers spoke highly of the company. And despite our (and others’) findings that Mercury offers higher average rates, dozens of reviews state that customers found their lowest rates with Mercury.

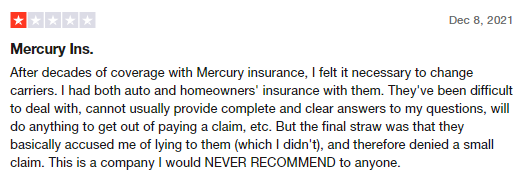

But, as I said, reviews were generally negative. One that stood out to me was this one from a longtime customer who bundled their home and auto policies. They claimed to have had trouble with Mercury several times over the decades they were insured with the company, including with Mercury’s claims process.

This review below stands out, because the reviewer both stayed with the company for decades and had nothing positive to say by the end of the relationship.

On Reddit, a user asked about switching to Mercury, as they’d never heard of the company before. Another user pretty much sums up everything you need to know about car insurance in their response: “There is no magic company” that is objectively the best car insurance company. The key is getting a good agent who can keep an eye on your policies and have your best interest at heart.

Mercury National Average Auto Insurance Rates

Mercury car insurance is generally more expensive than the average policy, both for full-coverage and liability-only policies.

| Liability Only | Full Coverage |

|---|---|

| $212 | $411 |

But these figures are just averages, which means they’re not an ideal representation of how Mercury will price your specific policy. Your premiums could be higher or much lower than what you see above, based on several factors like your age, location, driving history, vehicle, coverages, credit score, and more.

To get a clearer picture of Mercury’s pricing, let’s look at average premiums based on different driver profiles and compare costs to Mercury’s closest competitors.

Mercury Rates Compared to Top Competitors

We’ve gathered average quotes from some of Mercury’s closest competitors to give you a better idea of how rates compare.

| Company | Liability Only | Full Coverage |

|---|---|---|

| Mercury | $212 | $411 |

| Amica | $117 | $259 |

| Auto-Owners | $55 | $141 |

| Erie | $67 | $146 |

| NJM Insurance | $81 | $137 |

As you can see, Mercury’s rates tend to be much higher than those found from its competitors, especially Auto-Owners (a favorite in the California region). But even compared to the second most expensive option, Mercury’s average rates are nearly double.

Mercury offers more discounts than Auto-Owners, NJM, and Erie, which could lower premiums significantly compared to competitors. Remember, many factors influence the cost of car insurance, which means the most expensive option for one driver may be the cheapest for another.

For example, though average rates at Mercury tend to be higher than rates at Amica, rates for high-mileage drivers (12,000+ miles annually) tend to be lower at Mercury. That’s why it’s always a good idea to compare quotes, coverages, and discounts from multiple insurers before deciding on the right option for you.

What Types of Coverage Does Mercury Offer?

Mercury has a fairly robust set of policy options, though specialty coverages — like gap insurance — are notably missing. Mercury underwrites policies with the following coverages.

- Bodily injury liability: Covers the other party’s injuries when you’re at fault in a collision, including attorney services for legal defense if sued.

- Property damage liability: Covers damages to someone else’s property if you’re at fault in an accident.

- Collision coverage: Covers damages to your vehicle caused by a collision, regardless of fault.

- Comprehensive coverage: Protects against damages caused by vandalism, theft, falling objects, animals, civil disturbance, fire, flood, or other covered perils.

- Medical payments coverage (MedPay): This supplemental coverage assists with your medical expenses resulting from a covered accident.

- Personal injury protection (PIP): Covers your medical costs and other expenses after a car collision, regardless of fault.

- Uninsured/underinsured motorists: Covers injuries to you, your passengers, and drivers of your insured vehicle caused by uninsured or underinsured drivers.

- Rental car: Helps cover the cost of a rental car while your vehicle is undergoing repairs due to a covered loss.

- Ride-hailing insurance: Mercury’s rideshare insurance for drivers who work for Lyft, Uber, or similar companies.

- Roadside assistance: Emergency, 24/7 coverage for towing, lockouts, jump starts, flat tires, and fuel or fluid delivery.

Your coverage options may be restricted or limited depending on your state. The company suggests you work directly with a Mercury agent to ensure you understand your policy and have the coverage you need.

Mercury Car Insurance Discounts

Mercury offers eight discounts to policyholders that can change from state to state. The company suggests getting a quote and then working with a Mercury agent to ensure you get all the discounts you’re eligible for.

Potential discounts include:

- Anti-theft: Installing an anti-theft device safeguards your vehicle and prevents theft claims, earning you a discount.

- Autopay: Sign up for automatic payments and enjoy a discount while ensuring your payments are always on time.

- E-Signature: Sign your documents electronically to get a discount.

- Good driver: Get a discount if you or any driver on your policy maintains a clean driving record.

- Good student: Good grades correlate with fewer accidents among young drivers. Talk to a Mercury agent to determine eligibility for student discounts and required documentation.

- Multi-car: Insuring multiple vehicles under one policy saves money and provides added convenience. Enjoy a discount for having all your vehicles insured with one company.

- Multi-policy: Bundle auto with your home, condo, renters, and more for savings on both policies.

- Pay-in-full: Get a discount for paying for your entire auto insurance term up front.

Mercury doesn’t advertise specific savings for any of its discounts — the only thing the company says for sure is that “individual savings” vary. Talk to your Mercury agent to learn more.

Mercury Car Insurance Rates by Age Group

Age has a huge effect on how much you pay for auto insurance. Below are the average quotes offered to prospective Mercury customers based on their age.

| Age | Liability Only | Full Coverage |

|---|---|---|

| Teens (18 years old) | $601 | $1,116 |

| Young adults (25 years old) | $235 | $469 |

| Adults (40 years old) | $205 | $397 |

| Retirees (65 years old) | $220 | $405 |

When you’re young and first get your license, you have less experience on the road. That can make you more error-prone (or even reckless), which means you’re more likely to cause a collision and file a claim. Car insurance companies charge higher rates to these drivers accordingly.

As you get older, those rates tend to go down, eventually more or less stabilizing around age 40. But remember, rates only go down so long as you maintain a good driving record.

Mercury Rates for teens and young drivers

Mercury’s average rates for teens and young drivers are high compared to the rest of the industry. For example, 18-year-olds pay $601 per month for liability-only and $1,116 per month for full coverage. That’s about double the national average of $297 for liability and $676 for full coverage.

Those rates fall dramatically by the time you reach 25 (as they do with most companies). But with Mercury, the trend is amplified: rates for 25-year-old drivers are less than half the rate of their 18-year-old counterparts.

But those rates are still nearly double the national average: $235 per month compared to $109 for basic liability and $469 per month compared to $266 for full coverage.

Mercury rates for seniors

Drivers in their 40s pay the least for Mercury car insurance, but it’s once again higher than national averages. At $205 per month, Mercury is more than double the average rate ($97 per month) for liability policies. And full-coverage policies — $397 per month at Mercury — are more than $100 higher than the national average of $232 per month.

Though average rates for drivers older than 65 tend to be slightly lower than those for 40-year-olds, rates at Mercury are, again, slightly higher. Senior drivers pay around $220 per month for liability and $405 for full coverage — both of which are around double the national rate ($97 and $221, respectively).

This could be due to several reasons, including the somewhat higher likelihood of causing an accident and increased vulnerability to injuries if they’re involved in a collision.

Mercury Car Insurance Rates by Driving Record

Your driving record has one of the largest impacts (if not the largest) on your car insurance rates, so let’s look at how quotes from Mercury change based on your driving history.

| Driving History | Liability Only | Full Coverage |

|---|---|---|

| Clean record | $197 | $433 |

| With a speeding ticket | $244 | $540 |

| With an at-fault accident | $288 | $633 |

| With a DUI | $253 | $553 |

Drivers with clean records get much cheaper car insurance rates than those with marks on their records. Histories of at-fault accidents or DUIs prove to be the most consequential at Mercury (indeed, they both indicate a higher risk of future incidents). But speeding tickets also create a significant increase in costs.

Rates, once again, are also higher on average at Mercury across all profiles. In fact, Mercury quotes are typically more than $100 per month higher than the national average. But does that mean the company will offer you a higher-than-average rate? It’s possible, but not certain. Let’s look at each incident in more detail.

Mercury rates after an accident

Mercury drivers with an at-fault accident spend about $288 per month on liability insurance and $633 for full coverage, on average. That’s high compared to the national average of $132 for liability-only and $309 for full coverage.

Contending with higher insurance rates is extremely common — if not guaranteed — after an at-fault accident. But you can still find ways to lower your auto insurance costs by taking a defensive driver course, lowering your coverage levels, or comparing quotes before buying.

Mercury rates after a speeding ticket

National average rates for drivers with a speeding ticket are $113 per month for liability and $268 for full coverage. That means Mercury charges, once again, about double the average, at $244 per month for a liability-only policy and $540 for full coverage after a speeding ticket.

Of course, wherever you go, you’re going to find somewhat higher rates when you have a speeding ticket (or other moving violation) compared to when you have a clean record. But you can still lower your costs in a few ways, including:

- Obey traffic laws going forward.

- Sign up for a telematics program to prove you’re using good driving practices.

- Ask for ticket forgiveness, or petition your state (or the charging locality) to lower the points on your license.

Mercury rates after a DUI

Compared to rates after an accident, Mercury is more lenient on drivers with a history of DUI, charging $253 per month for liability and $553 for full coverage, on average. But those rates are still quite a bit higher than the national average, at just $179 per month for liability and $413 for full coverage (though less so compared to other driving histories).

Once again, comparing auto insurance rates before buying your policy is an effective way to get a lower rate. You can also raise your deductibles or lower your coverage levels. But if you’re really struggling to find affordable coverage, consider downsizing to a more affordable vehicle.

Mercury Car Insurance Rates by Credit Score

Though insurers don’t advertise it, your credit score can have a big impact on your car insurance premiums (except in a handful of states where the practice is prohibited). Below are the average quotes for Mercury drivers based on their credit scores.

| Credit Score | Liability Only | Full Coverage |

|---|---|---|

| Excellent | $152 | $309 |

| Good | $205 | $397 |

| Average | $207 | $418 |

| Poor | $293 | $596 |

It may be because they’re headquartered in California, but Mercury doesn’t appear to increase its rates due to credit score as much as many other insurers. But keep in mind that we’re starting from higher-than-average rates in general.

That being said, rates follow the typical trend of being most expensive for drivers with poor credit (on average, double the rates for drivers with excellent credit) and cheapest for those with excellent credit. Rates for drivers with either good or average credit scores are similar, making Mercury relatively more favorable for drivers with average or fair credit.

How to Purchase a Car Insurance Policy from Mercury

Mercury advertises that you can get a quote online, but it doesn’t specify whether you can purchase your policy entirely online or if you have to speak with customer service to receive your policy. There may be some variation when it comes to quoting and buying abilities depending on your state.

For example, Mercury partners with AIS — an agency subsidiary — to fulfill policies in some states, including Indiana and Massachusetts. AIS is an agency, so it can connect you with a provider that may allow you to purchase entirely online. As you’ll see in the next section, I was offered a policy with Progressive (which offers a fully online buying process) when I looked for a policy in Indiana.

Once you buy your auto insurance policy, Mercury will mail your proof of insurance. You can also create an online account and print your ID cards or download the Mercury Insurance app to access your documents immediately after purchasing your policy.

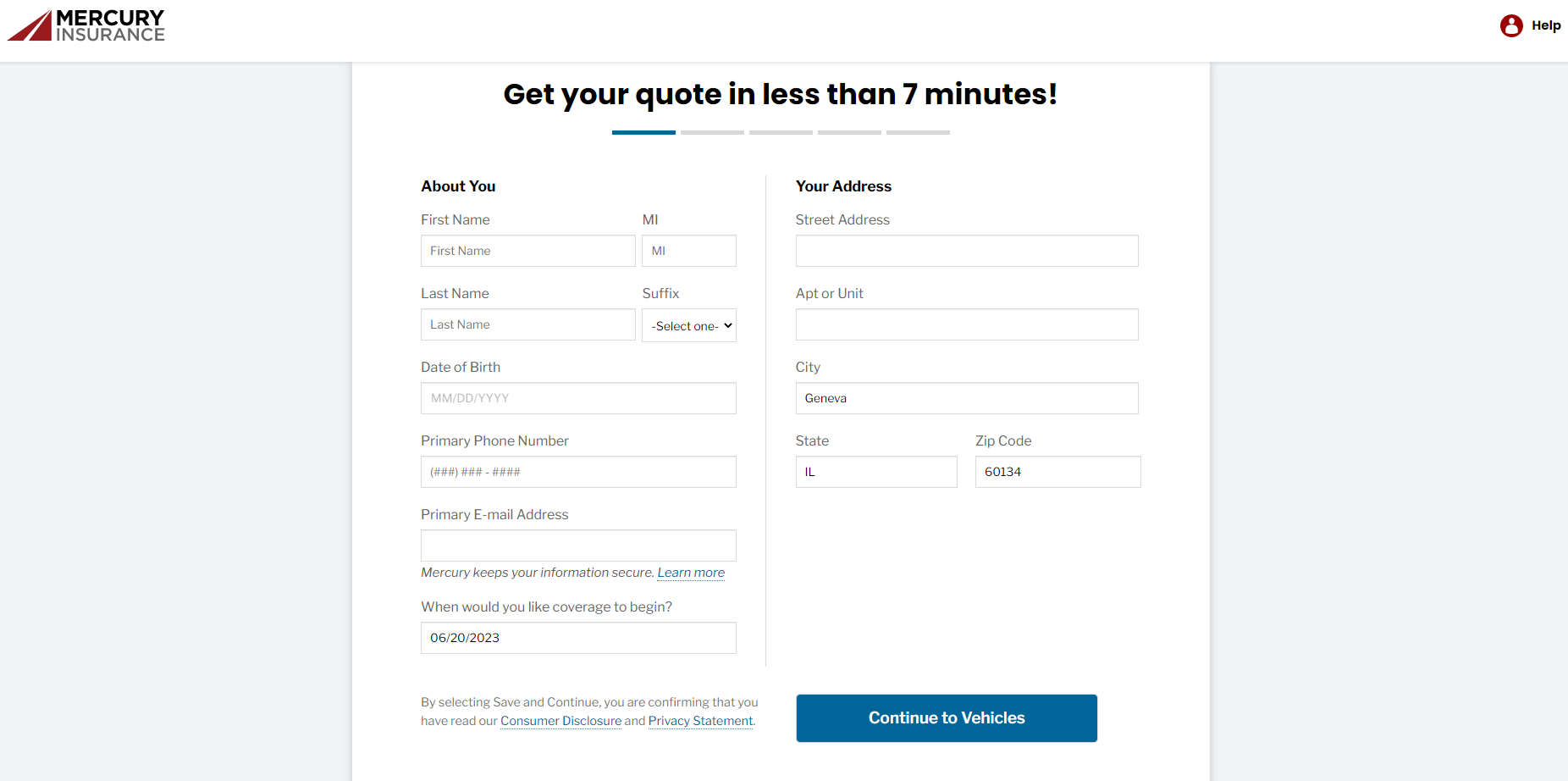

Getting a quote from Mercury

The first step to getting a Mercury car insurance quote is to go to the company’s home page. There, I entered my ZIP code to check availability in my area.

Mercury writes policies in my state, so I was able to continue through the process. I had to enter my personal information next, including my phone number and address. The company also advertises on this page that it only takes seven minutes to get a quote.

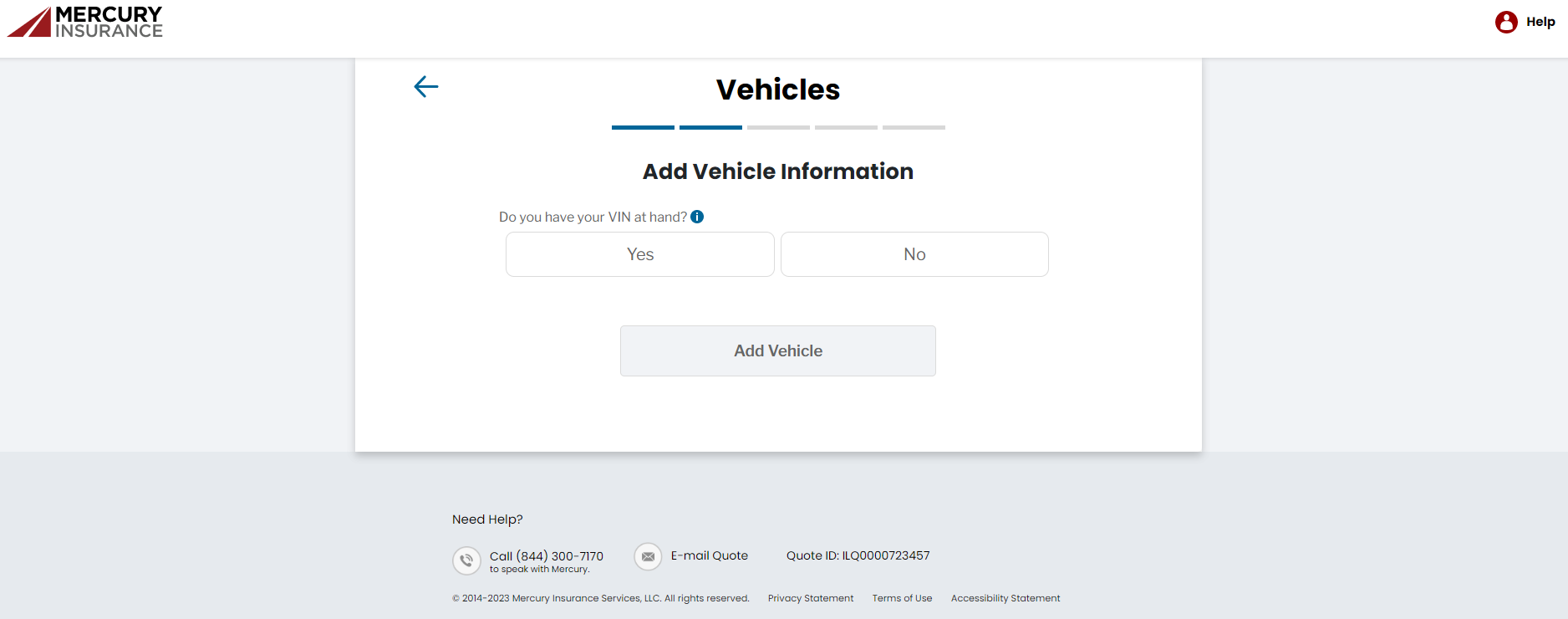

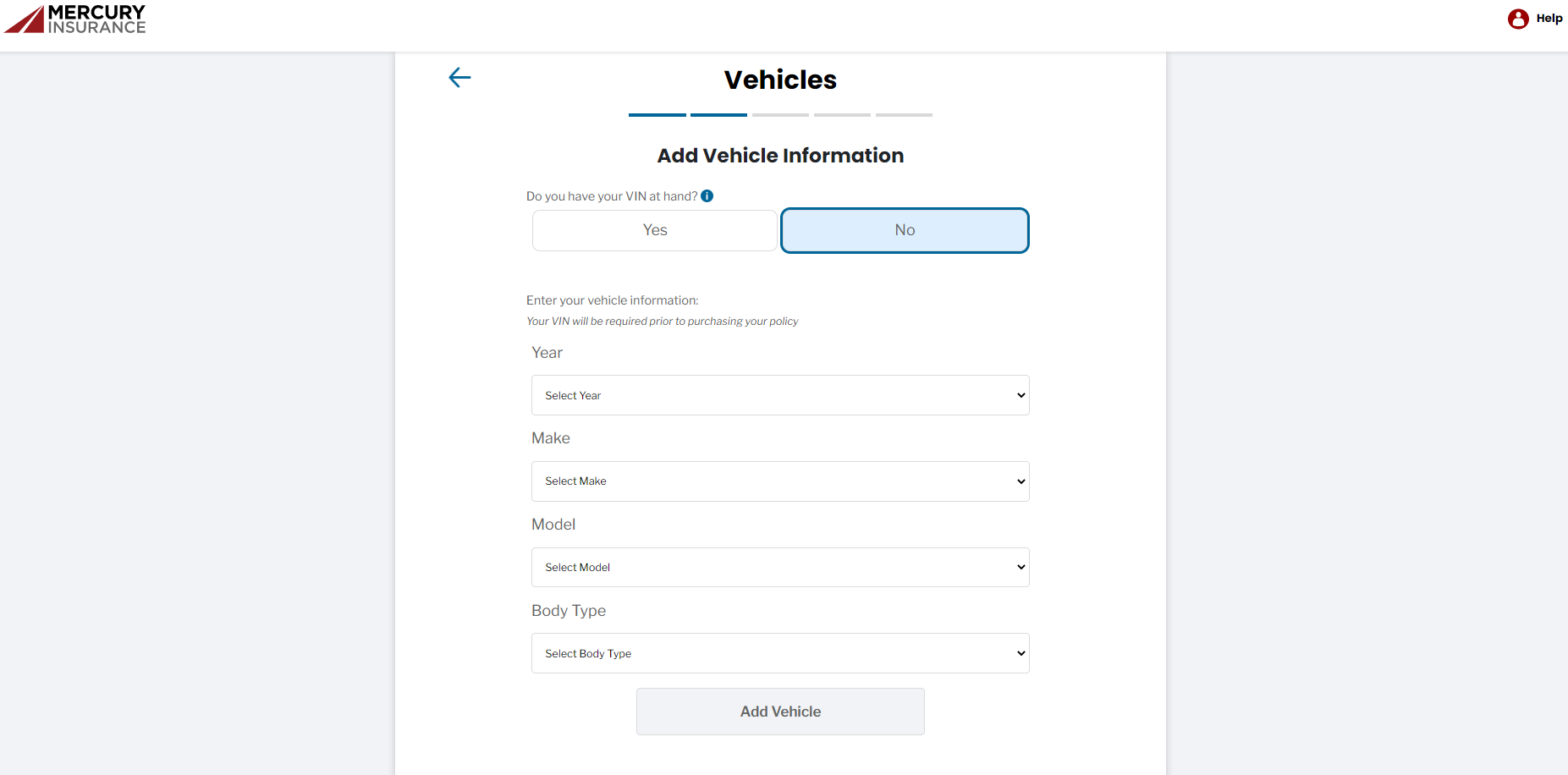

I continued to the next page, where I was asked to enter my vehicle identification number (VIN), which I didn’t have on hand. I clicked “No” and a group of questions about my vehicle appeared directly beneath this area.

So I filled in the make and model of my car and added it to the policy.

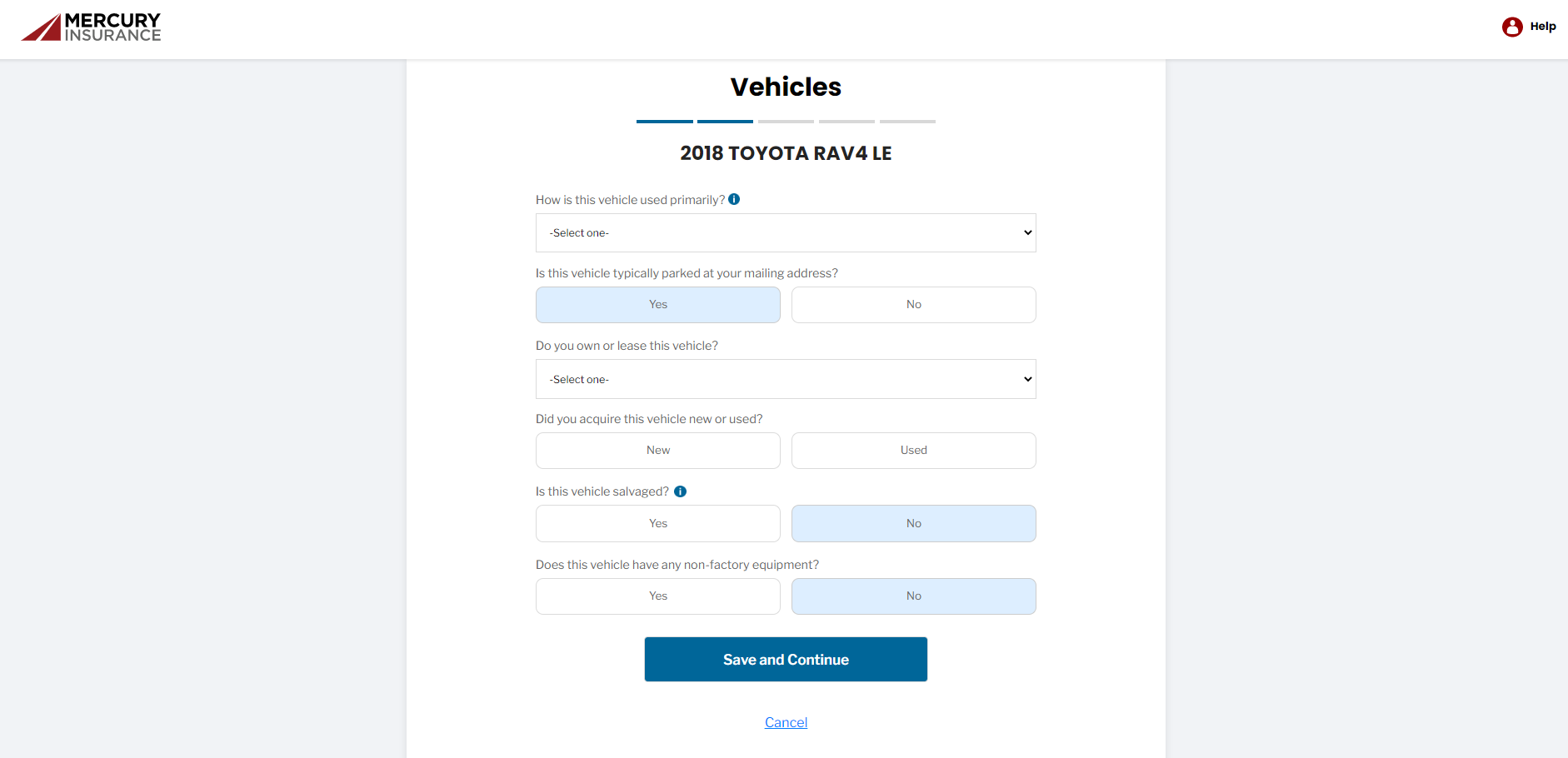

The next page automatically prefilled a few answers for me. I was asked to fill in information about how I use my car (commuting) and whether it’s financed (it is).

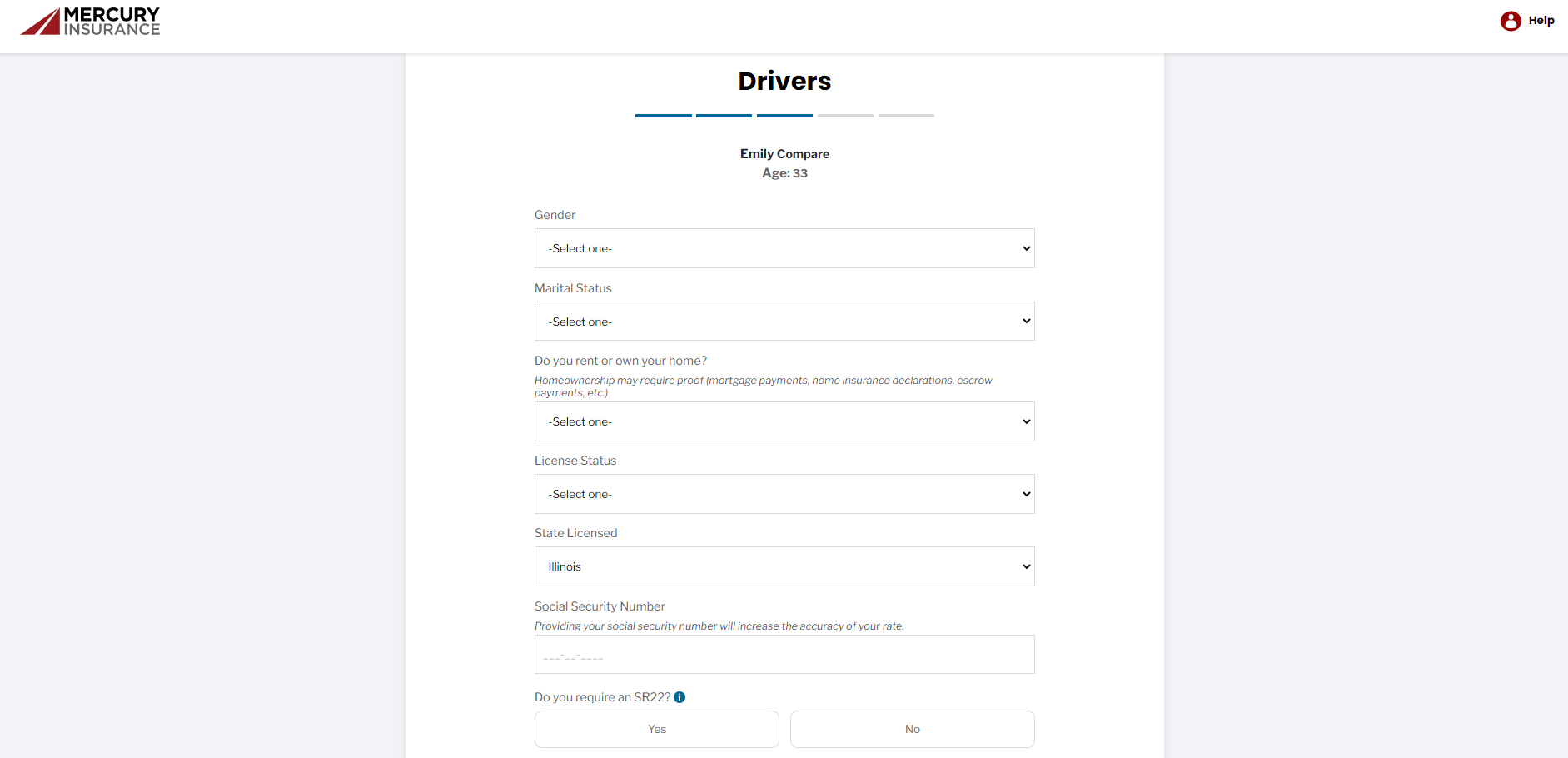

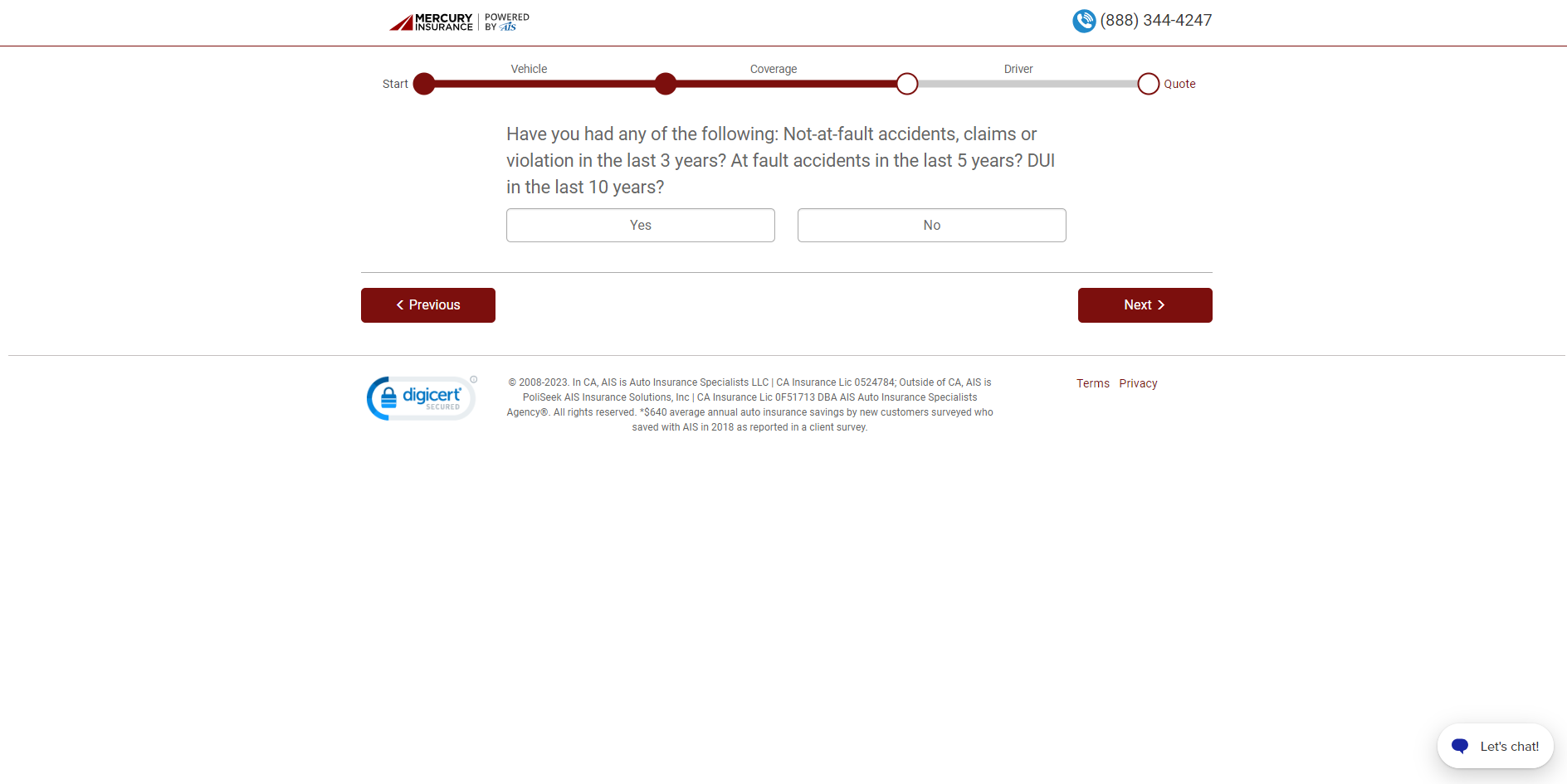

The next part of the form included information about me and my driving history. This is where I entered information about a speeding ticket I received in 2020. I also noticed that the form asked for my Social Security number. It didn’t indicate whether the information was required, so I decided to leave that blank.

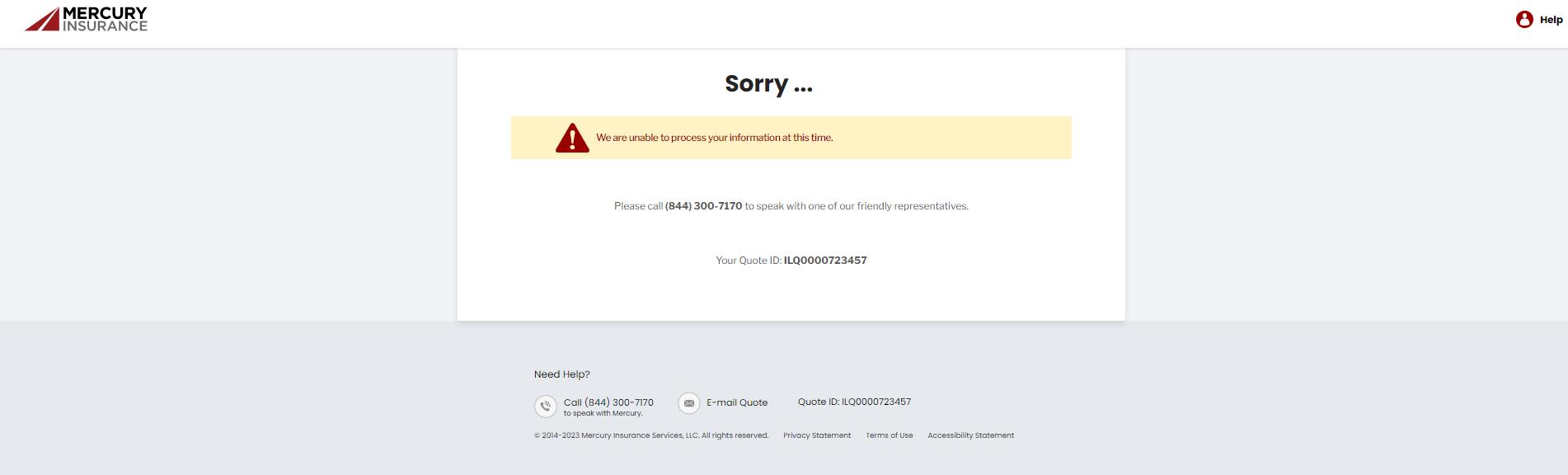

After continuing, I ran into a problem — an unknown error stopped the system from processing my quote. This was admittedly annoying, but I was determined to get a quote from Mercury, so I started the process over (and passed the seven-minute average the company advertises).

And as a note, I withheld my Social Security number the second time around, too.

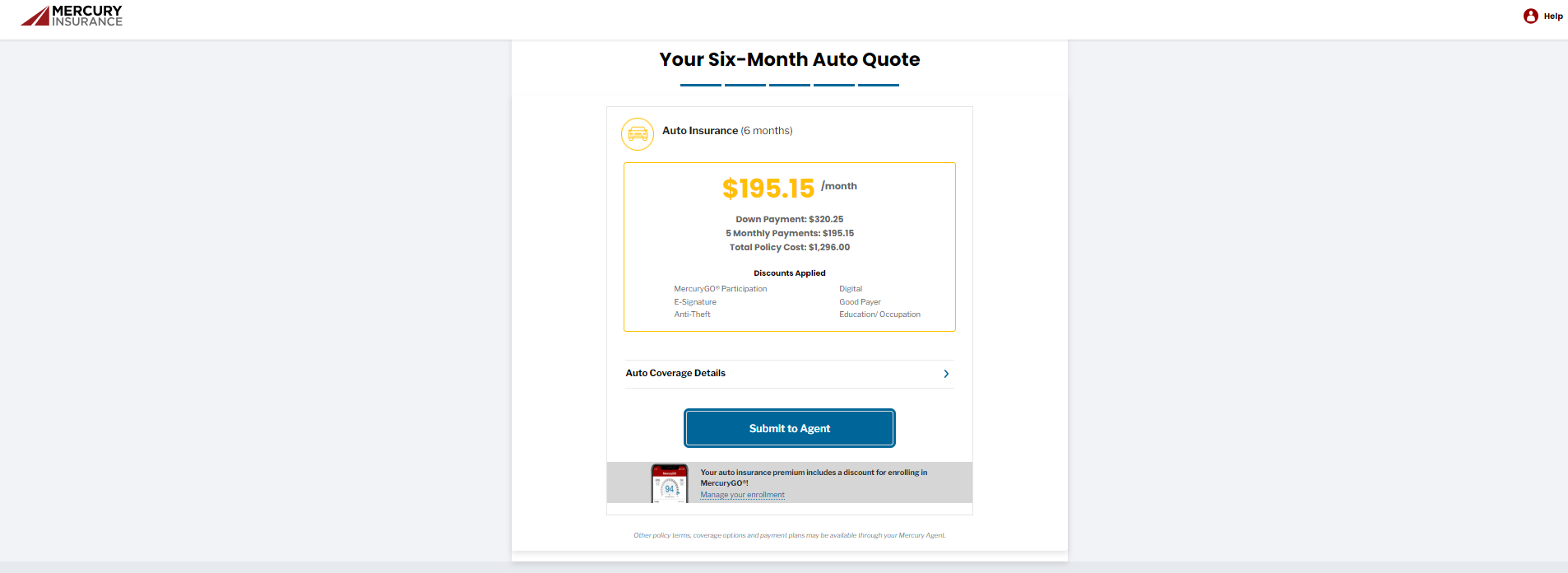

Luckily, I was able to get a quote this time.

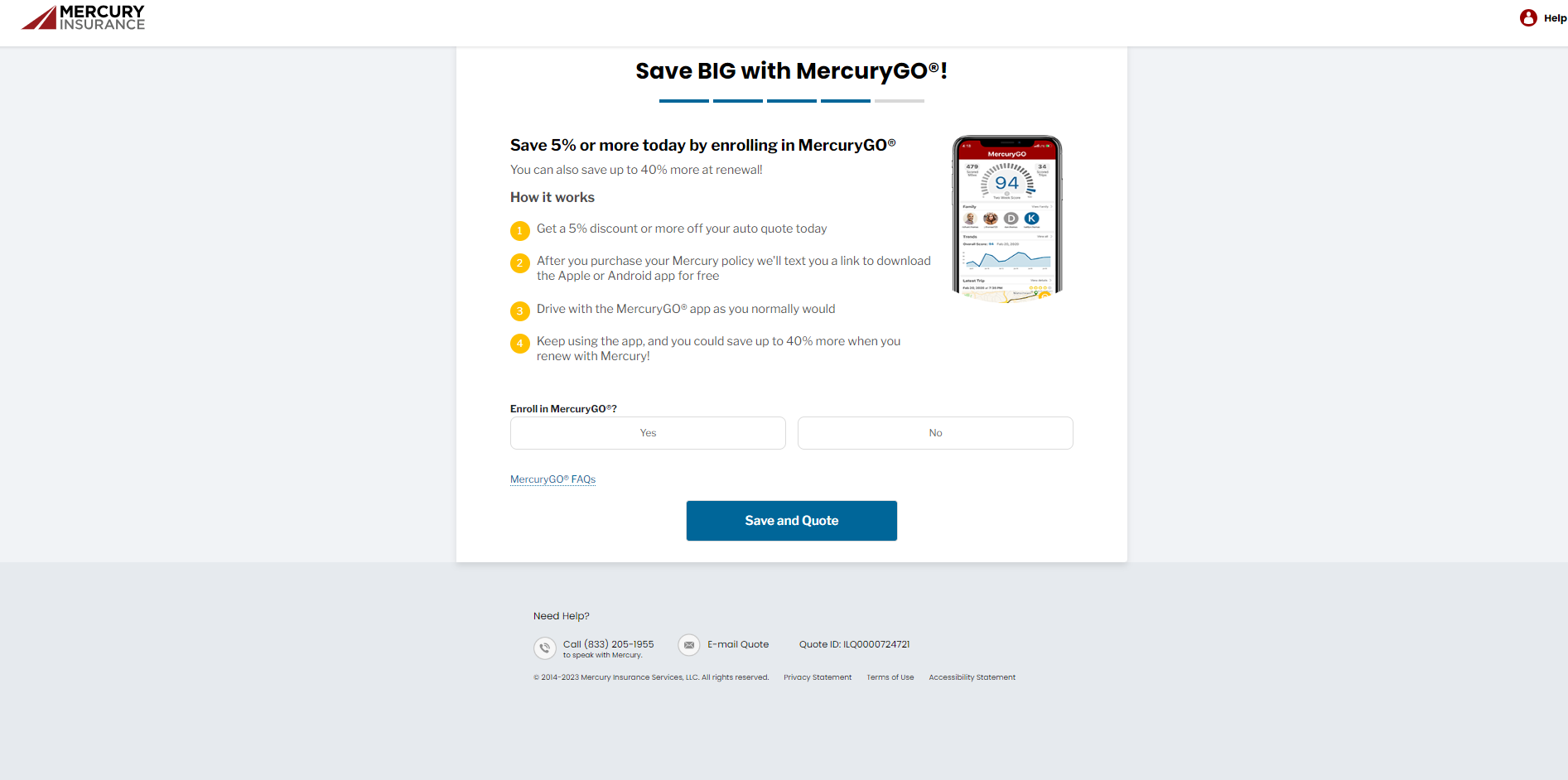

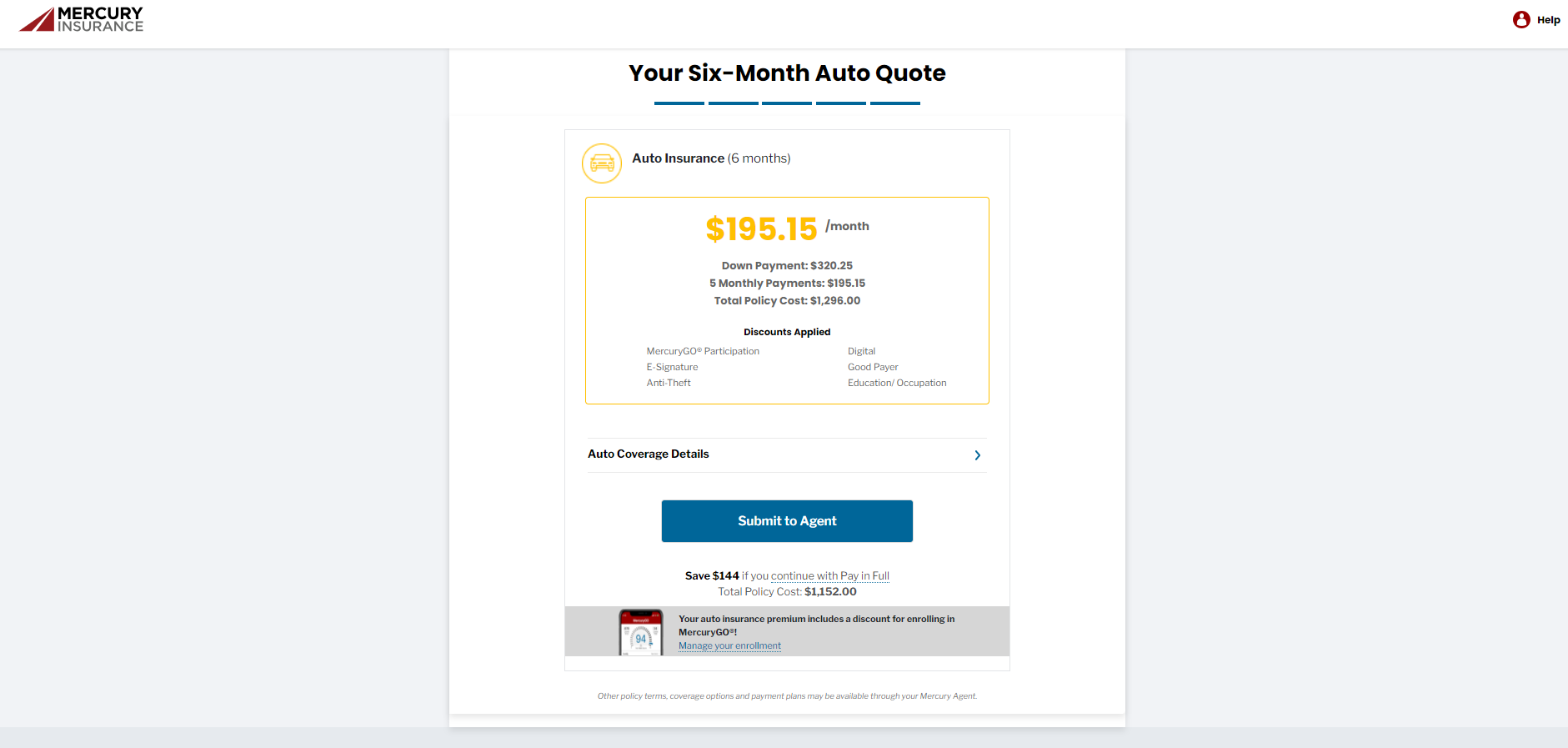

The next step in the process was to choose whether I wanted to sign up for MercuryGO, the company’s telematics program (we’ll go over the specifics and reviews of that program a little later). Signing up comes with an immediate 5% discount and up to 40% off for good driving.

I decided to sign up for the program and then hit “Save and Quote” to get my quote. It took a while for the page to load (or maybe it felt longer because I was expecting to receive an error message again), but eventually, I received my quote.

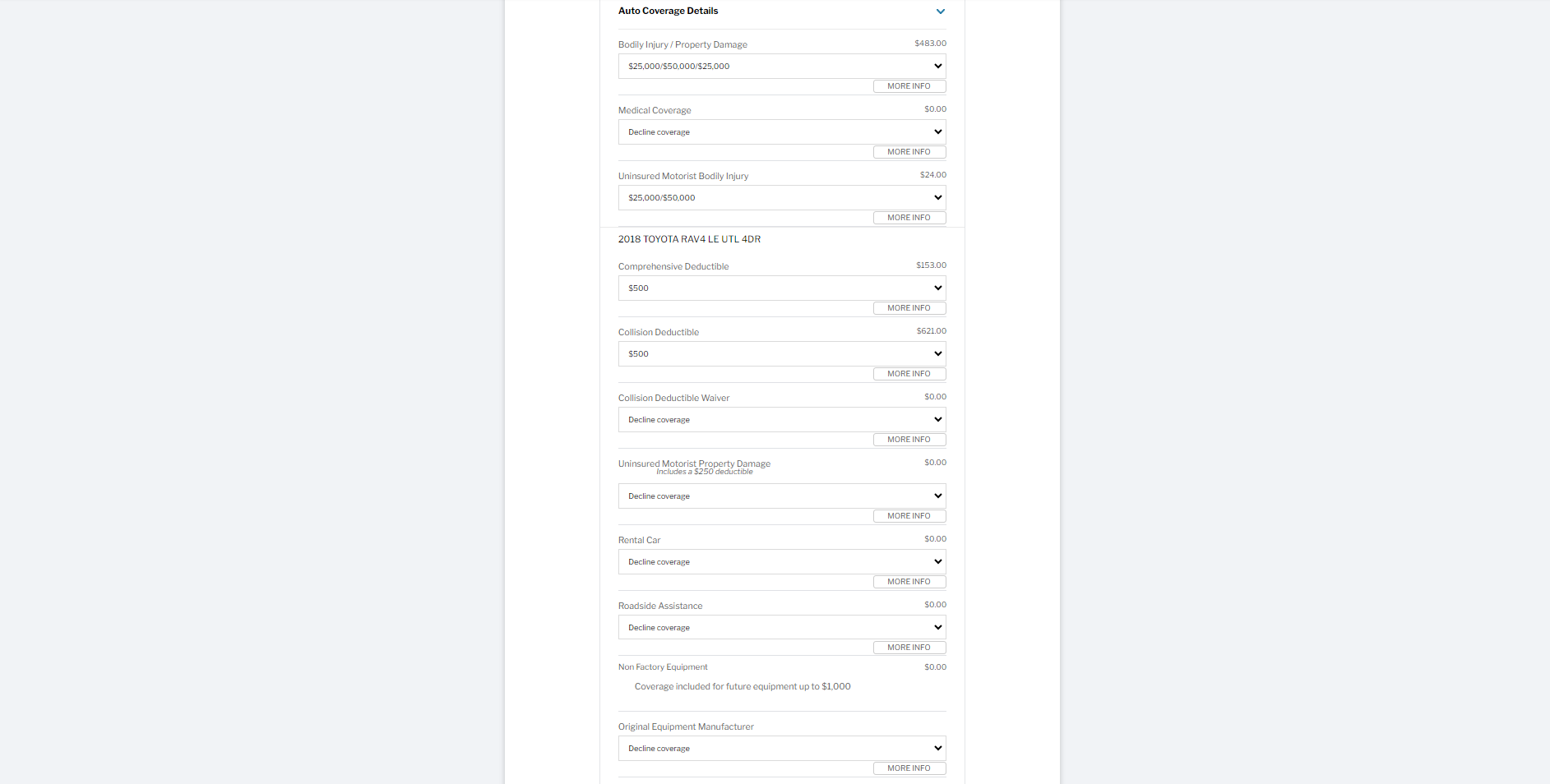

I liked that the company made the cost totally clear and included the discounts I qualified for right under the pricing guide. And, when I toggled open the “Auto Coverage Details,” I was given another opportunity to adjust my coverage options.

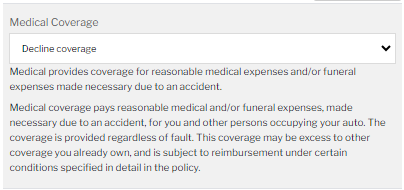

It was easy to learn more about each coverage option by clicking on the “More Info” button. This opens a text box that gives a glossary definition of the option, plus additional clarifying information. It made it easy to understand exactly what I was signing up for (and the potential limitations of my selected policy).

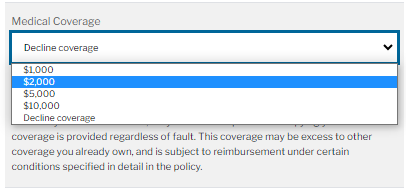

Additionally, adjusting the coverage options was quite easy through a drop-down menu. Once satisfied with the changes, I could update the quote.

I decided to leave things as is and looked for the next step. Unfortunately, the system didn’t provide me with an opportunity to buy online. Instead, I had to send the quote to an agent and wait for a callback.

Overall, it was a pretty simple process. The only significant drawback was the inability to buy online. We can chalk up the initial error to a fluke (or user error).

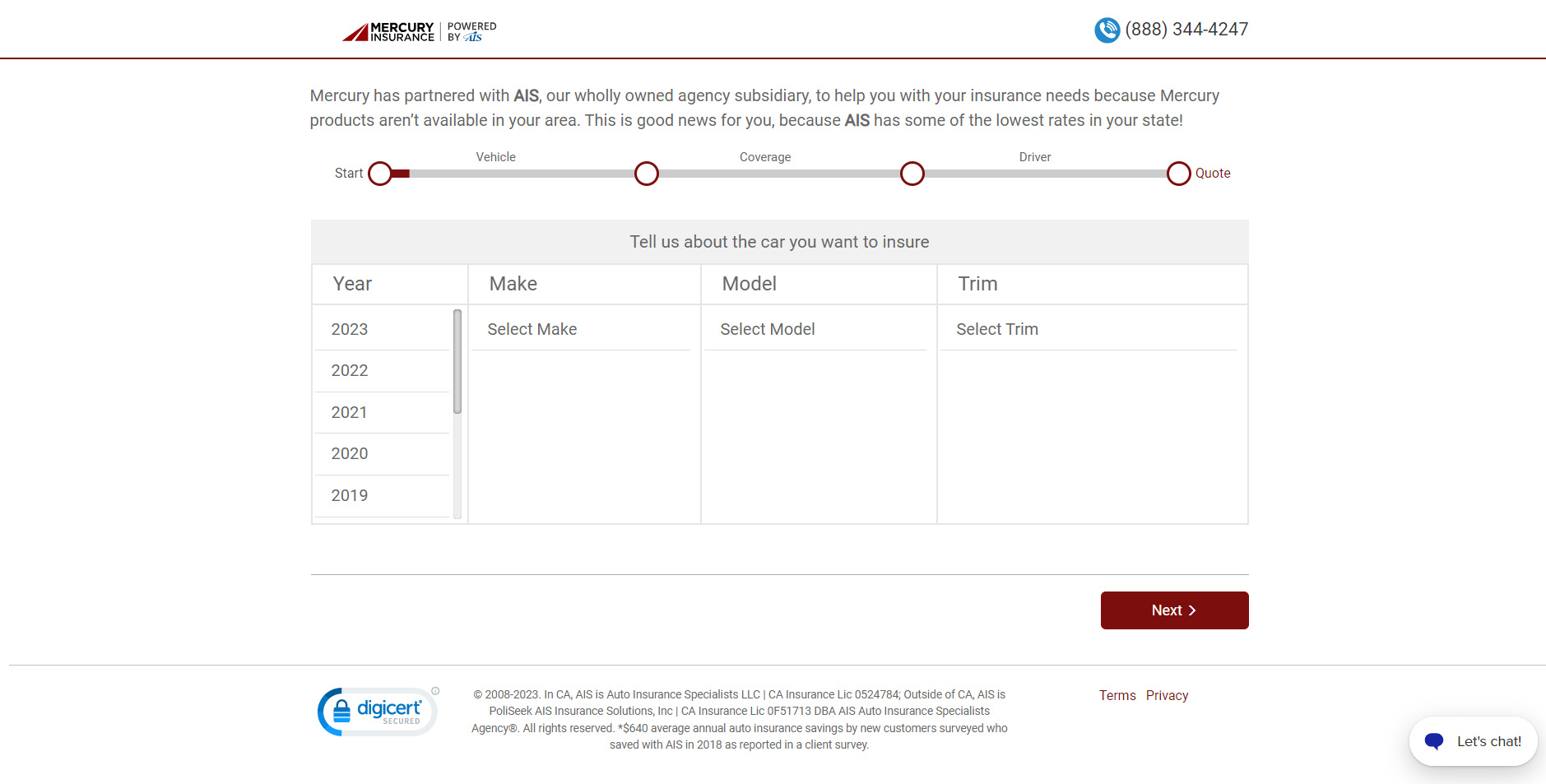

But, given that the company directs some drivers to affiliates, I decided to generate a quote through an affiliate by using an old address. I was then directed to AIS, and the questionnaire was similar to what I experienced on Mercury’s site (although the design of the form was pretty different).

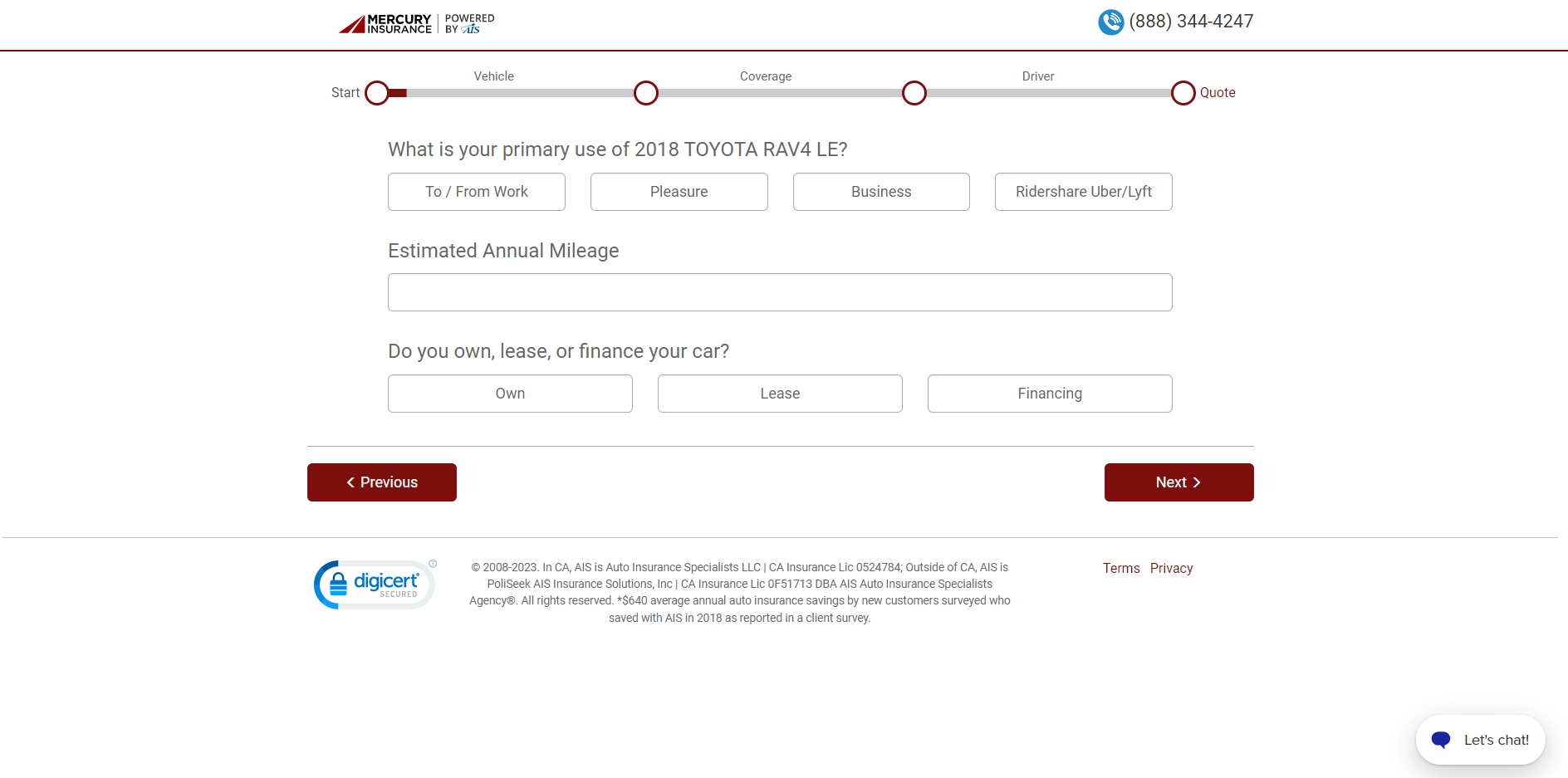

I started by selecting my make and model from the table provided. Despite looking a little simpler or rudimentary in design, the table was very easy to navigate, and I found my vehicle details quickly. Next, I filled out information about how I use my vehicle.

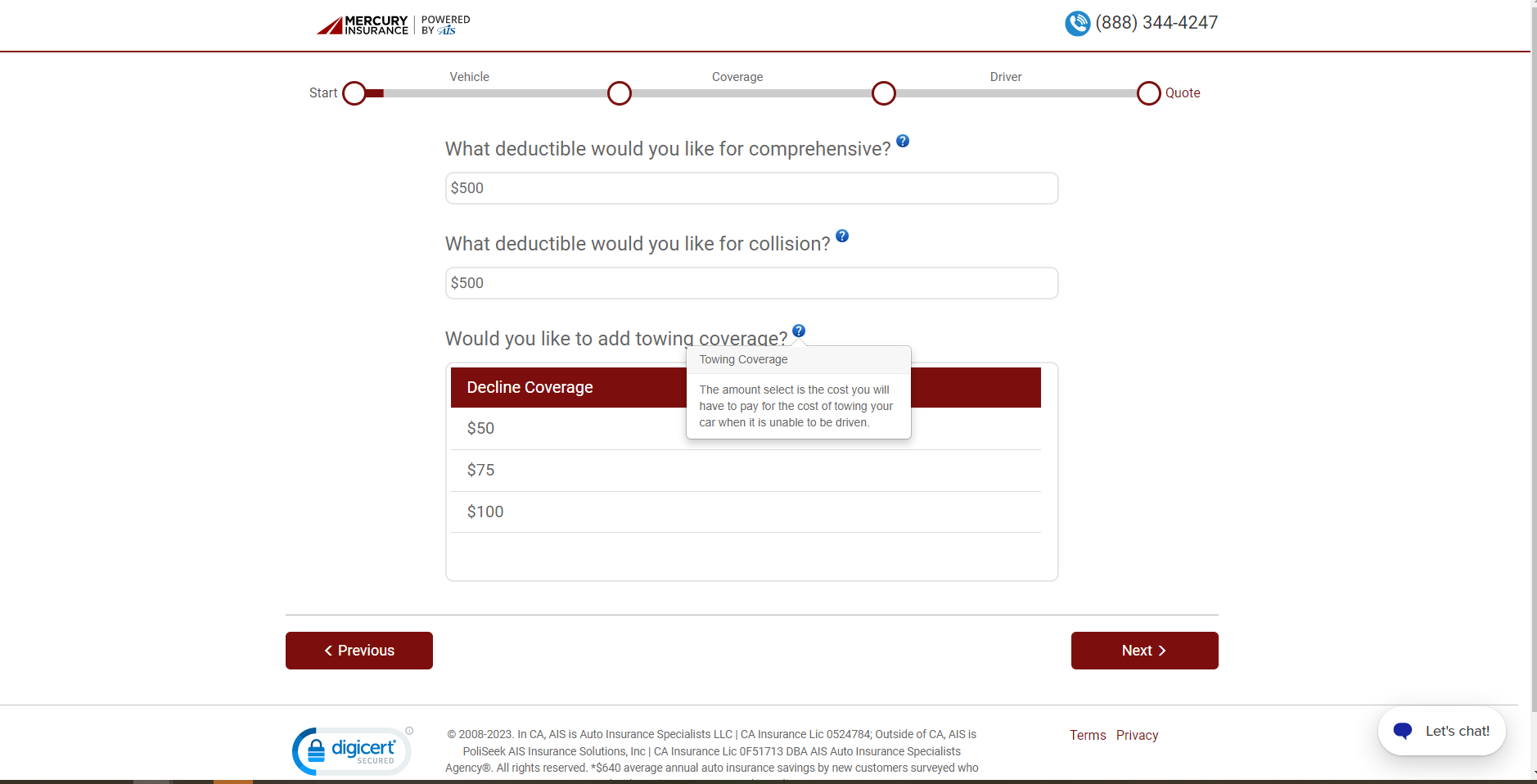

I once again clarified that the car was for commuting and was financed. That brought me to the first part that was noticeably different from the Mercury form — selecting my deductible levels and choosing whether to add optional towing coverage.

Each of these coverage options had information symbols next to them, and when I clicked, a small text box popped up and explained what the coverage was.

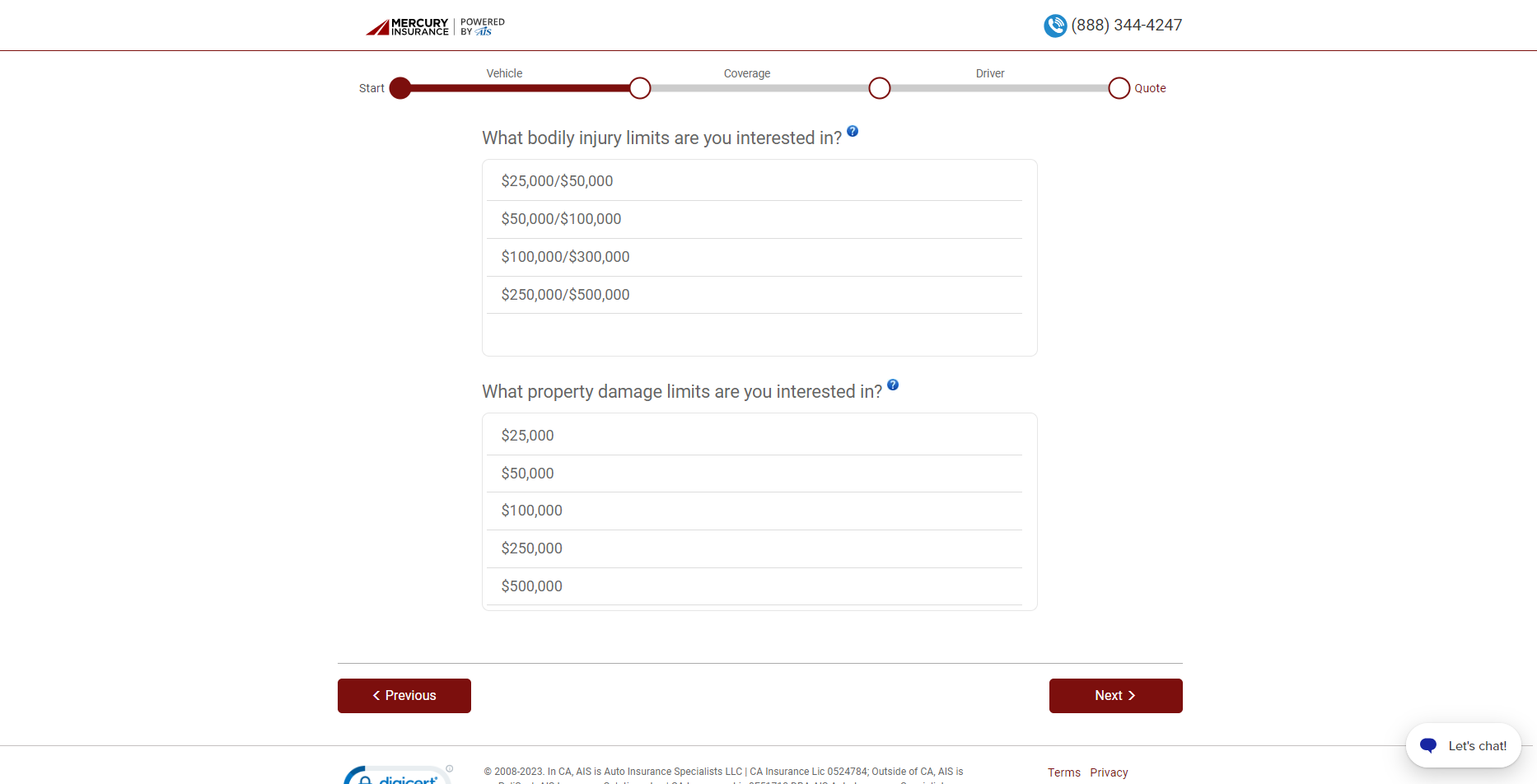

The next step was selecting my liability coverage limits. I decided to stay within the state minimums here, thinking I’d get the chance to adjust it later as I’d been able to on the Mercury site. (Spoiler alert: I was wrong.)

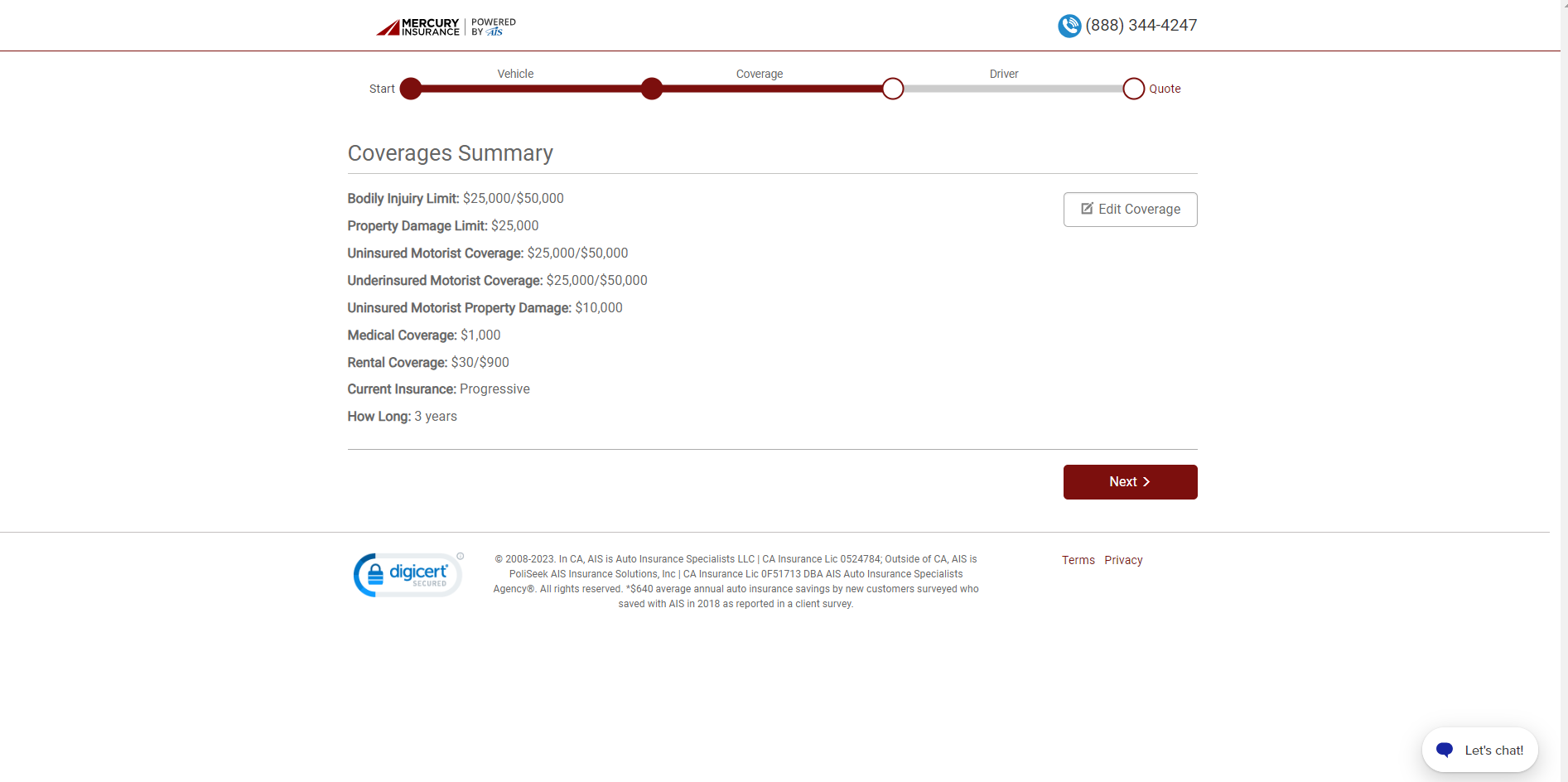

The system brought me to a page to verify my coverage selections. I didn’t need to change anything, but noted that the “Edit Coverage” button made it easy to adjust my options.

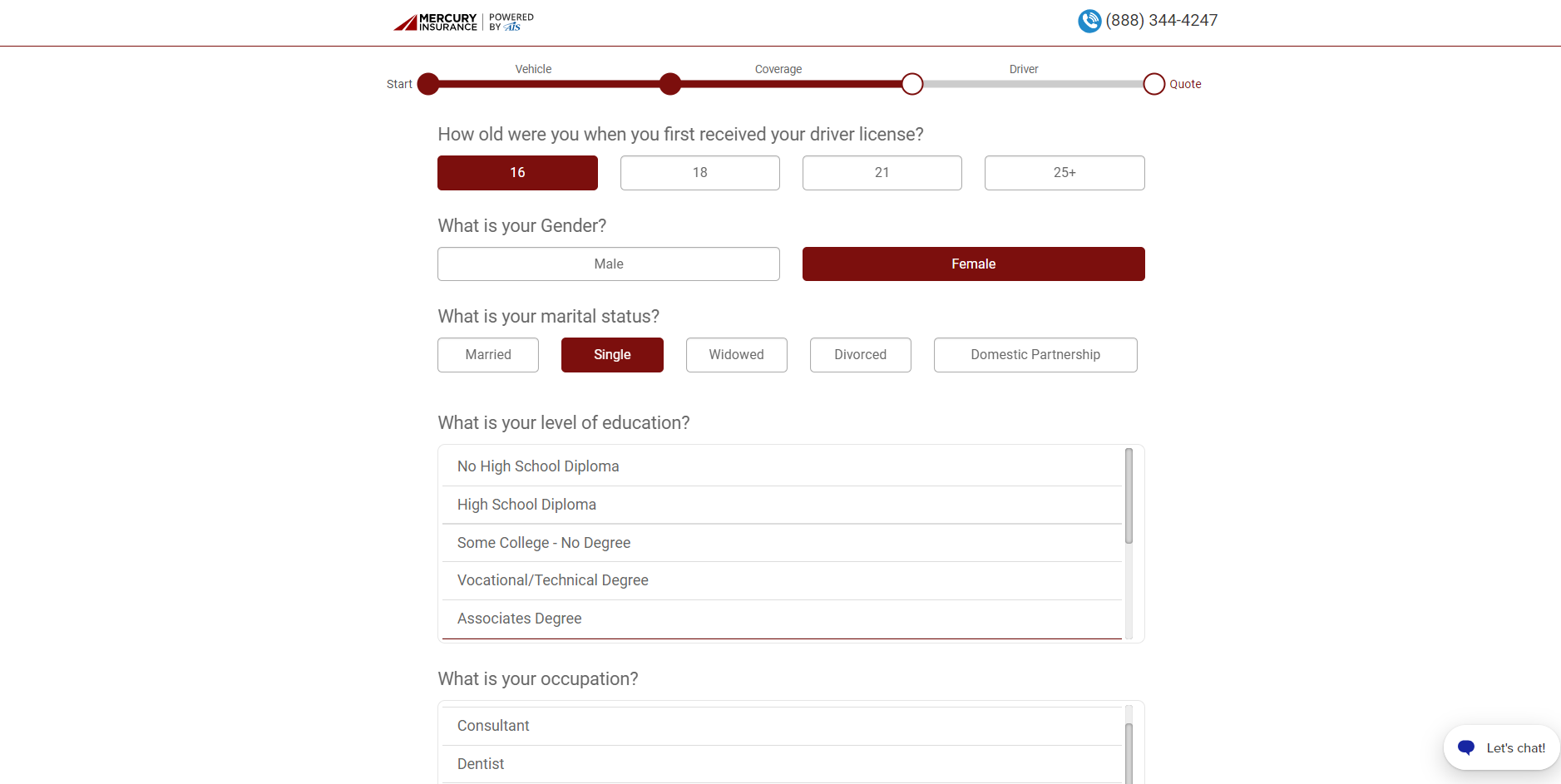

Next, I had to provide my personal driving history and information, including how old I was when I first got my license, my education history, and my current occupation.

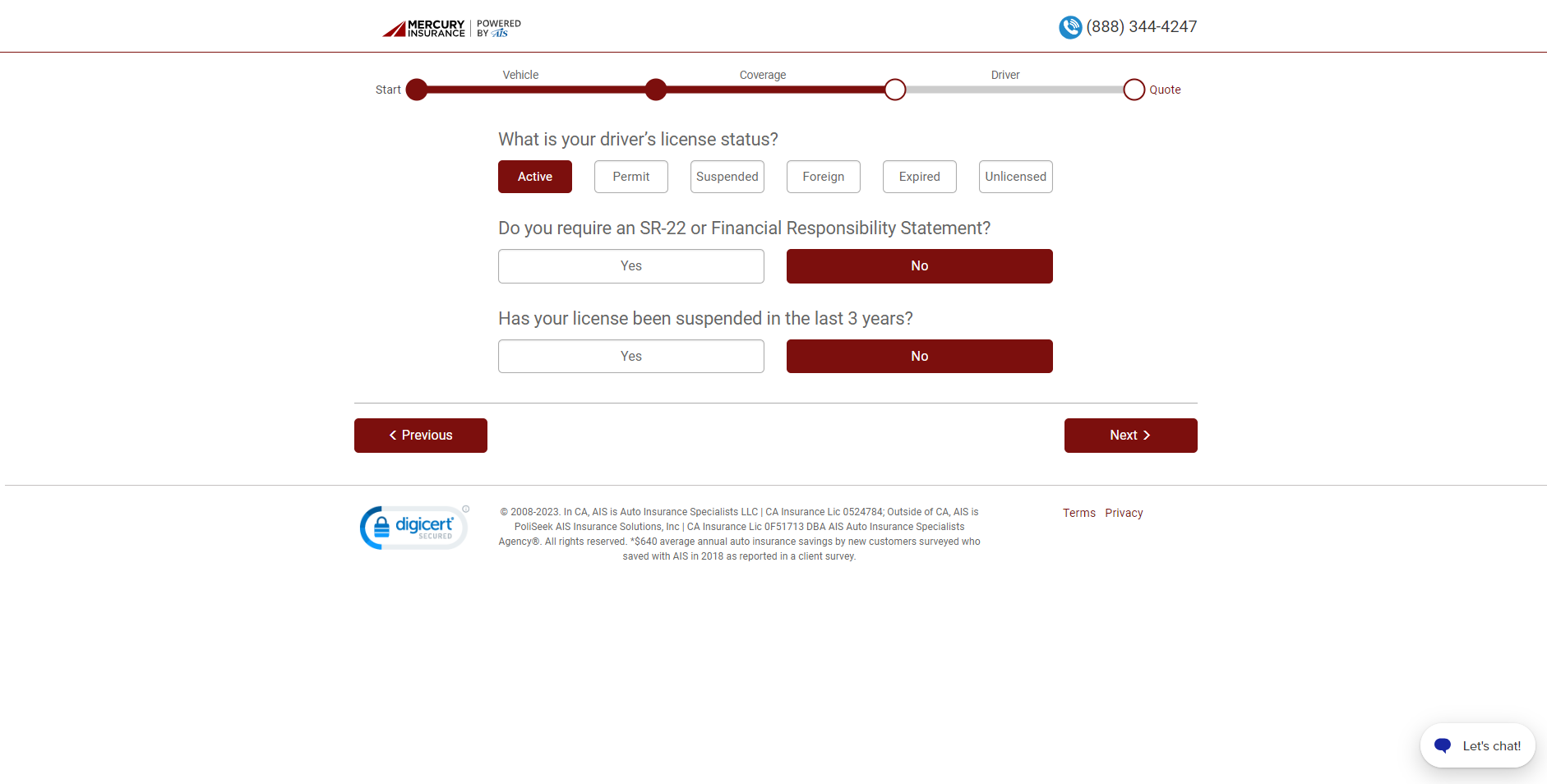

The next questions were about my driver’s license status and screening me for anything that would make me high-risk, including whether I needed an SR-22.

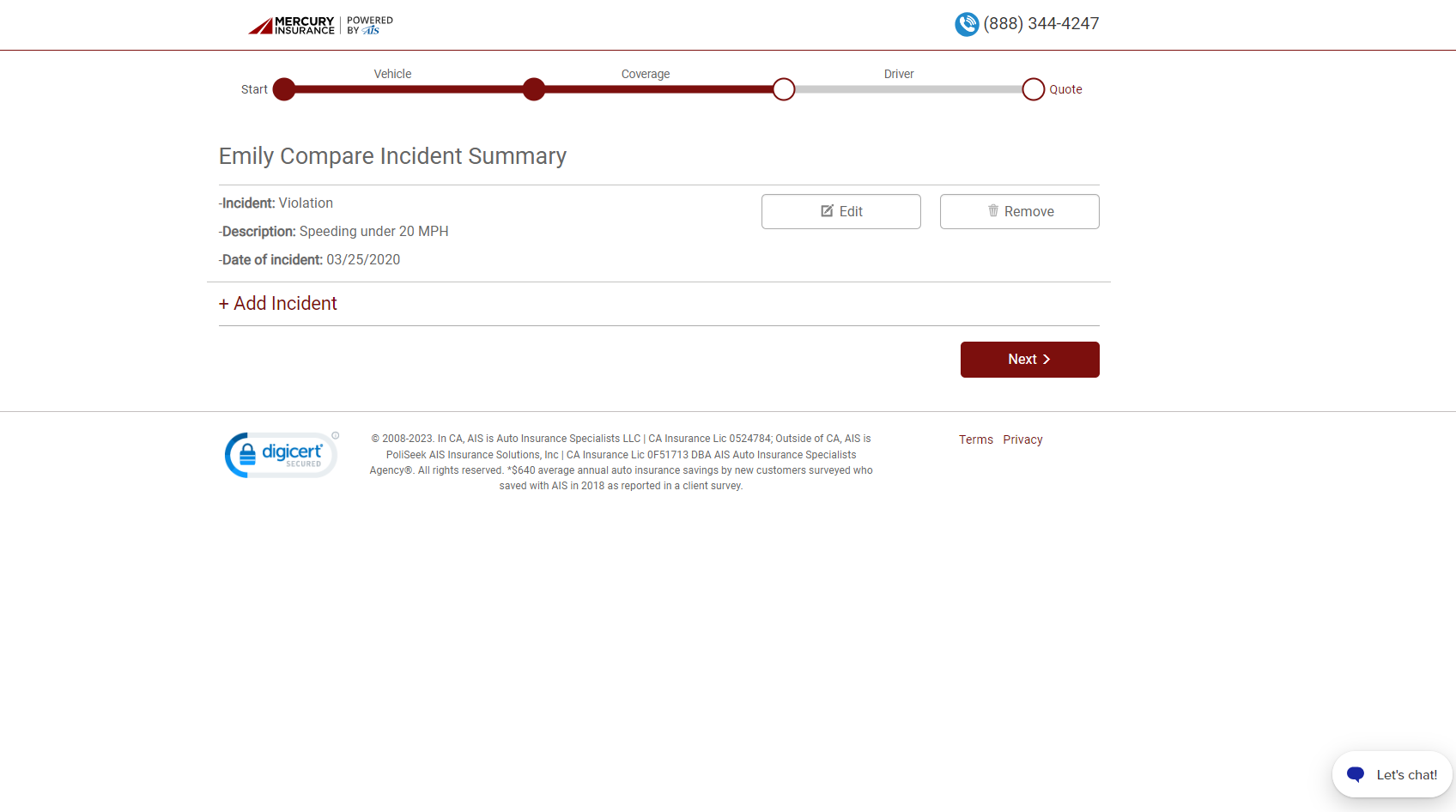

The next page asked about other incidents on my driving record. I once again confirmed that I received a speeding ticket three years ago.

Here, the system asked me to review my personal information again. And it made it easy to edit the information I’d entered.

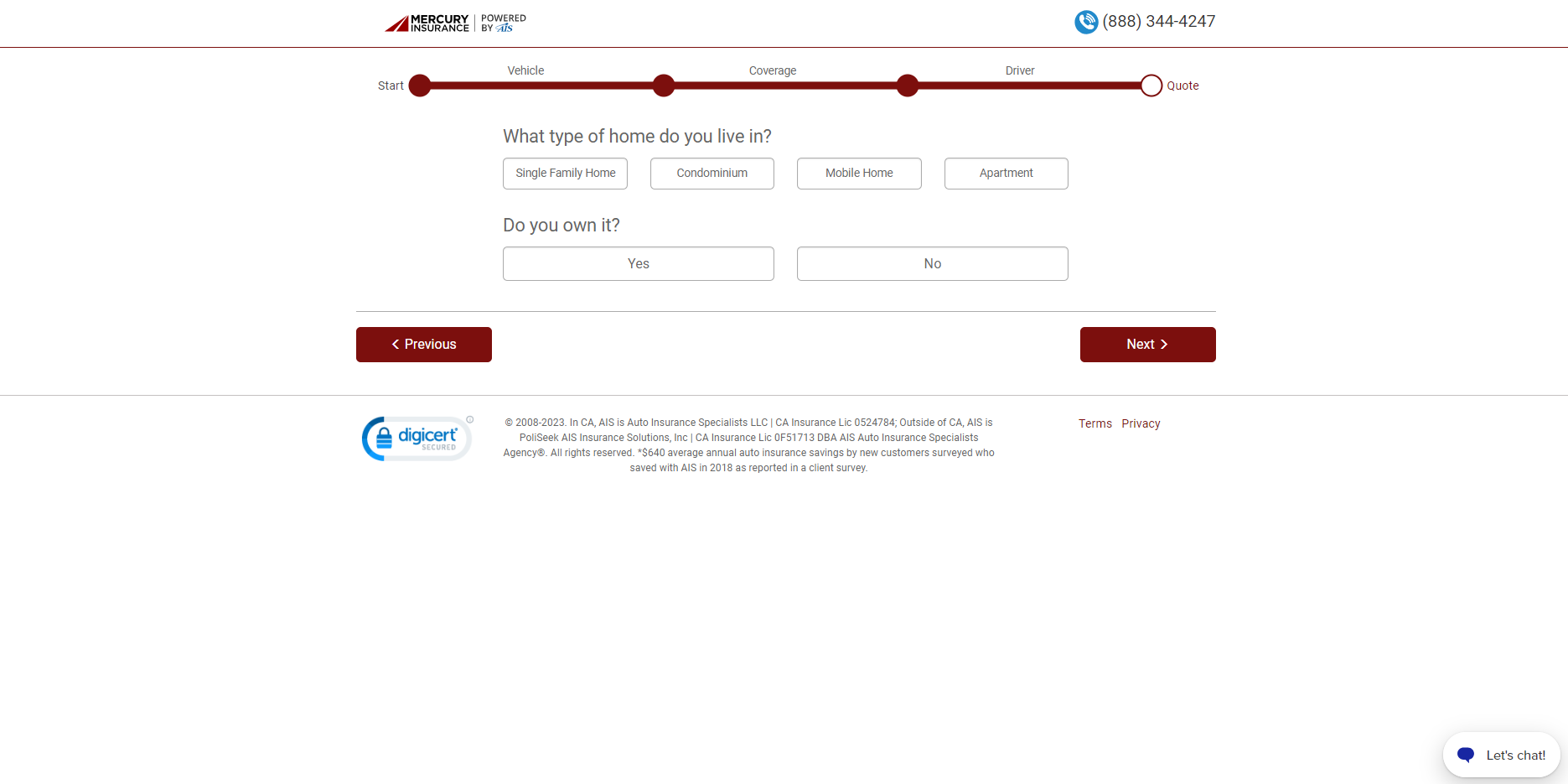

The last step was to provide information about where I live and whether I’m a homeowner (I’m not). From there, I was finally able to submit my completed questionnaire.

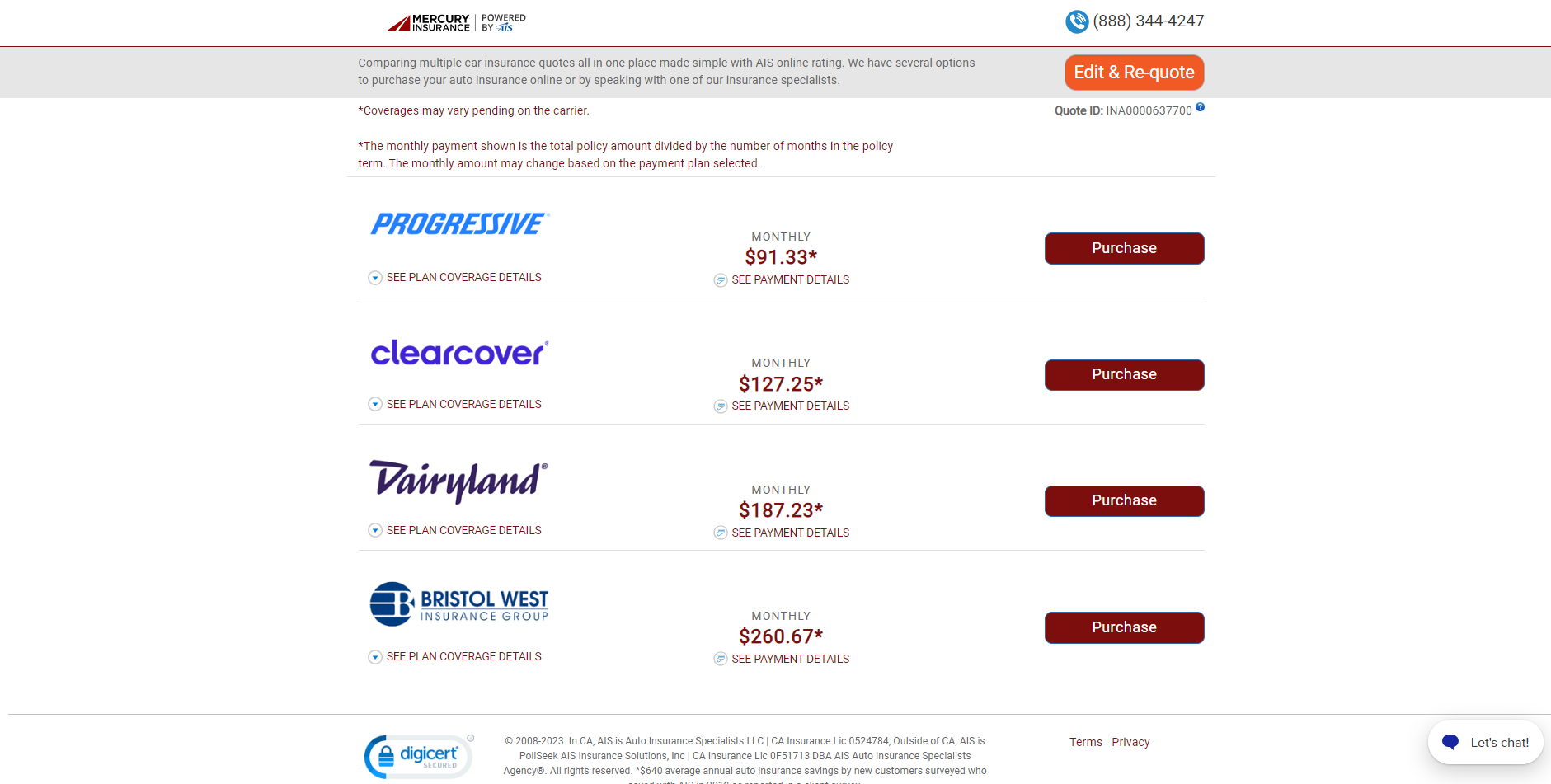

The system, once again, took a while to process. But I was able to get four quotes this time.

Remember, AIS is an agency, which means it doesn’t underwrite the policy but instead helps you find the right one for your unique profile and budget.

I noticed that Progressive offered the cheapest premiums on the list. I clicked the purchase button to see where it would take me, and it redirected me to a joint site between Progressive and AIS/Mercury. There, I was asked to provide more information and verify my coverage options. But ultimately, I could follow this process all the way through and purchase the policy online.

Overall, I’d say it was easier to find a policy with the affiliate agency rather than through Mercury directly. On the one hand, the agency provided me with cheaper options (granted, in another state), and I was able to purchase the policy 100% online.

But Mercury’s quote process allowed me plenty of opportunities to customize my policy, which the agency process didn’t. Once I received my quote, I had to back out of the results and adjust my options in the form rather than directly on the quote page.

Mercury Customer Service

As I stated earlier, Mercury’s reviews are generally negative across several platforms. J.D. Power also found Mercury performs below average in customer satisfaction.

That said, I found several positive reviews that directly mention getting great customer service (including claims service, which I’ll cover in the next section).

This customer claims to be quite satisfied with Mercury’s customer service, despite paying an expensive rate due to their accident history.

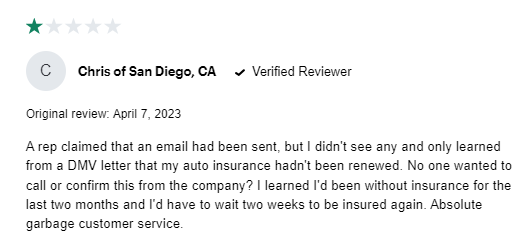

However, I found several recurring issues — the worst of which was how often customers complained about a flukey issue (a slightly delayed payment or miscommunication over email, as the next customer details) that leads to Mercury abruptly canceling the policy.

Further, as you’ll also see in this review, Mercury typically drops the ball bouncing back from these errors. The customer below claims to have spent two weeks resolving their lapse in coverage.

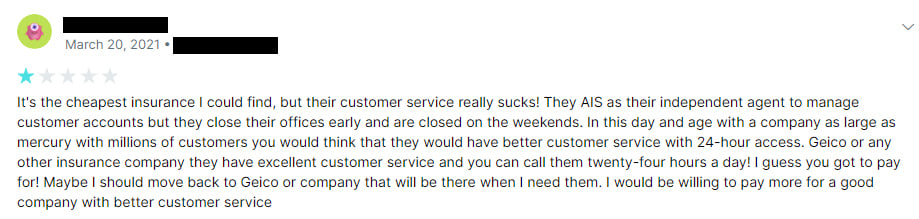

Finally, I also discovered some negative reviews pertaining to the agency partner AIS (where I got my second quote). Many of them, including the one below, talk about not knowing where to go for efficient service — the agency or the company underwriting the policy. This caused a lot of frustration and confusion.

Filing a Claim with Mercury

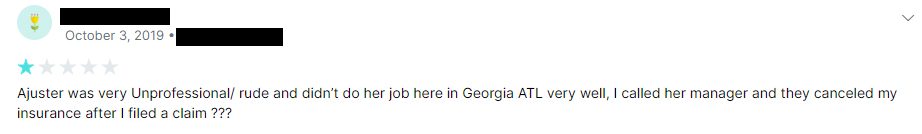

Overall, reviews specifically talking about claims experiences were fairly negative, which tracks with the company’s below-average performance in the 2023 J.D. Power Auto Insurance Study. One that jumped out to me was where the customer seems to lose their policy after having issues with the service received from a claims adjuster. It’s worth noting that it’s fairly common for insurers to drop coverage after an at-fault accident claim (especially if it’s a large one), but the timeline in the review below doesn’t look great.

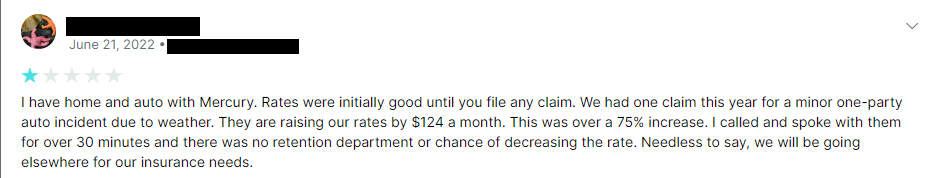

And a common thread I found in claims reviews was the huge price increases seen after the customer makes the claim. This customer received a 75% increase after a “minor” claim.

But it’s not all bad. In earlier reviews, customers rave about getting quick and courteous claims service. This next review talks about receiving kind and attentive service (though they weren’t at fault for the claim).

What Other Types of Insurance Does Mercury Offer?

Mercury offers quite a few insurance products (and potential bundling opportunities). The company also advertises that its agents can create policies tailored to all your insurance needs (plus uncover all your eligible discounts).

Depending on your state, you’ll have access to some or all of the following insurance products at Mercury:

- Home

- Condo

- Renters

- Umbrella

- Landlord

- Mechanical protection

Mercury also offers a number of business insurance products, such as business owners insurance and commercial auto.

Other Mercury products, services, and perks

Mercury doesn’t offer products outside of traditional property and casualty insurance. But the company does provide a few things on its website that prospective customers might enjoy, including:

- An online driving test to assess your driving skills and knowledge

- A directory of local agents, arranged by city, so you can find your local office

- Specialized driving and insurance tips based on your driving profile and location

MercuryGO

MercuryGO is Mercury’s usage-based insurance program that determines rates based on your driving habits. If you sign up for MercuryGO when you originally purchase your policy, you’ll get an initial 5% participation discount (10% for teens). Then, you just need to download the app, drive safely, and potentially receive even greater savings — up to 40% off. Plus, you’ll receive personalized feedback about your driving.

Unlike many of its competitors, Mercury does NOT punish drivers who have lower driving scores. Instead, the app simply provides guidance and feedback to help drivers improve. Online reviews are mixed, with most citing issues with draining battery or glitches with tracking driving correctly (a problem seen with usage-based mobile apps across competitors). But I was impressed that the company doesn’t penalize drivers.

Bottom Line: Is Mercury Auto Insurance Right for You?

I’m not going to mince words: Rates are high and satisfaction levels low at Mercury. But your experience may vary. Many happy customers talk about getting their best rate with Mercury, plus great customer service and quick claims resolution. So it’s important to check out reviews for your local office and develop a good relationship with your agent.

That being said, it’s hard to know if Mercury is right for you without assessing a quote for yourself and comparing it to quotes from similar companies. Be sure to consider the value of your policy (coverages included and their limits) in addition to the price. Go with the option that best suits your needs, preferences, and budget.

Find the Policy That’s Right for You

Mercury Auto Insurance FAQs

Mercury is lesser known than many of its larger competitors, so people naturally have lots of questions about the company. Here are answers to some of the most often-asked questions about Mercury car insurance.

Does Mercury have the cheapest car insurance?

Mercury’s car insurance rates are often competitive, but the cheapest option for you will depend on various factors, such as your age, location, credit score, and driving history. However, for the average driver, Mercury’s rates are often more expensive than many of its competitors.

Can you purchase a policy from Mercury 100% online?

Yes. Mercury allows you to purchase a policy entirely online, though you may need to purchase it through one of its affiliates (like AIS).

Does Mercury offer auto and home insurance bundling?

Yes. Mercury offers a bundling discount for auto and homeowners insurance and for bundling auto with a renters, umbrella, and business owners policy.

Is Mercury good at paying claims?

Mercury Insurance generally has a decent reputation for paying claims, but individual experiences may vary based on specific circumstances.

Is Mercury hard to deal with?

Experiences with Mercury’s customer service vary. Some customers may find Mercury easy to deal with, while others have more difficult experiences. It often depends on the customer service skills and helpfulness of your local agent.

Methodology

Data scientists at Compare.com analyzed more than 50 million real-time auto insurance rates from more than 75 partner insurance providers in order to compile the quotes and statistics seen in this article. Compare.com’s auto insurance data includes coverage analysis and details on drivers’ vehicles, driving records, insurance histories, and demographic information.

All the quotes listed in this article have been gathered from a combination of real Compare.com quotes and external insurance rate data gathered in collaboration with Quadrant Information Services. Compare.com uses these observations to provide drivers with insight into how auto insurance companies determine their premiums.

Sources

- J.D. Power, “Insurers Struggle to Manage Expectations in Auto Claims Process as Repair Times Increase” Accessed June 20, 2023.

- J.D. Power, “Auto Insurance Customer Satisfaction Plummets as Rates Continue to Surge,” Accessed June 20, 2023.

- AAA Foundation, “Rates of Motor Vehicle Crashes, Injuries and Deaths in Relation to Driver Age, United States, 2014-2015,” Accessed June 20, 2023

- Centers for Disease Control and Prevention, “Teen Driver and Passenger Safety,” Accessed June 20, 2023

- NHTSA’s National Center for Statistics and Analysis, “Traffic Safety Facts,” Accessed June 20, 2023

- National Safety Council, “Motor Vehicle Safety Issues,” Accessed June 20, 2023