Pros

- SR-22 insurance available

- Below-average premiums for high-risk drivers

- Less-frequent rate increases

Cons

- Online quotes not available

- Poor customer satisfaction ratings

- Limited available coverage and discount options

Bottom Line

Kemper has lower-than-average customer satisfaction ratings, and many users complain about a poor claims process, but it may be an affordable option for high-risk drivers.Is Kemper a Good Choice for Auto Insurance?

Kemper is available in most states and has a long, stable reputation within the industry, but it performs poorly in terms of cost, customer satisfaction, and ease of use. See below how Kemper ranks in five key categories.

| Category | Score |

|---|---|

| Cost | 2.7/5 |

| Customer satisfaction | 1.3/5 |

| Ease of use | 3.2/5 |

| Availability | 3/5 |

| Industry reputation | 4.3/5 |

| Overall score* | 2.80/5 |

| *Company ratings for each category are determined using our proprietary Compare.com Rating formula. You can find more information on our unique scoring methodology at the bottom of this article. | |

Kemper has been in business for nearly 70 years, and, though the company has somewhat scaled back in recent years, it still offers auto insurance in most states. Though Kemper has some key downsides — such as customer service and coverage options — it stands out as a good and affordable option for many high-risk drivers.

While we can offer general statements about Kemper’s rates for certain drivers, it’s important to get a quote based on your unique situation. Kemper uses a network of local independent agents, so if you’re considering getting a policy through Kemper, you’ll have to contact an agent to learn about your potential rates and coverage options.

Find the Best Insurance Company for You in Minutes

Where Kemper stands out

Kemper offers affordable auto insurance to high-risk drivers, including people who need an SR-22 policy or who’ve previously had a suspended, revoked, or canceled driver’s license.

Where Kemper falls short

Kemper has fewer available discount and coverage options than many of its competitors. And its poor customer service ratings — especially for its claims handling — leave a lot to be desired.

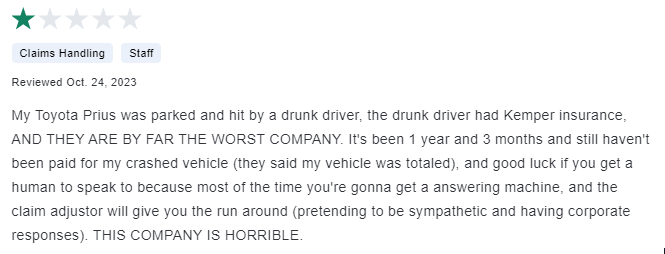

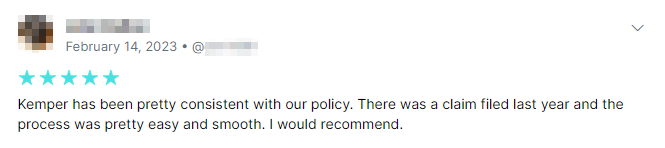

Kemper Reviews: What Real Customers Are Saying

Kemper has largely negative reviews from its customers. With the Better Business Bureau (BBB), Kemper has an average rating of just 1.02 out of 5, including more than 230 complaints filed within the past year. Similarly, the company has an average rating of just 2.4 out of 5 on ConsumerAffairs.

Many customers pointed to the company’s poor claims process as a reason for frustration. Some reviewers — like in the screenshot below — complained about poor communication from the company throughout the claims process, as well as the company refusing to pay for allegedly legitimate claims.

Unfortunately, these complaints are backed up by several third-party organizations. In J.D. Power’s 2023 U.S. Auto Claims Satisfaction Study, Kemper received the lowest rating of any company. Kemper also has a high number of complaints with the National Association of Insurance Commissioners (NAIC).

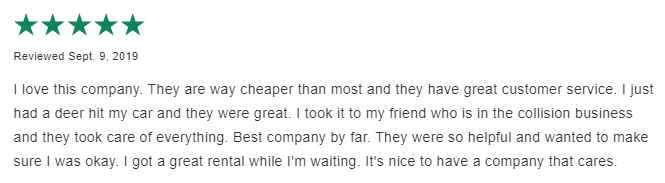

Still, many customers rave about the affordable rates Kemper offers. The reviewer below even calls it the “best company by far.”

Some even praise the claims process, so it seems the claims adjuster Kemper assigns could play a big role in your overall satisfaction.

How Much Is Kemper Car Insurance?

Insurance premiums are determined based on many different factors. Each insurer uses its own formula to weigh those factors and set each driver’s rates. As a result, premiums can vary significantly from one driver to the next, and it’s important to get your own quote for an accurate number.

The table below breaks down Kemper’s average rates for the two most common types of coverage.

| Liability Only | Full Coverage |

|---|---|

| $103 | $207 |

Kemper charges an average of $155 per month for auto insurance, according to Compare.com data. You can expect to pay less for liability coverage, which only pays for damages to other drivers, their passengers, and their property. Meanwhile, you’ll likely pay more for full coverage, which also protects your vehicle.

In the next few sections, we’ll cover more about how Kemper’s rates compare to other companies and how rates may vary based on certain factors.

Kemper vs. the Competition

Kemper is among the most expensive insurance companies when compared with similar companies. The table below shows how Kemper’s rates stack up to some of its closest competitors.

| Company | Compare.com Rating | Average Monthly Rate | Average Monthly Savings* |

|---|---|---|---|

| Kemper | 2.80/5 | $155 | $46 |

| Direct Auto | 3.76/5 | $148 | $53 |

| National General | 4.30/5 | $107 | $94 |

| The General | 3.35/5 | $187 | $14 |

| GEICO | 4.65/5 | $70 | $131 |

| *Savings are calculated based on the difference between each insurer’s average monthly rate and the national average for all insurers. | |||

As we’ve mentioned, each insurer uses its own formula for setting insurance premiums. Unfortunately, Kemper has among the highest premiums overall, falling behind only The General.

Keep in mind that these are national averages — certain insurers may have higher or lower averages in specific states. The best way to find which company has the cheapest rates for your unique profile is to compare quotes from as many insurers as possible.

Compare Quotes from America’s Top Insurers

A Closer Look at Kemper Car Insurance Costs

Several important factors affect your car insurance premiums, including your driving and credit history. The table below shows Kemper’s average monthly premium for common driver profiles and compares each to the national average premiums.

| Driver Type | Kemper Average Monthly Premium | National Average Monthly Premium |

|---|---|---|

| Clean driving record, excellent credit | $155 | $201 |

| Clean driving record, poor credit | $211 | $394 |

| Recent speeding ticket, good credit | $205 | $173 |

| Recent at-fault accident, good credit | $242 | $189 |

| Recent DUI, good credit | $254 | $258 |

A clean driving history and a good credit score are key factors in qualifying for the best insurance rates. A violation on your driving record — such as a speeding ticket, at-fault accident, or DUI — can result in higher premiums. Additionally, drivers with good or excellent credit pay generally substantially lower rates than people with poor credit.

Kemper’s typical rates are cheaper than average for certain drivers, such as people with clean driving records and poor credit. But it tends to be more expensive for drivers with recent speeding tickets or at-fault accidents on their records.

In the next few sections, you can see how other factors, including your age and location, can affect your premiums.

Kemper’s Average Rates by Age

There’s usually a strong correlation between your age and your auto insurance premiums. Rates tend to start out high for teenagers and decrease throughout your lifetime.

We’ve broken down Kemper’s average rates for different age groups in the table below.

| Age Group | Kemper Average Monthly Rate | National Average |

|---|---|---|

| Teens (18 years old) | $456 | $397 |

| Young drivers (25 years old) | $185 | $155 |

| Adults (40 years old) | $160 | $130 |

| Seniors (65 years old) | $156 | $122 |

Teen drivers tend to pay the highest insurance premiums of any age group. An 18-year-old Kemper driver can expect to pay more than double what a 25-year-old driver would pay for similar coverage.

Meanwhile, senior drivers in their 60s tend to pay the lowest premiums. Still, Kemper charges higher-than-average premiums for drivers of each age bracket.

Kemper’s Average Rates by State

Car insurance rates vary significantly from state to state for a variety of factors, including minimum insurance requirements, crime rates, accident rates, number of uninsured drivers, and more.

Let’s take a look at Kemper’s average rates for each state in the table below.

| State | Kemper Average Monthly Rate | Statewide Average Monthly Rate |

|---|---|---|

| California | $101 | $109 |

| Colorado | $125 | $140 |

| Connecticut | $132 | $160 |

| Maryland | $105 | $173 |

| Missouri | $297 | $161 |

| Montana | $133 | $106 |

| Nevada | $283 | $175 |

| New Mexico | $135 | $112 |

| New York | $361 | $306 |

| North Carolina | $93 | $81 |

| Oregon | $145 | $154 |

| South Dakota | $56 | $77 |

| Utah | $149 | $130 |

| Virginia | $187 | $113 |

| Washington | $79 | $110 |

| Wisconsin | $168 | $110 |

New York has the highest insurance premiums of any state where Kemper offers coverage, according to Compare.com data. It also has the nation’s most densely populated city and no-fault auto insurance, which is often more expensive. Meanwhile, South Dakota — which has much cheaper average rates — has a relatively low population density and lower insurance requirements.

Compared to the statewide averages for all companies, Kemper is a particularly affordable option in about half of the states shown.

Kemper Car Insurance Discounts

Kemper offers a handful of discounts that allow drivers to save on their auto insurance premiums. Here are Kemper’s available discounts:

- Advance quote discount: You can save if you get a quote and sign up for a policy before the date you need your next policy to start.

- Proof of prior insurance: This discount applies if you had auto insurance before signing up for a policy through Kemper.

- Paid-in-full discount: You can lower your premiums by paying for your entire premium up front instead of making monthly payments.

- Multi-car discount: This discount allows you to save if you have multiple vehicles insured on the same Kemper policy.

- Defensive driving course discount: You can save money by taking an approved defensive driving course.

- Good student discount: If you’re a full-time student, you can get a discount on your premiums by maintaining a 3.0 or higher GPA.

- Military discount: Active-duty military and National Guard members can save on their auto insurance premiums through Kemper.

- Homeowner discount: This discount applies if you or someone on your policy is a homeowner and has an auto insurance policy from Kemper.

It’s worth noting that Kemper offers fewer discounts than many of its competitors. So, if discounts are important to you, it may be worth shopping around for better savings.

Find the Best Insurer for You in Minutes

Kemper Auto Insurance Coverage Options

When you sign up for a Kemper policy, you’ll have the opportunity to choose from a handful of coverage types. First, Kemper offers the liability coverage that’s required in nearly every state, including both bodily injury and property damage liability.

You can also get full coverage from Kemper, which includes collision coverage and comprehensive coverage, among others. Kemper also offers roadside assistance and SR-22 coverage that’s required for high-risk drivers.

Unfortunately, Kemper doesn’t advertise a comprehensive list of its coverage options, nor does it allow you to get a quote online. If you’re interested in a Kemper policy, you’ll have to call a local independent agent to get a quote and learn more about Kemper’s available coverage options.

How to Purchase a Car Insurance Policy from Kemper

Kemper works with a network of local independent agents to serve its policyholders. On the company’s website, you’ll enter your ZIP code and the type of insurance policy you want. From there, the company will provide you with a phone number to speak with a Kemper agent and sign up for a policy.

You can speak with a Kemper representative Monday through Friday, 8:00 a.m.–8:00 p.m. CST, and on Saturday, 8:00 a.m.–5:00 p.m.

What to Know About Filing a Claim with Kemper

As a Kemper customer, you can file a claim online using the company’s claims form. All you’ll need to get started is your Kemper policy number and your VIN.

Here’s how the process works:

- File your claim using the online claim form.

- Kemper will assign an adjuster to your claim and contact you within one business day.

- Your insurance adjuster will evaluate your vehicle’s damage. Depending on the severity, you may be able to submit photos, or the adjuster may need to evaluate it in person.

- After you receive your estimate, your adjuster will help you schedule your repairs through the Kemper Repair Network (or you can pick a shop and schedule them on your own).

- Depending on the situation, Kemper will either pay the claim settlement directly to you or to the repair shop.

Unfortunately, existing customers have largely negative things to say about Kemper’s claims process. As we covered in a previous section, many customers — like the one in the review below — report a slow claims process or trouble getting Kemper to pay at all.

More About Kemper Insurance

| Founded | 1955 |

| Available in | 43 states |

| Owned by | Infinity Property & Casualty Corporation |

| National average premium | $155 per month |

| Mobile app | Android, iOS |

| Customer service | 1-800-782-1020 |

| Claims | 1-800-353-6737 |

| Primary competitors | Direct Auto, National General, The General |

Kemper’s other insurance products

In addition to its auto insurance, Kemper also offers a handful of other coverage types, including:

- Commercial auto insurance

- Commercial general liability insurance

- Business owners policy insurance

- Life insurance

- Accident and health insurance

- Fire/contents protection

- Motorcycle insurance

- ATV insurance

Kemper Auto Insurance FAQs

If you’re considering signing up for Kemper auto insurance, check out these answers to commonly asked questions to learn more about its policies.

Does Kemper have cheap car insurance?

It depends. Your ability to get cheap car insurance through Kemper depends on your personal characteristics and where you live. You may get an affordable policy through Kemper, but it has higher-than-average rates for many drivers.

How long does Kemper Insurance take to settle a claim?

It depends. Each claim is different, according to Kemper’s website. This means that the company can’t give you an estimate for how long it will take to settle.

Unfortunately, many of Kemper’s customer reviews state the claims process is long and frustrating. It may not be the best option if claims timeliness is a priority for you.

Does Kemper still offer home and auto insurance?

No. Kemper still offers auto insurance, but it no longer offers homeowners insurance. Still, the company offers personal life insurance, business insurance, and several other policy types.

Is Kemper a real insurance company?

Yes. Kemper is a real insurance company. It was founded in 1955 and is a publicly traded company under Infinity Property & Casualty Corporation.

Why did Kemper Insurance go out of business?

Contrary to what many believe, Kemper didn’t go out of business. But it reduced its business and eliminated its preferred home and auto insurance policies. Kemper may cancel or not renew existing policies from these two categories.

Data Methodology:

Data scientists at Compare.com analyzed more than 50 million real-time auto insurance quotes from more than 75 partner insurers in order to compile the rates and statistics seen in this article. Compare.com’s auto insurance data includes coverage analysis and details on drivers’ vehicles, driving records, insurance histories, and demographic information.

All the rates listed in this article have been collected from a combination of real Compare.com quotes and external insurance rate data gathered in collaboration with Quadrant Information Services. Compare.com uses these observations to provide readers with insights into how auto insurance companies determine their premiums.

Rating Methodology

Compare.com’s mission is to help our readers make more informed decisions when it comes to their personal finances. To help our readers better analyze and compare insurance companies, our editorial staff has crafted a proprietary rating formula to determine each company’s objective Compare.com Rating. The score you see referenced in this article is based on several factors, including:

- Cost: How the insurer’s average rates compare to its direct competitors and the industry as a whole. This includes available savings opportunities, such as discounts and other factors.

- Customer satisfaction: How satisfied existing customers are with the service they receive. This includes the insurer’s scores among various third-party studies, such as the J.D. Power U.S. Insurance Shopping and Claims Satisfaction studies, and the National Association of Insurance Commissioners (NAIC) Complaint Index, among others.

- Ease of use: How easy it is for policyholders to utilize their policies. This includes mobile app availability, customer service availability, payment flexibility, and other related factors.

- Availability: The overall scope of the company’s insurance offerings. This includes available coverage types, national footprint, and other related factors.

- Industry reputation: A measure of the insurer’s overall standing within the industry. This includes its AM Best financial strength rating, BBB accreditation, and other related factors.

Sources

- Better Business Bureau, “Kemper Corporation,” accessed March 5, 2024.

- J.D. Power, “2023 U.S. Auto Claims Satisfaction Study,” accessed March 5, 2024.

- National Association of Insurance Commissioners, “Kemper Independence Ins Co National Complaint Index Report,” accessed March 5, 2024.

- Insurance Information Institute, “Automobile Financial Responsibility Laws By State,” accessed March 5, 2024.